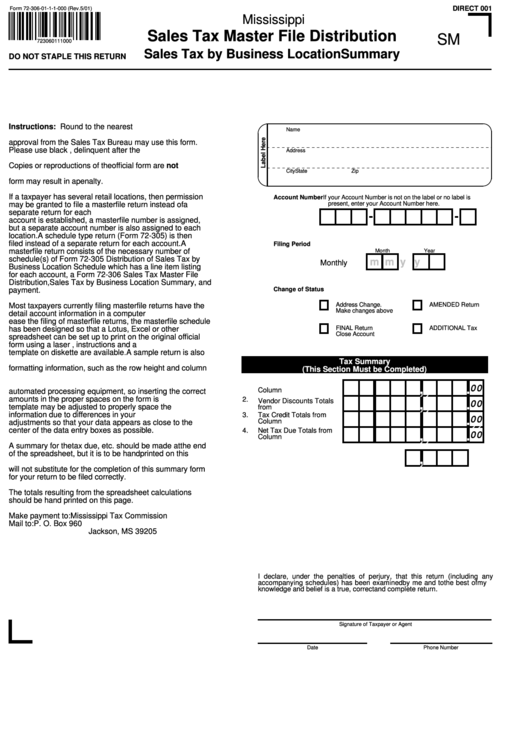

Sales Tax Master File Distribution Form - Sales Tax By Business Location Summary

ADVERTISEMENT

DIRECT 001

Form 72-306-01-1-1-000 (Rev. 5/01)

Mississippi

Sales Tax Master File Distribution

SM

723060111000

Sales Tax by Business Location Summary

DO NOT STAPLE THIS RETURN

Instructions: Round to the nearest dollar. Do not include

Name

pennies. Only taxpayers who have received previous

approval from the Sales Tax Bureau may use this form.

Please use black ink. Due 1st to 20th, delinquent after the

Address

20th. No discount allowed and add penalty if delinquent.

Copies or reproductions of the official form are not

City

State

Zip

acceptable. Failure to submit your return on the official

form may result in a penalty.

If a taxpayer has several retail locations, then permission

Account Number If your Account Number is not on the label or no label is

may be granted to file a masterfile return instead of a

present, enter your Account Number here.

separate return for each account. When a masterfile

-

-

account is established, a masterfile number is assigned,

but a separate account number is also assigned to each

location. A schedule type return (Form 72-305) is then

filed instead of a separate return for each account. A

Filing Period

masterfile return consists of the necessary number of

Month

Year

schedule(s) of Form 72-305 Distribution of Sales Tax by

m m

y y

Monthly

Business Location Schedule which has a line item listing

for each account, a Form 72-306 Sales Tax Master File

Distribution,Sales Tax by Business Location Summary, and

Change of Status

payment.

Address Change.

AMENDED Return

Most taxpayers currently filing masterfile returns have the

Make changes above

detail account information in a computer spreadsheet. To

ease the filing of masterfile returns, the masterfile schedule

FINAL Return

ADDITIONAL Tax

has been designed so that a Lotus, Excel or other

Close Account

spreadsheet can be set up to print on the original official

form using a laser printer. Formatting, instructions and a

template on diskette are available. A sample return is also

available. The template and instructions only contain

Tax Summary

formatting information, such as the row height and column

(This Section Must be Completed)

width. They do not contain the formulas for the

,

,

.

computations. These forms will be processed by

1.

Balance Totals from

00

Column 5........................

automated processing equipment, so inserting the correct

,

,

.

amounts in the proper spaces on the form is critical. The

2.

Vendor Discounts Totals

00

template may be adjusted to properly space the

from Column 6................

,

,

.

information due to differences in your environment. Make

3.

Tax Credit Totals from

00

Column 7........................

adjustments so that your data appears as close to the

,

,

.

center of the data entry boxes as possible.

4.

Net Tax Due Totals from

00

Column 8........................

A summary for the tax due, etc. should be made at the end

,

of the spreadsheet, but it is to be handprinted on this

5.

Number of Accounts

Included.........................

summary. Information printed at the end of the schedules

will not substitute for the completion of this summary form

for your return to be filed correctly.

The totals resulting from the spreadsheet calculations

should be hand printed on this page.

Make payment to:

Mississippi Tax Commission

Mail to:

P. O. Box 960

Jackson, MS 39205

I declare, under the penalties of perjury, that this return (including any

accompanying schedules) has been examined by me and to the best of my

knowledge and belief is a true, correct and complete return.

Signature of Taxpayer or Agent

Date

Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1