Magnetic Media Filing Requirements Form - Indiana Department Of Revenue Page 19

ADVERTISEMENT

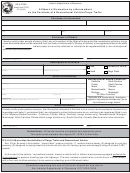

Code “S” Record - Length = 275

Tape Positions

Length

Field Name

1

1

Record Identifier (S)

2 - 10

9

Employee Social Security Number

11 - 37

27

Employee Name

38 - 77

40

Street Address

78 - 102

25

City

103 - 104

2

State

105 - 112

8

Not Used

113 - 117

5

ZIP Code Extension

118 - 122

5

ZIP Code or Foreign Postal Code

123

1

Not Used

124 - 125

2

State Code (“18” for Indiana)

126 - 127

2

County Code

128 - 133

6

Reporting Period

134 - 170

37

Not Used

171 - 182

12

Employer Taxpayer Identification Number (TID)

183 - 190

8

Not Used

191 - 199

9

State Taxable Wages/Pension

200 - 207

8

State Income Tax Withheld

208 - 217

10

Information Return Type (W-2)

218

1

Tax Type Code (“D” for County Tax or Blank)

219 - 223

5

Not Used

224 - 232

9

County Taxable Wages/Pension

233 - 239

7

County Income Tax withheld

240 - 275

36

Not Used

Record Identifier - Constant “S”.

Social Security Number - Enter the employee’s social security number. If not available

enter the letter “I” in positions 2 and blanks in positions 3 - 10.

Employee Name - Enter the employee’s name. Left justify and fill unused positions with

blanks.

Street Address - Left justify and fill unused positions with blanks.

City - Left justify and fill unused positions with blanks. If this is a foreign address, include

the name of the foreign “state”, province, etc., i.e., Ontario.

State - Enter the standard FIBS postal alphabetical abbreviation as illustrated in Appendix

B. If this is a foreign address, enter the two-character country code, i.e., CN for Canada.

Left justify and fill with blanks. (NOTE - this is the actual state where the employee

resides).

Not Used - Enter blanks or zeroes. This field is ignored and will not be processed.

19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24