Instructions For Form Ed-50 Notice Of Property Tax And Certification Of Intent To Impose A Tax - 2001-2002

ADVERTISEMENT

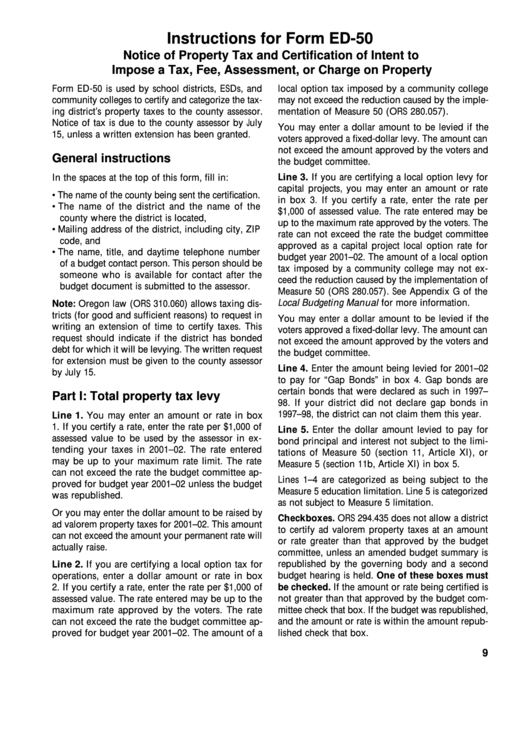

Instructions for Form ED-50

Notice of Property Tax and Certification of Intent to

Impose a Tax, Fee, Assessment, or Charge on Property

Form ED-50 is used by school districts, ESDs, and

local option tax imposed by a community college

community colleges to certify and categorize the tax-

may not exceed the reduction caused by the imple-

ing district’s property taxes to the county assessor.

mentation of Measure 50 (ORS 280.057).

Notice of tax is due to the county assessor by July

You may enter a dollar amount to be levied if the

15, unless a written extension has been granted.

voters approved a fixed-dollar levy. The amount can

not exceed the amount approved by the voters and

General instructions

the budget committee.

Line 3. If you are certifying a local option levy for

In the spaces at the top of this form, fill in:

capital projects, you may enter an amount or rate

• The name of the county being sent the certification.

in box 3. If you certify a rate, enter the rate per

• The name of the district and the name of the

$1,000 of assessed value. The rate entered may be

county where the district is located,

up to the maximum rate approved by the voters. The

• Mailing address of the district, including city, ZIP

rate can not exceed the rate the budget committee

code, and

approved as a capital project local option rate for

• The name, title, and daytime telephone number

budget year 2001–02. The amount of a local option

of a budget contact person. This person should be

tax imposed by a community college may not ex-

someone who is available for contact after the

ceed the reduction caused by the implementation of

budget document is submitted to the assessor.

Measure 50 (ORS 280.057). See Appendix G of the

Local Budgeting Manual for more information.

Note: Oregon law (ORS 310.060) allows taxing dis-

tricts (for good and sufficient reasons) to request in

You may enter a dollar amount to be levied if the

writing an extension of time to certify taxes. This

voters approved a fixed-dollar levy. The amount can

request should indicate if the district has bonded

not exceed the amount approved by the voters and

debt for which it will be levying. The written request

the budget committee.

for extension must be given to the county assessor

Line 4. Enter the amount being levied for 2001–02

by July 15.

to pay for “Gap Bonds” in box 4. Gap bonds are

certain bonds that were declared as such in 1997–

Part I: Total property tax levy

98. If your district did not declare gap bonds in

1997–98, the district can not claim them this year.

Line 1. You may enter an amount or rate in box

1. If you certify a rate, enter the rate per $1,000 of

Line 5. Enter the dollar amount levied to pay for

assessed value to be used by the assessor in ex-

bond principal and interest not subject to the limi-

tending your taxes in 2001–02. The rate entered

tations of Measure 50 (section 11, Article XI), or

may be up to your maximum rate limit. The rate

Measure 5 (section 11b, Article XI) in box 5.

can not exceed the rate the budget committee ap-

Lines 1–4 are categorized as being subject to the

proved for budget year 2001–02 unless the budget

Measure 5 education limitation. Line 5 is categorized

was republished.

as not subject to Measure 5 limitation.

Or you may enter the dollar amount to be raised by

Checkboxes. ORS 294.435 does not allow a district

ad valorem property taxes for 2001–02. This amount

to certify ad valorem property taxes at an amount

can not exceed the amount your permanent rate will

or rate greater than that approved by the budget

actually raise.

committee, unless an amended budget summary is

republished by the governing body and a second

Line 2. If you are certifying a local option tax for

budget hearing is held. One of these boxes must

operations, enter a dollar amount or rate in box

be checked. If the amount or rate being certified is

2. If you certify a rate, enter the rate per $1,000 of

assessed value. The rate entered may be up to the

not greater than that approved by the budget com-

maximum rate approved by the voters. The rate

mittee check that box. If the budget was republished,

and the amount or rate is within the amount repub-

can not exceed the rate the budget committee ap-

proved for budget year 2001–02. The amount of a

lished check that box.

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3