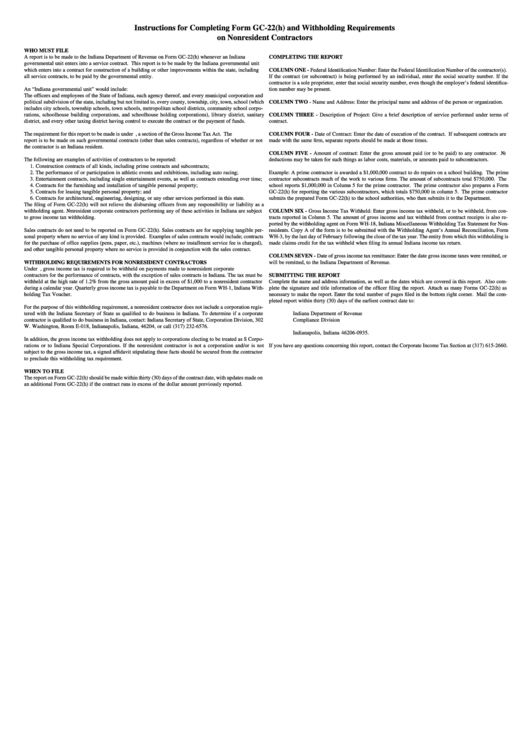

Instructions For Completing Form Gc-22(H) And Withholding Requirements On Nonresident Contractors

ADVERTISEMENT

Instructions for Completing Form GC-22(h) and Withholding Requirements

on Nonresident Contractors

WHO MUST FILE

A report is to be made to the Indiana Department of Revenue on Form GC-22(h) whenever an Indiana

COMPLETING THE REPORT

governmental unit enters into a service contract. This report is to be made by the Indiana governmental unit

which enters into a contract for construction of a building or other improvements within the state, including

COLUMN ONE - Federal Identification Number: Enter the Federal Identification Number of the contractor(s).

all service contracts, to be paid by the governmental entity.

If the contract (or subcontract) is being performed by an individual, enter the social security number. If the

contractor is a sole proprietor, enter that social security number, even though the employer’s federal identifica-

An “Indiana governmental unit” would include:

tion number may be present.

The officers and employees of the State of Indiana, each agency thereof, and every municipal corporation and

political subdivision of the state, including but not limited to, every county, township, city, town, school (which

COLUMN TWO - Name and Address: Enter the principal name and address of the person or organization.

includes city schools, township schools, town schools, metropolitan school districts, community school corpo-

rations, schoolhouse building corporations, and schoolhouse holding corporations), library district, sanitary

COLUMN THREE - Description of Project: Give a brief description of service performed under terms of

district, and every other taxing district having control to execute the contract or the payment of funds.

contract.

The requirement for this report to be made is under I.C. 6-2.1-5-11, a section of the Gross Income Tax Act. The

COLUMN FOUR - Date of Contract: Enter the date of execution of the contract. If subsequent contracts are

report is to be made on such governmental contracts (other than sales contracts), regardless of whether or not

made with the same firm, separate reports should be made at those times.

the contractor is an Indiana resident.

COLUMN FIVE - Amount of contract: Enter the gross amount paid (or to be paid) to any contractor. No

The following are examples of activities of contractors to be reported:

deductions may be taken for such things as labor costs, materials, or amounts paid to subcontractors.

1. Construction contracts of all kinds, including prime contracts and subcontracts;

2. The performance of or participation in athletic events and exhibitions, including auto racing;

Example: A prime contractor is awarded a $1,000,000 contract to do repairs on a school building. The prime

3. Entertainment contracts, including single entertainment events, as well as contracts extending over time;

contractor subcontracts much of the work to various firms. The amount of subcontracts total $750,000. The

4. Contracts for the furnishing and installation of tangible personal property;

school reports $1,000,000 in Column 5 for the prime contractor. The prime contractor also prepares a Form

5. Contracts for leasing tangible personal property; and

GC-22(h) for reporting the various subcontractors, which totals $750,000 in column 5. The prime contractor

6. Contracts for architectural, engineering, designing, or any other services performed in this state.

submits the prepared Form GC-22(h) to the school authorities, who then submits it to the Department.

The filing of Form GC-22(h) will not relieve the disbursing officers from any responsibility or liability as a

withholding agent. Nonresident corporate contractors performing any of these activities in Indiana are subject

COLUMN SIX - Gross Income Tax Withheld: Enter gross income tax withheld, or to be withheld, from con-

to gross income tax withholding.

tracts reported in Column 5. The amount of gross income and tax withheld from contract receipts is also re-

ported by the withholding agent on Form WH-18, Indiana Miscellaneous Withholding Tax Statement for Non-

Sales contracts do not need to be reported on Form GC-22(h). Sales contracts are for supplying tangible per-

residents. Copy A of the form is to be submitted with the Withholding Agent’s Annual Reconciliation, Form

sonal property where no service of any kind is provided. Examples of sales contracts would include; contracts

WH-3, by the last day of February following the close of the tax year. The entity from which this withholding is

for the purchase of office supplies (pens, paper, etc.), machines (where no installment service fee is charged),

made claims credit for the tax withheld when filing its annual Indiana income tax return.

and other tangible personal property where no service is provided in conjunction with the sales contract.

COLUMN SEVEN - Date of gross income tax remittance: Enter the date gross income taxes were remitted, or

WITHHOLDING REQUIREMENTS FOR NONRESIDENT CONTRACTORS

will be remitted, to the Indiana Department of Revenue.

Under I.C. 6-2.1-6-1, gross income tax is required to be withheld on payments made to nonresident corporate

contractors for the performance of contracts, with the exception of sales contracts in Indiana. The tax must be

SUBMITTING THE REPORT

withheld at the high rate of 1.2% from the gross amount paid in excess of $1,000 to a nonresident contractor

Complete the name and address information, as well as the dates which are covered in this report. Also com-

during a calendar year. Quarterly gross income tax is payable to the Department on Form WH-1, Indiana With-

plete the signature and title information of the officer filing the report. Attach as many Forms GC-22(h) as

holding Tax Voucher.

necessary to make the report. Enter the total number of pages filed in the bottom right corner. Mail the com-

pleted report within thirty (30) days of the earliest contract date to:

For the purpose of this withholding requirement, a nonresident contractor does not include a corporation regis-

tered with the Indiana Secretary of State as qualified to do business in Indiana. To determine if a corporate

Indiana Department of Revenue

contractor is qualified to do business in Indiana, contact: Indiana Secretary of State, Corporation Division, 302

Compliance Division

W. Washington, Room E-018, Indianapolis, Indiana, 46204, or call (317) 232-6576.

P.O. Box 935

Indianapolis, Indiana 46206-0935.

In addition, the gross income tax withholding does not apply to corporations electing to be treated as S Corpo-

rations or to Indiana Special Corporations. If the nonresident contractor is not a corporation and/or is not

If you have any questions concerning this report, contact the Corporate Income Tax Section at (317) 615-2660.

subject to the gross income tax, a signed affidavit stipulating these facts should be secured from the contractor

to preclude this withholding tax requirement.

WHEN TO FILE

The report on Form GC-22(h) should be made within thirty (30) days of the contract date, with updates made on

an additional Form GC-22(h) if the contract runs in excess of the dollar amount previously reported.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1