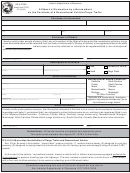

Magnetic Media Filing Requirements Form - Indiana Department Of Revenue Page 15

ADVERTISEMENT

Logical Record Length:

Each record must be a uniform length of 275 (or 276) characters. A 275 character record

is preferred. However, if your system cannot produce an odd number record length, a 276

character record will be acceptable. Tape files with a record length of 276 must contain

a blank in the 276th character which is coded in the same character set as the first 275

characters. For example, the first 275 characters are coded in or translated to EBCDIC,

character 276 must also be coded in or translated to EBCDIC. Logical records MUST

NOT be prefixed by record descriptor words or block descriptor words.

Blocking Factor:

The blocking factor must not exceed 25. Although 25 logical records per block are

preferred, blocking of 1 to 25 logical records will be accepted. If your system requires the

block length to be a multiple of 4, use a blocking factor of 4, 8, 12, 16, 20 or 24 for 275

character records.

Other Information:

- Intermediate Total Records (Code I), Total Records (Code T) and Employee Wage

Records (Code W) are allowed but are not required.

- Lower case letters, control codes, punctuation and special characters with the exception

of the ampersand (&) are not acceptable on magnetic tape.

- Tapes may be written in either ASCII or EBCDIC and the external label should identify

which is being used.

- Indiana is interested ONLY in Indiana state or county tax that has been withheld - do not

include other state information.

- Fields marked “NOT USED” are not processed. Enter blanks or zeroes as these fields

are overlooked.

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24