Instructions For Municipal Ir-Long Form 2006

ADVERTISEMENT

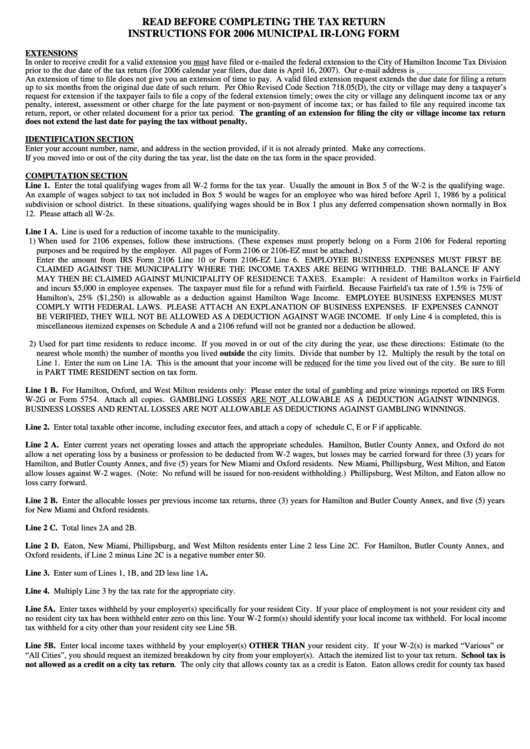

READ BEFORE COMPLETING THE TAX RETURN

INSTRUCTIONS FOR 2006 MUNICIPAL IR-LONG FORM

EXTENSIONS

In order to receive credit for a valid extension you must have filed or e-mailed the federal extension to the City of Hamilton Income Tax Division

prior to the due date of the tax return (for 2006 calendar year filers, due date is April 16, 2007). Our e-mail address is citytax@ci.hamilton.oh.us.

An extension of time to file does not give you an extension of time to pay. A valid filed extension request extends the due date for filing a return

up to six months from the original due date of such return. Per Ohio Revised Code Section 718.05(D), the city or village may deny a taxpayer’s

request for extension if the taxpayer fails to file a copy of the federal extension timely; owes the city or village any delinquent income tax or any

penalty, interest, assessment or other charge for the late payment or non-payment of income tax; or has failed to file any required income tax

return, report, or other related document for a prior tax period. The granting of an extension for filing the city or village income tax return

does not extend the last date for paying the tax without penalty.

IDENTIFICATION SECTION

Enter your account number, name, and address in the section provided, if it is not already printed. Make any corrections.

If you moved into or out of the city during the tax year, list the date on the tax form in the space provided.

COMPUTATION SECTION

Line 1. Enter the total qualifying wages from all W-2 forms for the tax year. Usually the amount in Box 5 of the W-2 is the qualifying wage.

An example of wages subject to tax not included in Box 5 would be wages for an employee who was hired before April 1, 1986 by a political

subdivision or school district. In these situations, qualifying wages should be in Box 1 plus any deferred compensation shown normally in Box

12. Please attach all W-2s.

Line 1 A. Line is used for a reduction of income taxable to the municipality.

1) When used for 2106 expenses, follow these instructions. (These expenses must properly belong on a Form 2106 for Federal reporting

purposes and be required by the employer. All pages of Form 2106 or 2106-EZ must be attached.)

Enter the amount from IRS Form 2106 Line 10 or Form 2106-EZ Line 6. EMPLOYEE BUSINESS EXPENSES MUST FIRST BE

CLAIMED AGAINST THE MUNICIPALITY WHERE THE INCOME TAXES ARE BEING WITHHELD. THE BALANCE IF ANY

MAY THEN BE CLAIMED AGAINST MUNICIPALITY OF RESIDENCE TAXES. Example: A resident of Hamilton works in Fairfield

and incurs $5,000 in employee expenses. The taxpayer must file for a refund with Fairfield. Because Fairfield's tax rate of 1.5% is 75% of

Hamilton's, 25% ($1,250) is allowable as a deduction against Hamilton Wage Income. EMPLOYEE BUSINESS EXPENSES MUST

COMPLY WITH FEDERAL LAWS. PLEASE ATTACH AN EXPLANATION OF BUSINESS EXPENSES. IF EXPENSES CANNOT

BE VERIFIED, THEY WILL NOT BE ALLOWED AS A DEDUCTION AGAINST WAGE INCOME. If only Line 4 is completed, this is

miscellaneous itemized expenses on Schedule A and a 2106 refund will not be granted nor a deduction be allowed.

2) Used for part time residents to reduce income. If you moved in or out of the city during the year, use these directions: Estimate (to the

nearest whole month) the number of months you lived outside the city limits. Divide that number by 12. Multiply the result by the total on

Line 1. Enter the sum on Line 1A. This is the amount that your income will be reduced for the time you lived out of the city. Be sure to fill

in PART TIME RESIDENT section on tax form.

Line 1 B. For Hamilton, Oxford, and West Milton residents only: Please enter the total of gambling and prize winnings reported on IRS Form

W-2G or Form 5754. Attach all copies. GAMBLING LOSSES ARE NOT ALLOWABLE AS A DEDUCTION AGAINST WINNINGS.

BUSINESS LOSSES AND RENTAL LOSSES ARE NOT ALLOWABLE AS DEDUCTIONS AGAINST GAMBLING WINNINGS.

Line 2. Enter total taxable other income, including executor fees, and attach a copy of schedule C, E or F if applicable.

Line 2 A. Enter current years net operating losses and attach the appropriate schedules. Hamilton, Butler County Annex, and Oxford do not

allow a net operating loss by a business or profession to be deducted from W-2 wages, but losses may be carried forward for three (3) years for

Hamilton, and Butler County Annex, and five (5) years for New Miami and Oxford residents. New Miami, Phillipsburg, West Milton, and Eaton

allow losses against W-2 wages. (Note: No refund will be issued for non-resident withholding.) Phillipsburg, West Milton, and Eaton allow no

loss carry forward.

Line 2 B. Enter the allocable losses per previous income tax returns, three (3) years for Hamilton and Butler County Annex, and five (5) years

for New Miami and Oxford residents.

Line 2 C. Total lines 2A and 2B.

Line 2 D. Eaton, New Miami, Phillipsburg, and West Milton residents enter Line 2 less Line 2C. For Hamilton, Butler County Annex, and

Oxford residents, if Line 2 minus Line 2C is a negative number enter $0.

Line 3. Enter sum of Lines 1, 1B, and 2D less line 1A.

Line 4. Multiply Line 3 by the tax rate for the appropriate city.

Line 5A. Enter taxes withheld by your employer(s) specifically for your resident City. If your place of employment is not your resident city and

no resident city tax has been withheld enter zero on this line. Your W-2 form(s) should identify your local income tax withheld. For local income

tax withheld for a city other than your resident city see Line 5B.

Line 5B. Enter local income taxes withheld by your employer(s) OTHER THAN your resident city. If your W-2(s) is marked “Various” or

“All Cities”, you should request an itemized breakdown by city from your employer(s). Attach the itemized list to your tax return. School tax is

not allowed as a credit on a city tax return. The only city that allows county tax as a credit is Eaton. Eaton allows credit for county tax based

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2