Form Wv/sev-401c - Annual Coal Severance Tax Return - 2006 Page 2

ADVERTISEMENT

PAGE 2

WV/SEV-401C (REV. 1/07)

BUSINESS

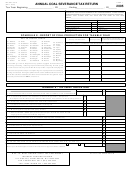

SCHEDULE B *SEVERANCE TAX COMPUTATION SCHEDULE

NAME

COMPUTATION

SEVERED

ACCOUNT IDENTIFICATION NUMBER

SEVERED AND

PURCHASED AND PROCESSED

OF SEVERANCE

BUT NOT

PROCESSED

TAX

PROCESSED

(COLUMN 3)

(COLUMN 1)

(COLUMN 4)

(COLUMN 5)

(COLUMN 6)

(COLUMN 7)

(COL 8)

(COLUMN 9)

(COLUMN 2)

TOTAL GROSS

RATE

TAX

VALUE

AMOUNT PAID

GROSS VALUE

GROSS VALUE

GROSS VALUE

GROSS VALUE

PER

OF PURCHASED

OF SEVERED

OF SEVERED

TO BE TAXED

(COL. 7 X COL. 8)

OR PAYABLE

TO BE TAXED

$100

AND PROCESSED

)

AND PROCESSED

RESOURCES BUT

(ADD COLUMNS

FOR PURCHASED

(COL. 2- COL. 3

RESOURCES

RESOURCES

NOT PROCESSED

4,5,AND/OR 6)

RESOURCES

1.

Coal - not qualified

5.00

as thin seam

2.

Qualified thin

2.00

seam 37" to 45"

Qualified thin seam

3.

1.00

less than 37"

TOTAL

Report on line 1-Sch A

Report on line 1-Sch A

4.

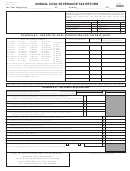

**SCHEDULE C - MINIMUM TAX ON COAL PRODUCTION

(If you process purchased coal only, do not complete Schedule C)

1. Total Tons Sold *(do not include tons from qualified thin seams on or after 4/1/2000)

2. Line 1 times $0.75

3. Net Severance Tax Payable (Schedule A, Line 4)

.

4. Net State Severance Tax Ratio (Enter .93)

5. Net State Severance Tax (Multiply Line 3 x Line 4)

6. Net Minimum Tax (Line 2 Minus Line 5) (If Less Than 0, Enter 0 here and on Line 5, Schedule A)

SCHEDULE D - SUBSIDIARIES REPORTED

FEIN

NAME

FEIN

NAME

1.

5.

2.

6.

3.

7.

4.

8.

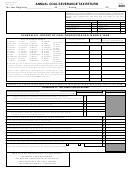

Please answer all questions:

1. If you purchased this business in the past twelve (12) months, give the previous owner's full name and address:

___________________________________________________________________________________________________________________________________________

2. During the period covered by this return, did you:

a. Quit business?_______________ Sell or otherwise dispose of your business?_______________ Exact date______________________________

b. If business was sold, give name and address of new owner_________________________________________________________________

3. Address where your records are loated___________________________________________________________________________________

4. Principal place of business in West Virginia

______________________________________________________________________________________________________________________

5. Nature of business conducted (Describe in Detail)__________________________________________________________________________________

6. Give name and account number of any additional business(es) operated in West Virginia by the reporting taxpayer________________________

__________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the

best of my knowledge and belief it is true, and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Person to Contact Concerning this Return)

(Telephone Number)

(Signature of preparer other than taxpayer)

(Address)

(Date)

*B27010702W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2