Arizona Form 301 - Nonrefundable Individual Tax Credits And Recapture - 2014

ADVERTISEMENT

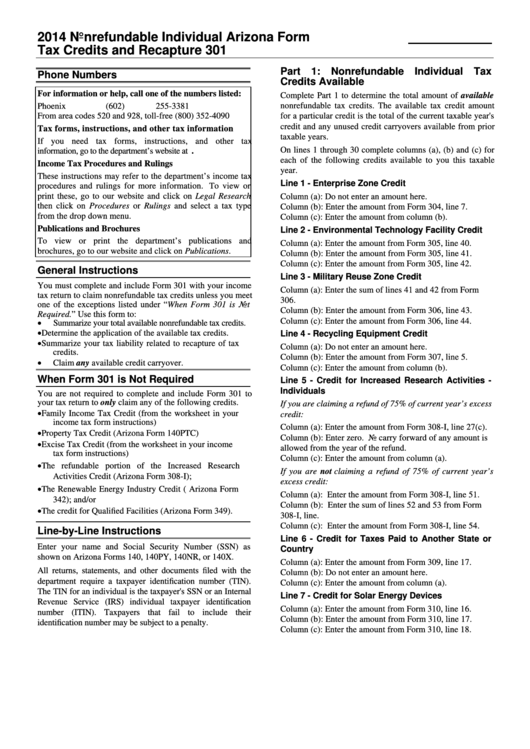

2014 Nonrefundable Individual

Arizona Form

Tax Credits and Recapture

301

Part 1: Nonrefundable Individual Tax

Phone Numbers

Credits Available

For information or help, call one of the numbers listed:

Complete Part 1 to determine the total amount of available

nonrefundable tax credits. The available tax credit amount

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

for a particular credit is the total of the current taxable year's

credit and any unused credit carryovers available from prior

Tax forms, instructions, and other tax information

taxable years.

If you need tax forms, instructions, and other tax

On lines 1 through 30 complete columns (a), (b) and (c) for

information, go to the department’s website at

each of the following credits available to you this taxable

Income Tax Procedures and Rulings

year.

These instructions may refer to the department’s income tax

Line 1 - Enterprise Zone Credit

procedures and rulings for more information. To view or

print these, go to our website and click on Legal Research

Column (a): Do not enter an amount here.

then click on Procedures or Rulings and select a tax type

Column (b): Enter the amount from Form 304, line 7.

from the drop down menu.

Column (c): Enter the amount from column (b).

Publications and Brochures

Line 2 - Environmental Technology Facility Credit

To view or print the department’s publications and

Column (a): Enter the amount from Form 305, line 40.

brochures, go to our website and click on Publications.

Column (b): Enter the amount from Form 305, line 41.

Column (c): Enter the amount from Form 305, line 42.

General Instructions

Line 3 - Military Reuse Zone Credit

You must complete and include Form 301 with your income

Column (a): Enter the sum of lines 41 and 42 from Form

tax return to claim nonrefundable tax credits unless you meet

306.

one of the exceptions listed under “When Form 301 is Not

Column (b): Enter the amount from Form 306, line 43.

Required.” Use this form to:

Column (c): Enter the amount from Form 306, line 44.

Summarize your total available nonrefundable tax credits.

Determine the application of the available tax credits.

Line 4 - Recycling Equipment Credit

Summarize your tax liability related to recapture of tax

Column (a): Do not enter an amount here.

credits.

Column (b): Enter the amount from Form 307, line 5.

Claim any available credit carryover.

Column (c): Enter the amount from column (b).

When Form 301 is Not Required

Line 5 - Credit for Increased Research Activities -

Individuals

You are not required to complete and include Form 301 to

your tax return to only claim any of the following credits.

If you are claiming a refund of 75% of current year’s excess

Family Income Tax Credit (from the worksheet in your

credit:

income tax form instructions)

Column (a): Enter the amount from Form 308-I, line 27(c).

Property Tax Credit (Arizona Form 140PTC)

Column (b): Enter zero. No carry forward of any amount is

Excise Tax Credit (from the worksheet in your income

allowed from the year of the refund.

tax form instructions)

Column (c): Enter the amount from column (a).

The refundable portion of the Increased Research

If you are not claiming a refund of 75% of current year’s

Activities Credit (Arizona Form 308-I);

excess credit:

The Renewable Energy Industry Credit ( Arizona Form

Column (a): Enter the amount from Form 308-I, line 51.

342); and/or

Column (b): Enter the sum of lines 52 and 53 from Form

The credit for Qualified Facilities (Arizona Form 349).

308-I, line.

Column (c): Enter the amount from Form 308-I, line 54.

Line-by-Line Instructions

Line 6 - Credit for Taxes Paid to Another State or

Enter your name and Social Security Number (SSN) as

Country

shown on Arizona Forms 140, 140PY, 140NR, or 140X.

Column (a): Enter the amount from Form 309, line 17.

All returns, statements, and other documents filed with the

Column (b): Do not enter an amount here.

department require a taxpayer identification number (TIN).

Column (c): Enter the amount from column (a).

The TIN for an individual is the taxpayer's SSN or an Internal

Line 7 - Credit for Solar Energy Devices

Revenue Service (IRS) individual taxpayer identification

Column (a): Enter the amount from Form 310, line 16.

number (ITIN). Taxpayers that fail to include their

Column (b): Enter the amount from Form 310, line 17.

identification number may be subject to a penalty.

Column (c): Enter the amount from Form 310, line 18.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5