Instructions For Municipality Ir Form

ADVERTISEMENT

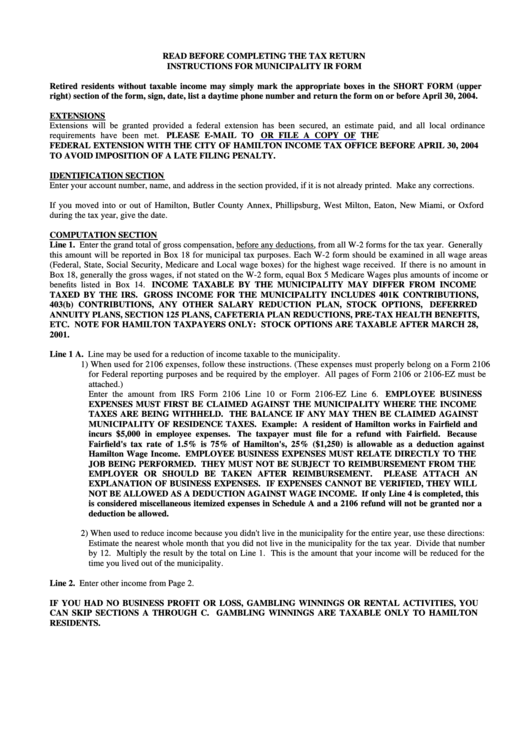

READ BEFORE COMPLETING THE TAX RETURN

INSTRUCTIONS FOR MUNICIPALITY IR FORM

Retired residents without taxable income may simply mark the appropriate boxes in the SHORT FORM (upper

right) section of the form, sign, date, list a daytime phone number and return the form on or before April 30, 2004.

EXTENSIONS

Extensions will be granted provided a federal extension has been secured, an estimate paid, and all local ordinance

requirements have been met.

PLEASE E-MAIL TO

citytax@ci.hamilton.oh.us

OR FILE A COPY OF THE

FEDERAL EXTENSION WITH THE CITY OF HAMILTON INCOME TAX OFFICE BEFORE APRIL 30, 2004

TO AVOID IMPOSITION OF A LATE FILING PENALTY.

IDENTIFICATION SECTION

Enter your account number, name, and address in the section provided, if it is not already printed. Make any corrections.

If you moved into or out of Hamilton, Butler County Annex, Phillipsburg, West Milton, Eaton, New Miami, or Oxford

during the tax year, give the date.

COMPUTATION SECTION

Line 1. Enter the grand total of gross compensation, before any deductions, from all W-2 forms for the tax year. Generally

this amount will be reported in Box 18 for municipal tax purposes. Each W-2 form should be examined in all wage areas

(Federal, State, Social Security, Medicare and Local wage boxes) for the highest wage received. If there is no amount in

Box 18, generally the gross wages, if not stated on the W-2 form, equal Box 5 Medicare Wages plus amounts of income or

benefits listed in Box 14. INCOME TAXABLE BY THE MUNICIPALITY MAY DIFFER FROM INCOME

TAXED BY THE IRS. GROSS INCOME FOR THE MUNICIPALITY INCLUDES 401K CONTRIBUTIONS,

403(b) CONTRIBUTIONS, ANY OTHER SALARY REDUCTION PLAN, STOCK OPTIONS,

DEFERRED

ANNUITY PLANS, SECTION 125 PLANS, CAFETERIA PLAN REDUCTIONS, PRE-TAX HEALTH BENEFITS,

ETC. NOTE FOR HAMILTON TAXPAYERS ONLY: STOCK OPTIONS ARE TAXABLE AFTER MARCH 28,

2001.

Line 1 A. Line may be used for a reduction of income taxable to the municipality.

1) When used for 2106 expenses, follow these instructions. (These expenses must properly belong on a Form 2106

for Federal reporting purposes and be required by the employer. All pages of Form 2106 or 2106-EZ must be

attached.)

Enter the amount from IRS Form 2106 Line 10 or Form 2106-EZ Line 6.

EMPLOYEE BUSINESS

EXPENSES MUST FIRST BE CLAIMED AGAINST THE MUNICIPALITY WHERE THE INCOME

TAXES ARE BEING WITHHELD. THE BALANCE IF ANY MAY THEN BE CLAIMED AGAINST

MUNICIPALITY OF RESIDENCE TAXES. Example: A resident of Hamilton works in Fairfield and

incurs $5,000 in employee expenses. The taxpayer must file for a refund with Fairfield. Because

Fairfield's tax rate of 1.5% is 75% of Hamilton's, 25% ($1,250) is allowable as a deduction against

Hamilton Wage Income. EMPLOYEE BUSINESS EXPENSES MUST RELATE DIRECTLY TO THE

JOB BEING PERFORMED. THEY MUST NOT BE SUBJECT TO REIMBURSEMENT FROM THE

EMPLOYER OR SHOULD BE TAKEN AFTER REIMBURSEMENT.

PLEASE ATTACH AN

EXPLANATION OF BUSINESS EXPENSES. IF EXPENSES CANNOT BE VERIFIED, THEY WILL

NOT BE ALLOWED AS A DEDUCTION AGAINST WAGE INCOME. If only Line 4 is completed, this

is considered miscellaneous itemized expenses in Schedule A and a 2106 refund will not be granted nor a

deduction be allowed.

2) When used to reduce income because you didn't live in the municipality for the entire year, use these directions:

Estimate the nearest whole month that you did not live in the municipality for the tax year. Divide that number

by 12. Multiply the result by the total on Line 1. This is the amount that your income will be reduced for the

time you lived out of the municipality.

Line 2. Enter other income from Page 2.

IF YOU HAD NO BUSINESS PROFIT OR LOSS, GAMBLING WINNINGS OR RENTAL ACTIVITIES, YOU

CAN SKIP SECTIONS A THROUGH C. GAMBLING WINNINGS ARE TAXABLE ONLY TO HAMILTON

RESIDENTS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5