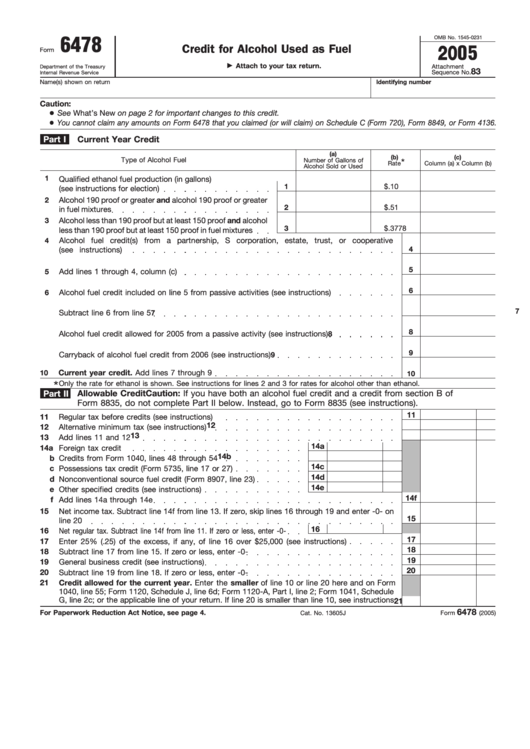

OMB No. 1545-0231

6478

Credit for Alcohol Used as Fuel

2005

Form

Attach to your tax return.

Attachment

Department of the Treasury

83

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Caution:

● See What’s New on page 2 for important changes to this credit.

● You cannot claim any amounts on Form 6478 that you claimed (or will claim) on Schedule C (Form 720), Form 8849, or Form 4136.

Part I

Current Year Credit

(a)

(b)

(c)

Type of Alcohol Fuel

Number of Gallons of

*

Rate

Column (a) x Column (b)

Alcohol Sold or Used

1

Qualified ethanol fuel production (in gallons)

1

$.10

(see instructions for election)

2

Alcohol 190 proof or greater and alcohol 190 proof or greater

2

$.51

in fuel mixtures

3

Alcohol less than 190 proof but at least 150 proof and alcohol

3

$.3778

less than 190 proof but at least 150 proof in fuel mixtures

Alcohol fuel credit(s) from a partnership, S corporation, estate, trust, or cooperative

4

4

(see instructions)

5

5

Add lines 1 through 4, column (c)

6

Alcohol fuel credit included on line 5 from passive activities (see instructions)

6

7

7

Subtract line 6 from line 5

8

8

Alcohol fuel credit allowed for 2005 from a passive activity (see instructions)

9

Carryback of alcohol fuel credit from 2006 (see instructions)

9

Current year credit. Add lines 7 through 9

10

10

*

Only the rate for ethanol is shown. See instructions for lines 2 and 3 for rates for alcohol other than ethanol.

Part II

Allowable Credit

Caution: If you have both an alcohol fuel credit and a credit from section B of

Form 8835, do not complete Part II below. Instead, go to Form 8835 (see instructions).

11

11

Regular tax before credits (see instructions)

12

12

Alternative minimum tax (see instructions)

13

13

Add lines 11 and 12

14a

14a

Foreign tax credit

14b

b

Credits from Form 1040, lines 48 through 54

14c

c

Possessions tax credit (Form 5735, line 17 or 27)

14d

d

Nonconventional source fuel credit (Form 8907, line 23)

14e

e

Other specified credits (see instructions)

14f

f

Add lines 14a through 14e

15

Net income tax. Subtract line 14f from line 13. If zero, skip lines 16 through 19 and enter -0- on

15

line 20

16

16

Net regular tax. Subtract line 14f from line 11. If zero or less, enter -0-

17

17

Enter 25% (.25) of the excess, if any, of line 16 over $25,000 (see instructions)

18

18

Subtract line 17 from line 15. If zero or less, enter -0-

19

19

General business credit (see instructions)

20

20

Subtract line 19 from line 18. If zero or less, enter -0-

21

Credit allowed for the current year. Enter the smaller of line 10 or line 20 here and on Form

1040, line 55; Form 1120, Schedule J, line 6d; Form 1120-A, Part I, line 2; Form 1041, Schedule

G, line 2c; or the applicable line of your return. If line 20 is smaller than line 10, see instructions

21

6478

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 13605J

Form

(2005)

1

1