2

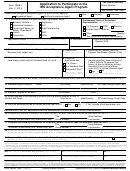

Form 8633 (Rev. 7-2003)

Page

7

Principals of Your Firm or Organization

Do not complete this section if you are adding a new location or you checked a box on Line 3, Page 1. If you are a sole proprietor, list your name, home address,

social security number, and respond to each question. If your firm is a partnership, list the name, home address, social security number, and respond to each question

for each partner who has a five percent (5%) or more interest in the partnership. If you are a partnership and no partners have at least 5% interest in the partnership,

list the name, title, home address, social security number, and respond to each question for at least one individual authorized to act for the firm in legal and/or tax

matters. (You may use continuation sheets.) If your firm is a corporation, list the name, title, home address, social security number, and respond to each question for

the President, Vice-President, Secretary, and Treasurer of the corporation. The signature of each person listed authorizes the Internal Revenue Service to conduct a

credit check on that individual.

Type or print name (first, middle, last)

U.S. citizenship?

Are you a/an:

Are you licensed or bonded

officer of a

in accordance with state or

Legal

publicly owned

local requirements?

attorney

resident

corporation

Title:

alien

Yes

No

banking official

Yes

No

None apply

Home address

Social Security Number

C.P.A.

Not applicable

(Fingerprint

enrolled agent

Card Required)

enrolled agent #_________

Have you ever been assessed any preparer penalties, been convicted of a

crime, failed to file personal tax returns, or pay tax liabilites, or been convicted

of any criminal offense under the U.S. Internal Revenue laws?

Yes

No

(Please attach an explanation for a “Yes” response.)

Date of birth (month, day, year)

Signature

Add

Delete

E-mail (optional):

Type or print name (first, middle, last)

U.S. citizenship?

Are you a/an:

Are you licensed or bonded

officer of a

in accordance with state or

Legal

publicly owned

local requirements?

attorney

resident

corporation

alien

Title:

Yes

No

banking official

Yes

No

None apply

Home address

Social Security Number

C.P.A.

Not applicable

(Fingerprint

enrolled agent

Card Required)

enrolled agent #_________

Have you ever been assessed any preparer penalties, been convicted of a

crime, failed to file personal tax returns, or pay tax liabilites, or been convicted

of any criminal offense under the U.S. Internal Revenue laws?

Yes

No

(Please attach an explanation for a “Yes” response.)

Date of birth (month, day, year)

Signature

Add

Delete

E-mail (optional):

8

Responsible Official (Please complete this section and provide signature even if it is the same as Line 7.) A Not for Profit service

selected in a box on Line 3, Page 1, must complete this section.

The responsible official is the individual with responsibility for and authority over the operations at designated sites. The responsible official is the first point of contact

with the IRS, has the authority to sign revised applications, and is responsible for ensuring that all requirements of the IRS e-file program are adhered to. A responsible

official may be responsible for more than one office. A principal listed in Section 7 may also be a responsible official.

Name of responsible official (first, middle initial, last)

U.S. citizenship?

Are you a/an:

Are you licensed or bonded

officer of a

in accordance with state or

Legal

publicly owned

local requirements?

attorney

resident

corporation

Yes

No

Title:

alien

Yes

No

banking official

None apply

Home address

Social Security Number

Not applicable

C.P.A.

(Fingerprint

Card Required)

enrolled agent

enrolled agent #_________

Have you ever been assessed any preparer penalties, been convicted of a

crime, failed to file personal tax returns, or pay tax liabilites, or been convicted

of any criminal offense under the U.S. Internal Revenue laws?

Yes

No

(Please attach an explanation for a “Yes” response.)

Date of birth (month, day, year)

Signature

E-mail (optional):

Applicant Agreement

Under the penalties of perjury, I declare that I have examined this application and read all accompanying information, and to the best of my knowledge and belief,

the information being provided is true, correct, and complete. This firm and employees will comply with all of the provisions of the Revenue Procedure for Electronic

Filing of Individual Income Tax Returns and Business Tax Returns, and related publications, for each year of our participation.

Acceptance for participation is not transferable. I understand that if this firm is sold or its organizational structure changes, a new application must be filed. I

further understand that noncompliance will result in the firm’s and/or the individuals listed on this application, being suspended from participation in the IRS e-file

program. I am authorized to make and sign this statement on behalf of the firm.

9

Name and title of Principal, Partner, or Owner (type or print)

10

Signature of Principal, Partner, or Owner

11

Date

1

1 2

2