Form Tc203 - Income And Expense Schedule For Cooperative And Condominium Property - 2008

ADVERTISEMENT

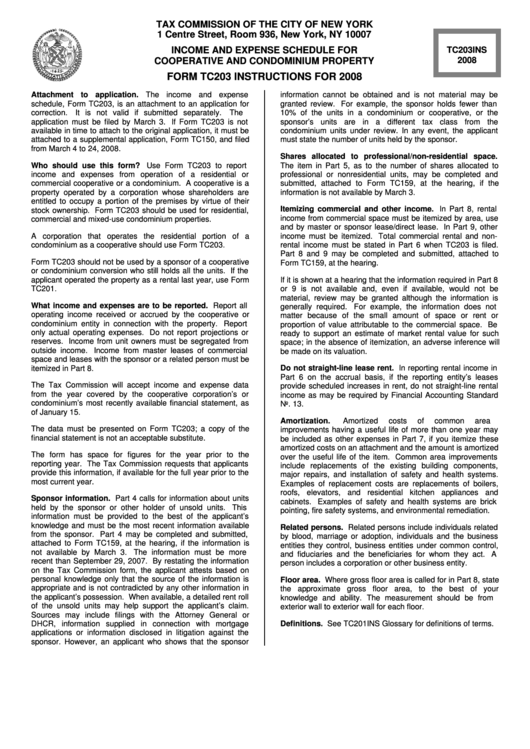

TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

INCOME AND EXPENSE SCHEDULE FOR

TC203INS

2008

COOPERATIVE AND CONDOMINIUM PROPERTY

FORM TC203 INSTRUCTIONS FOR 2008

Attachment to application. The income and expense

information cannot be obtained and is not material may be

schedule, Form TC203, is an attachment to an application for

granted review. For example, the sponsor holds fewer than

correction.

It is not valid if submitted separately.

The

10% of the units in a condominium or cooperative, or the

application must be filed by March 3. If Form TC203 is not

sponsor’s units are in a different tax class from the

available in time to attach to the original application, it must be

condominium units under review. In any event, the applicant

attached to a supplemental application, Form TC150, and filed

must state the number of units held by the sponsor.

from March 4 to 24, 2008.

Shares allocated to professional/non-residential space.

Who should use this form?

Use Form TC203 to report

The item in Part 5, as to the number of shares allocated to

income and expenses from operation of a residential or

professional or nonresidential units, may be completed and

commercial cooperative or a condominium. A cooperative is a

submitted, attached to Form TC159, at the hearing, if the

property operated by a corporation whose shareholders are

information is not available by March 3.

entitled to occupy a portion of the premises by virtue of their

Itemizing commercial and other income. In Part 8, rental

stock ownership. Form TC203 should be used for residential,

income from commercial space must be itemized by area, use

commercial and mixed-use condominium properties.

and by master or sponsor lease/direct lease. In Part 9, other

A corporation that operates the residential portion of a

income must be itemized. Total commercial rental and non-

condominium as a cooperative should use Form TC203.

rental income must be stated in Part 6 when TC203 is filed.

Part 8 and 9 may be completed and submitted, attached to

Form TC203 should not be used by a sponsor of a cooperative

Form TC159, at the hearing.

or condominium conversion who still holds all the units. If the

applicant operated the property as a rental last year, use Form

If it is shown at a hearing that the information required in Part 8

TC201.

or 9 is not available and, even if available, would not be

material, review may be granted although the information is

What income and expenses are to be reported. Report all

generally required.

For example, the information does not

operating income received or accrued by the cooperative or

matter because of the small amount of space or rent or

condominium entity in connection with the property. Report

proportion of value attributable to the commercial space. Be

only actual operating expenses. Do not report projections or

ready to support an estimate of market rental value for such

reserves. Income from unit owners must be segregated from

space; in the absence of itemization, an adverse inference will

outside income. Income from master leases of commercial

be made on its valuation.

space and leases with the sponsor or a related person must be

itemized in Part 8.

Do not straight-line lease rent. In reporting rental income in

Part 6 on the accrual basis, if the reporting entity’s leases

The Tax Commission will accept income and expense data

provide scheduled increases in rent, do not straight-line rental

from the year covered by the cooperative corporation’s or

income as may be required by Financial Accounting Standard

condominium’s most recently available financial statement, as

No. 13.

of January 15.

Amortization.

Amortized

costs

of

common

area

The data must be presented on Form TC203; a copy of the

improvements having a useful life of more than one year may

financial statement is not an acceptable substitute.

be included as other expenses in Part 7, if you itemize these

amortized costs on an attachment and the amount is amortized

The form has space for figures for the year prior to the

over the useful life of the item. Common area improvements

reporting year. The Tax Commission requests that applicants

include replacements of the existing building components,

provide this information, if available for the full year prior to the

major repairs, and installation of safety and health systems.

most current year.

Examples of replacement costs are replacements of boilers,

roofs, elevators, and residential kitchen appliances and

Sponsor information. Part 4 calls for information about units

cabinets. Examples of safety and health systems are brick

held by the sponsor or other holder of unsold units.

This

pointing, fire safety systems, and environmental remediation.

information must be provided to the best of the applicant’s

knowledge and must be the most recent information available

Related persons. Related persons include individuals related

from the sponsor. Part 4 may be completed and submitted,

by blood, marriage or adoption, individuals and the business

attached to Form TC159, at the hearing, if the information is

entities they control, business entities under common control,

not available by March 3.

The information must be more

and fiduciaries and the beneficiaries for whom they act. A

recent than September 29, 2007. By restating the information

person includes a corporation or other business entity.

on the Tax Commission form, the applicant attests based on

personal knowledge only that the source of the information is

Floor area. Where gross floor area is called for in Part 8, state

appropriate and is not contradicted by any other information in

the approximate gross floor area, to the best of your

the applicant’s possession. When available, a detailed rent roll

knowledge and ability.

The measurement should be from

of the unsold units may help support the applicant’s claim.

exterior wall to exterior wall for each floor.

Sources may include filings with the Attorney General or

DHCR, information supplied in connection with mortgage

Definitions. See TC201INS Glossary for definitions of terms.

applications or information disclosed in litigation against the

sponsor. However, an applicant who shows that the sponsor

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3