Form 1 - Loan Submission Summary Page 2

ADVERTISEMENT

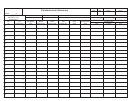

Loan Submission Summary (LSS) and Document Checklist

Form 1

Incomplete or inaccurate information will delay funding.

Please check off each item to confirm that you have enclosed all required documentation. Compiling

documentation in the order listed will expedite the review and funding process. Note: All credit documentation

should be original or lender-certified copies.

LEFT SIDE

CREDIT DOCUMENTS - unless required on the "Right Side", all documentation used in underwriting the

loan, including but not limited to:

IRS Form 4506-T

Executed IRS Form 4506-T transcripts. Vendor: ____________________________

LP Feedback Certificate or DU Underwriting Findings or FHA Loan Score

Verification of income/employment

Verification of assets

Signed Purchase Agreement w/ all addenda

Preliminary Title Work

Copy of Certificate of Eligibility

VA Indebtedness Letter

Other ______________________

ADDITIONAL DOCUMENTATION, AS APPLICABLE

Loan Sale Notice to MI Company

W-9(s)

Notice to Homeowners RE: Assumptions

HUD Form 2561, "Hotel and Transient Use of Property"

Federal Collection Policy Notice

Copy of VA Funding Fee Transmittal & check

VA 1820, "Certificate of Loan Disbursement"

Initial Truth-in-Lending

Initial RESPA Good Faith Estimate

Any redisclosed RESPA Good Faith Estimate(s) with changed circumstance detail attached in order of date

Final RESPA Good Faith Estimate (labeled FINAL)

Initial ARM Disclosures

Mortgage Broker Compensation Disclosure

®

Notice to HomePath

Program Buyers Regarding Appraisals

Other _________________________________

RIGHT SIDE

CLOSED LOAN PACKAGE DOCUMENTATION, AS APPLICABLE

Original Note with any addenda, endorsed to Wells Fargo Bank, N.A.

Copy of Note

Wiring Instructions/Bailee Letter

Borrower Interest Rate Date

Consolidation Extension Modification Agreement

Modification Agreement

Assignments (including intervening assignments), if non-MERS

Power of Attorney (POA)

Name affidavit(s)

Pay History for subject loan (required if seasoned two months or more, or if disbursement/curtailments made)

Copy of Mortgage/Deed of Trust with all required riders/addenda

Title commitment

Final signed HUD-1/HUD-1A – original certified true copy with any addenda

Evidence of refund of settlement charges, if applicable per RESPA

Buydown Agreement

Initial Escrow Disclosure Statement

Borrowers Notice of Transfer

1st Payment Letter

Hazard insurance policy or binder with proof of premium payment

Flood zone determination/Third Party flood certification

Flood insurance policy or application with proof of premium payment

Copy of loss payee change letter to insurer(s) naming Wells Fargo Bank, N.A., its successors and/or assigns

Tax Information Sheet

MI Certificate & documentation that initial premiums were paid

Final Inspection Report

Work Escrow Agreement

Right of Rescission

Final Truth-in-Lending (TIL)

Itemization of HUD-1 Fees – REG Z Itemization of Amount Financed or similar form.

Builder Grant Option Transmittal Form (Form 41), if applicable

Homebuyer Education Certificate

Post Purchase Delinquency Counseling Authorization (Seller Guide Form 12)

Other _____________________________________

Effective Date: January 18, 2011

Form 1 - Page 2 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3