Form Nh-1120-We - Combined Business Profits Tax Return 2001

ADVERTISEMENT

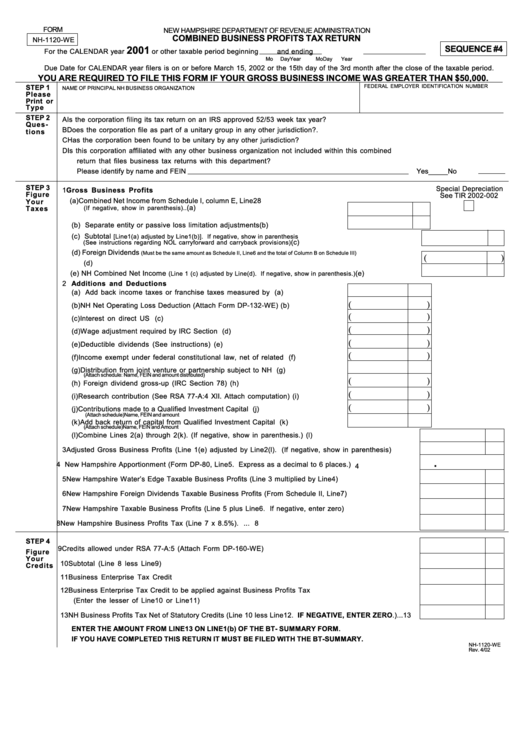

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

COMBINED BUSINESS PROFITS TAX RETURN

NH-1120-WE

SEQUENCE #4

2001

For the CALENDAR year

or other taxable period beginning

and ending

Mo

Day

Year

Mo

Day

Year

Due Date for CALENDAR year filers is on or before March 15, 2002 or the 15th day of the 3rd month after the close of the taxable period.

YOU ARE REQUIRED TO FILE THIS FORM IF YOUR GROSS BUSINESS INCOME WAS GREATER THAN $50,000.

STEP 1

FEDERAL EMPLOYER IDENTIFICATION NUMBER

NAME OF PRINCIPAL NH BUSINESS ORGANIZATION

Please

Print or

Type

STEP 2

A

Is the corporation filing its tax return on an IRS approved 52/53 week tax year? ....................................... Yes ______

No _______

Ques-

B

Does the corporation file as part of a unitary group in any other jurisdiction?. ...........................................

Yes ______

No _______

tions

C

Has the corporation been found to be unitary by any other jurisdiction? ..................................................... Yes ______

No _______

D

Is this corporation affiliated with any other business organization not included within this combined

return that files business tax returns with this department?

Please identify by name and FEIN

Yes _____

No

STEP 3

Special Depreciation

1 Gross Business Profits

Figure

See TIR 2002-002

(a) Combined Net Income from Schedule I, column E, Line28

Your

......................................................................1(a)

Taxes

(If negative, show in parenthesis)..

(b) Separate entity or passive loss limitation adjustments ................................. 1(b)

(c) Subtotal

[Line1(a) adjusted by Line1(b)]. If negative, show in parenthesis

.......................................................1(c)

(See instructions regarding NOL carryforward and carryback provisions)

(d) Foreign Dividends

(Must be the same amount as Schedule II, Line6 and the total of Column B on Schedule III)

(

)

..........................................................................................................................................................1(d)

(e) NH Combined Net Income

.........................1(e)

(Line 1 (c) adjusted by Line(d). If negative, show in parenthesis.)

2 Additions and Deductions

(a) Add back income taxes or franchise taxes measured by income.................2(a)

(

)

(b) NH Net Operating Loss Deduction (Attach Form DP-132-WE)........................2(b)

(

)

(c) Interest on direct US Obligations...................................................................2(c)

(

)

(d) Wage adjustment required by IRC Section 280C............................................2(d)

(

)

(e) Deductible dividends (See instructions)........................................................2(e)

(

)

(f) Income exempt under federal constitutional law, net of related expenses.....2(f)

(g) Distribution from joint venture or partnership subject to NH taxation.............2(g)

(Attach schedule: Name, FEIN and amount distributed)

(

)

(h) Foreign dividend gross-up (IRC Section 78)..................................................2(h)

(

)

(i) Research contribution (See RSA 77-A:4 XII. Attach computation).................2(i)

(

)

(j) Contributions made to a Qualified Investment Capital Company......................2(j)

(Attach schedule)Name, FEIN and amount

(k) Add back return of capital from Qualified Investment Capital Company.........2(k)

(Attach schedule)Name, FEIN and Amount

(l) Combine Lines 2(a) through 2(k). (If negative, show in parenthesis.)................................................ 2(l)

3 Adjusted Gross Business Profits (Line 1(e) adjusted by Line2(l). (If negative, show in parenthesis).... 3

.

4 New Hampshire Apportionment (Form DP-80, Line5. Express as a decimal to 6 places.)........................ 4

5 New Hampshire Water’s Edge Taxable Business Profits (Line 3 multiplied by Line4)............................... 5

6 New Hampshire Foreign Dividends Taxable Business Profits (From Schedule II, Line7).......................... 6

7 New Hampshire Taxable Business Profits (Line 5 plus Line6. If negative, enter zero)........................... 7

8 New Hampshire Business Profits Tax (Line 7 x 8.5%). .......................................................................... 8

STEP 4

9

Credits allowed under RSA 77-A:5 (Attach Form DP-160-WE).............................................................. 9

Figure

Your

10 Subtotal (Line 8 less Line9)....................................................................................................................10

Credits

11 Business Enterprise Tax Credit ..............................................................................................................11

12 Business Enterprise Tax Credit to be applied against Business Profits Tax

(Enter the lesser of Line10 or Line11).................................................................................................... 12

13 NH Business Profits Tax Net of Statutory Credits (Line 10 less Line12. IF NEGATIVE, ENTER ZERO.)...13

ENTER THE AMOUNT FROM LINE13 ON LINE1(b) OF THE BT- SUMMARY FORM.

IF YOU HAVE COMPLETED THIS RETURN IT MUST BE FILED WITH THE BT-SUMMARY.

NH-1120-WE

Rev. 4/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2