Form Mi-8633 - Application To Participate In The Michigan E-File Program October 2000

ADVERTISEMENT

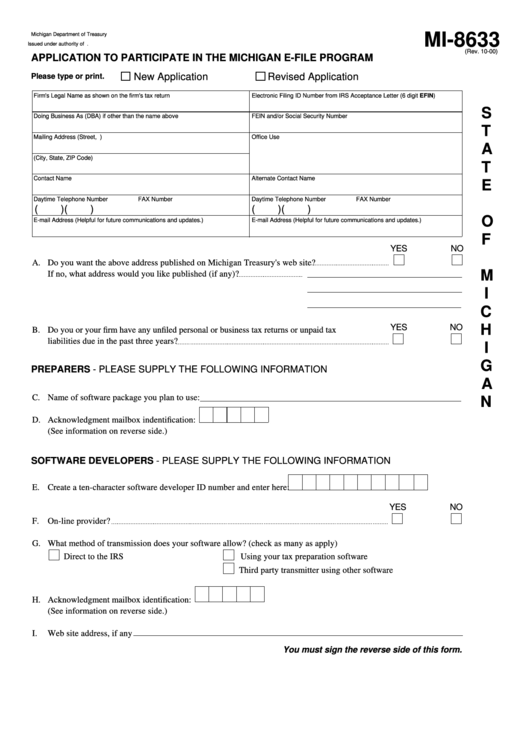

MI-8633

Michigan Department of Treasury

Issued under authority of P.A. 281 of 1967. Filing is voluntary .

(Rev. 10-00)

APPLICATION TO PARTICIPATE IN THE MICHIGAN E-FILE PROGRAM

Please type or print.

New Application

Revised Application

Firm's Legal Name as shown on the firm's tax return

Electronic Filing ID Number from IRS Acceptance Letter (6 digit EFIN)

S

Doing Business As (DBA) if other than the name above

FEIN and/or Social Security Number

T

Mailing Address (Street, P.O. Box)

Office Use

A

(City, State, ZIP Code)

T

Contact Name

Alternate Contact Name

E

Daytime Telephone Number

FAX Number

Daytime Telephone Number

FAX Number

(

)

(

)

(

)

(

)

O

E-mail Address (Helpful for future communications and updates.)

E-mail Address (Helpful for future communications and updates.)

F

YES

NO

A.

Do you want the above address published on Michigan Treasury's web site?

M

If no, what address would you like published (if any)?

I

C

H

YES

NO

B.

Do you or your firm have any unfiled personal or business tax returns or unpaid tax

liabilities due in the past three years?

I

G

PREPARERS - PLEASE SUPPLY THE FOLLOWING INFORMATION

A

C.

Name of software package you plan to use:

N

D.

Acknowledgment mailbox indentification:

(See information on reverse side.)

SOFTWARE DEVELOPERS - PLEASE SUPPLY THE FOLLOWING INFORMATION

E.

Create a ten-character software developer ID number and enter here:

YES

NO

F.

On-line provider?

G.

What method of transmission does your software allow? (check as many as apply)

Direct to the IRS

Using your tax preparation software

Third party transmitter using other software

H.

Acknowledgment mailbox identification:

(See information on reverse side.)

I.

Web site address, if any

You must sign the reverse side of this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2