Form Tc203 - Income And Expense Schedule For Cooperative And Condominium Property - 2006

ADVERTISEMENT

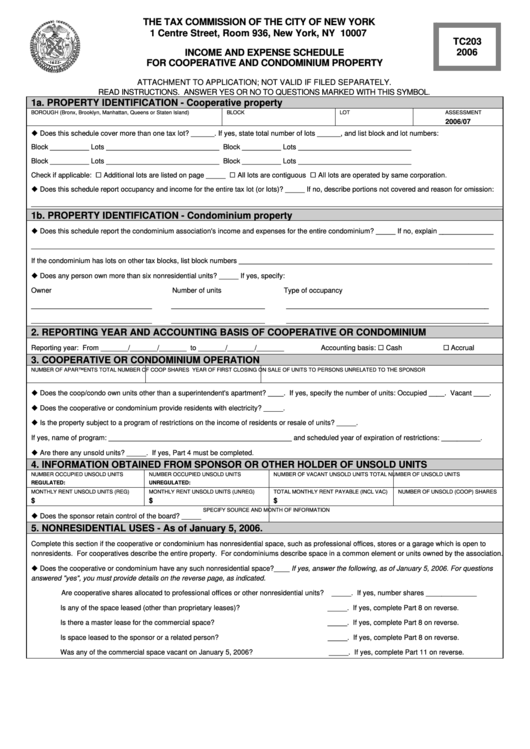

THE TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

TC203

INCOME AND EXPENSE SCHEDULE

2006

FOR COOPERATIVE AND CONDOMINIUM PROPERTY

ATTACHMENT TO APPLICATION; NOT VALID IF FILED SEPARATELY.

READ INSTRUCTIONS. ANSWER YES OR NO TO QUESTIONS MARKED WITH THIS SYMBOL.

1a. PROPERTY IDENTIFICATION - Cooperative property

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2006/07

Does this schedule cover more than one tax lot? ______. If yes, state total number of lots ______, and list block and lot numbers:

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Check if applicable:

Additional lots are listed on page _____

All lots are contiguous

All lots are operated by same corporation.

Does this schedule report occupancy and income for the entire tax lot (or lots)? _____ If no, describe portions not covered and reason for omission:

_________________________________________________________________________________________________________________________

1b. PROPERTY IDENTIFICATION - Condominium property

Does this schedule report the condominium association's income and expenses for the entire condominium? _____ If no, explain ______________

_______________________________________________________________________________________________________________________

If the condominium has lots on other tax blocks, list block numbers _________________________________________________________________

Does any person own more than six nonresidential units? _____ If yes, specify:

Owner

Number of units

Type of occupancy

_______________________________

________________________

____________________________________________________

_______________________________

________________________

____________________________________________________

2. REPORTING YEAR AND ACCOUNTING BASIS OF COOPERATIVE OR CONDOMINIUM

Reporting year: From _______/_______/_______ to _______/_______/_______

Accounting basis:

Cash

Accrual

3. COOPERATIVE OR CONDOMINIUM OPERATION

NUMBER OF APARTMENTS

TOTAL NUMBER OF COOP SHARES

YEAR OF FIRST CLOSING ON SALE OF UNITS TO PERSONS UNRELATED TO THE SPONSOR

Does the coop/condo own units other than a superintendent's apartment? ____. If yes, specify the number of units: Occupied ____. Vacant ____.

Does the cooperative or condominium provide residents with electricity? _____.

Is the property subject to a program of restrictions on the income of residents or resale of units? _____.

If yes, name of program: _______________________________________________ and scheduled year of expiration of restrictions: __________.

Are there any unsold units? _____. If yes, Part 4 must be completed.

4. INFORMATION OBTAINED FROM SPONSOR OR OTHER HOLDER OF UNSOLD UNITS

NUMBER OCCUPIED UNSOLD UNITS

NUMBER OCCUPIED UNSOLD UNITS

NUMBER OF VACANT UNSOLD UNITS

TOTAL NUMBER OF UNSOLD UNITS

REGULATED:

UNREGULATED:

MONTHLY RENT UNSOLD UNITS (REG)

MONTHLY RENT UNSOLD UNITS (UNREG)

TOTAL MONTHLY RENT PAYABLE (INCL VAC)

NUMBER OF UNSOLD (COOP) SHARES

$

$

$

SPECIFY SOURCE AND MONTH OF INFORMATION

Does the sponsor retain control of the board? _____

5. NONRESIDENTIAL USES - As of January 5, 2006.

Complete this section if the cooperative or condominium has nonresidential space, such as professional offices, stores or a garage which is open to

nonresidents. For cooperatives describe the entire property. For condominiums describe space in a common element or units owned by the association.

Does the cooperative or condominium have any such nonresidential space?____ If yes, answer the following, as of January 5, 2006. For questions

answered "yes", you must provide details on the reverse page, as indicated.

Are cooperative shares allocated to professional offices or other nonresidential units?

_____. If yes, number shares _____________

Is any of the space leased (other than proprietary leases)?

_____. If yes, complete Part 8 on reverse.

Is there a master lease for the commercial space?

_____. If yes, complete Part 8 on reverse.

Is space leased to the sponsor or a related person?

_____. If yes, complete Part 8 on reverse.

Was any of the commercial space vacant on January 5, 2006?

_____. If yes, complete Part 11 on reverse.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2