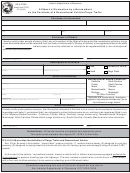

Magnetic Media Filing Requirements Form - Indiana Department Of Revenue Page 2

ADVERTISEMENT

The Indiana Department of Revenue prefers reports on 31/2 diskettes but will accept 51/4

diskettes or magnetic reel tapes or 3480/3490 cartridges. Note - the Indiana Department

of Revenue does not accept media filed on 8" diskettes. There is one format for

tape/cartridge reporting and one format for diskette reporting. However, both formats

follow the guidelines outlined in SSA TIB-4, as amended. The Department of Revenue

does not process test tapes.

If you currently file magnetic media with the Federal

Government, we urge you to file magnetic media with the State. The State of Indiana uses

the same format for filing W-2 information as used to file your Federal report, but be sure

to include the ”S” Record (State Information).

The State of Indiana does participate in the combined Federal/State Filing Program of

1099's. Submission of 1099 information is required ONLY if State tax has been withheld.

Payers reporting 1099 information should use the current Federal format specified for the

purpose of federal information return reporting. All submissions MUST be accompanied

by a completed WH-3 Reconciliation Form. W-2 and 1099 information must be filed

separately, on separate magnetic media.

DUE DATE:

February 28th or 29th of the current year is the filing deadline for the previous years

reporting. This date moves if it falls on a weekend to the next working day. For example,

if the 28th falls on a Saturday or Sunday, the filing deadline moves to the following

Monday. Taxpayers who do not meet the filing deadline may be subject to a penalty of ten

dollars ($10.00) per delinquent W-2 form and any other applicable penalties.

The Department of Revenue uses the post mark date to determine the timely filed status

of each report. A request for an extension to the filing deadline must be made in writing

and be accompanied by a copy of Federal Form 8809 (Extension Request Form). Your

request should be sent to the following address:

Withholding Tax Section

Indiana Department of Revenue

100 North Senate Avenue, N203

Indianapolis, IN 46204-2253

Withholding questions may be directed to the Withholding Tax Section (317) 232-2265

(8:15 A.M. to 4:45 P.M., Monday through Friday)

If the Indiana Department of Revenue determines a timely filed magnetic media report is

unprocessable, the filer will be given forty-five (45) days to correct and return the report

to the Indiana Department of Revenue. If a processable tape is returned within this period,

a penalty for late filing will not be imposed.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24