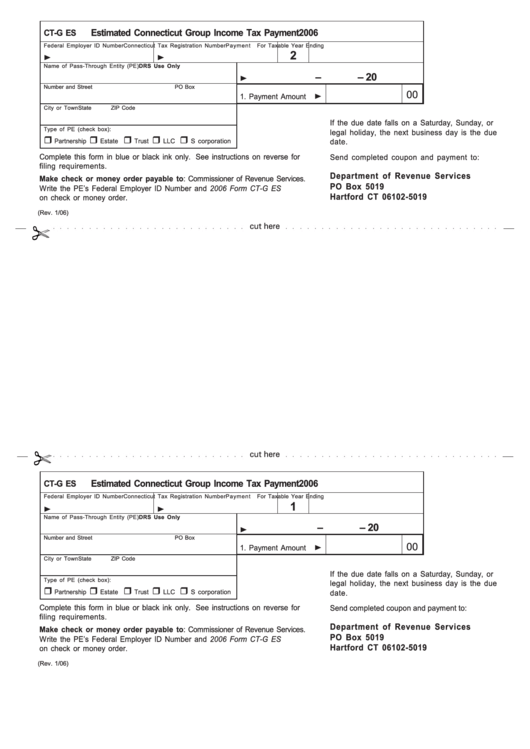

Form Ct-G Es - Estimated Connecticut Group Income Tax Payment 2006

ADVERTISEMENT

Estimated Connecticut Group Income Tax Payment

2006

CT-G ES

Federal Employer ID Number

Connecticut Tax Registration Number

Payment

For Taxable Year Ending

2

Name of Pass-Through Entity (PE)

DRS Use Only

–

– 20

Number and Street

PO Box

00

1. Payment Amount

City or Town

State

ZIP Code

If the due date falls on a Saturday, Sunday, or

Type of PE (check box):

legal holiday, the next business day is the due

Partnership

Estate

Trust

LLC

S corporation

date.

Complete this form in blue or black ink only. See instructions on reverse for

Send completed coupon and payment to:

filing requirements.

Department of Revenue Services

Make check or money order payable to: Commissioner of Revenue Services.

PO Box 5019

Write the PE’s Federal Employer ID Number and 2006 Form CT-G ES

Hartford CT 06102-5019

on check or money order.

(Rev. 1/06)

cut here

cut here

Estimated Connecticut Group Income Tax Payment

2006

CT-G ES

Federal Employer ID Number

Connecticut Tax Registration Number

Payment

For Taxable Year Ending

1

Name of Pass-Through Entity (PE)

DRS Use Only

–

– 20

Number and Street

PO Box

00

1. Payment Amount

City or Town

State

ZIP Code

If the due date falls on a Saturday, Sunday, or

Type of PE (check box):

legal holiday, the next business day is the due

Partnership

Estate

Trust

LLC

S corporation

date.

Complete this form in blue or black ink only. See instructions on reverse for

Send completed coupon and payment to:

filing requirements.

Department of Revenue Services

Make check or money order payable to: Commissioner of Revenue Services.

PO Box 5019

Write the PE’s Federal Employer ID Number and 2006 Form CT-G ES

Hartford CT 06102-5019

on check or money order.

(Rev. 1/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2