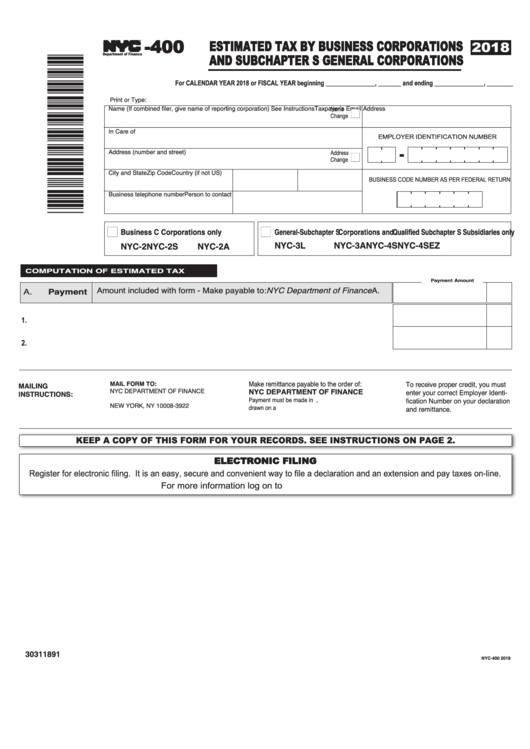

Form Nyc-400 - Estimated Tax By Business Corporations And Subchapter S General Corporations - 2018

ADVERTISEMENT

-400

ESTIMATED TAX BY BUSINESS CORPORATIONS

2018

AND SUBCHAPTER S GENERAL CORPORATIONS

TM

Department of Finance

For CALENDAR YEAR 2018 or FISCAL YEAR beginning _______________, _______ and ending _______________, ________

Print or Type:

Name (If combined filer, give name of reporting corporation) See Instructions

Taxpayer’s Email Address

Name

n

Change

In Care of

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

n

Address

Change

City and State

Zip Code

Country (if not US)

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

Business telephone number

Person to contact

n

n

Business C Corporations only

General-Subchapter S Corporations and Qualified Subchapter S Subsidiaries only

NYC-3L

NYC-3A

NYC-4S

NYC-4SEZ

NYC-2

NYC-2S

NYC-2A

C O M P U TAT I O N O F E S T I M AT E D TA X

Payment Amount

Amount included with form - Make payable to: NYC Department of Finance...... A.

Payment

A.

1. Declaration of estimated tax for current year........................................................................

1.

2. Estimated Payment Amount .................................................................................................

2.

Make remittance payable to the order of:

To receive proper credit, you must

MAIL FORM TO:

MAILING

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

enter your correct Employer Identi-

INSTRUCTIONS:

P.O. BOX 3922

fication Number on your declaration

Payment must be made in U.S.dollars,

NEW YORK, NY 10008-3922

drawn on a U.S. bank.

and remittance.

KEEP A COPY OF THIS FORM FOR YOUR RECORDS. SEE INSTRUCTIONS ON PAGE 2.

ELECTRONIC FILING

Register for electronic filing. It is an easy, secure and convenient way to file a declaration and an extension and pay taxes on-line.

For more information log on to NYC gov/eservices

30311891

NYC-400 2018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2