Instruction For Form E-505

ADVERTISEMENT

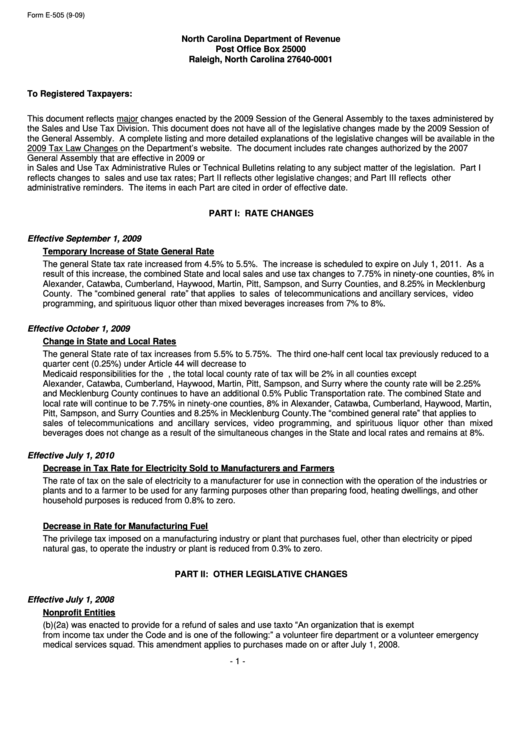

Form E-505 (9-09)

North Carolina Department of Revenue

Post Office Box 25000

Raleigh, North Carolina 27640-0001

To Registered Taxpayers:

This document reflects major changes enacted by the 2009 Session of the General Assembly to the taxes administered by

the Sales and Use Tax Division. This document does not have all of the legislative changes made by the 2009 Session of

the General Assembly. A complete listing and more detailed explanations of the legislative changes will be available in the

2009 Tax Law Changes on the Department‟s website. The document includes rate changes authorized by the 2007

General Assembly that are effective in 2009 or 2010. Legislative changes supersede any information previously set forth

in Sales and Use Tax Administrative Rules or Technical Bulletins relating to any subject matter of the legislation. Part I

reflects changes to sales and use tax rates; Part II reflects other legislative changes; and Part III reflects other

administrative reminders. The items in each Part are cited in order of effective date.

PART I: RATE CHANGES

Effective September 1, 2009

Temporary Increase of State General Rate

The general State tax rate increased from 4.5% to 5.5%. The increase is scheduled to expire on July 1, 2011. As a

result of this increase, the combined State and local sales and use tax changes to 7.75% in ninety-one counties, 8% in

Alexander, Catawba, Cumberland, Haywood, Martin, Pitt, Sampson, and Surry Counties, and 8.25% in Mecklenburg

The “combined general rate” that applies to sales of telecommunications and ancillary services, video

County.

programming, and spirituous liquor other than mixed beverages increases from 7% to 8%.

Effective October 1, 2009

Change in State and Local Rates

The general State rate of tax increases from 5.5% to 5.75%. The third one-half cent local tax previously reduced to a

quarter cent (0.25%) under Article 44 will decrease to zero. These changes occur as the State continues assuming

Medicaid responsibilities for the counties. Therefore, the total local county rate of tax will be 2% in all counties except

Alexander, Catawba, Cumberland, Haywood, Martin, Pitt, Sampson, and Surry where the county rate will be 2.25%

and Mecklenburg County continues to have an additional 0.5% Public Transportation rate. The combined State and

local rate will continue to be 7.75% in ninety-one counties, 8% in Alexander, Catawba, Cumberland, Haywood, Martin,

Pitt, Sampson, and Surry Counties and 8.25% in Mecklenburg County. The “combined general rate” that applies to

sales of telecommunications and ancillary services, video programming, and spirituous liquor other than mixed

beverages does not change as a result of the simultaneous changes in the State and local rates and remains at 8%.

Effective July 1, 2010

Decrease in Tax Rate for Electricity Sold to Manufacturers and Farmers

The rate of tax on the sale of electricity to a manufacturer for use in connection with the operation of the industries or

plants and to a farmer to be used for any farming purposes other than preparing food, heating dwellings, and other

household purposes is reduced from 0.8% to zero.

Decrease in Rate for Manufacturing Fuel

The privilege tax imposed on a manufacturing industry or plant that purchases fuel, other than electricity or piped

natural gas, to operate the industry or plant is reduced from 0.3% to zero.

PART II: OTHER LEGISLATIVE CHANGES

Effective July 1, 2008

Nonprofit Entities

G.S. 105-164.14(b)(2a) was enacted to provide for a refund of sales and use tax to “An organization that is exempt

from income tax under the Code and is one of the following:” a volunteer fire department or a volunteer emergency

medical services squad. This amendment applies to purchases made on or after July 1, 2008.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4