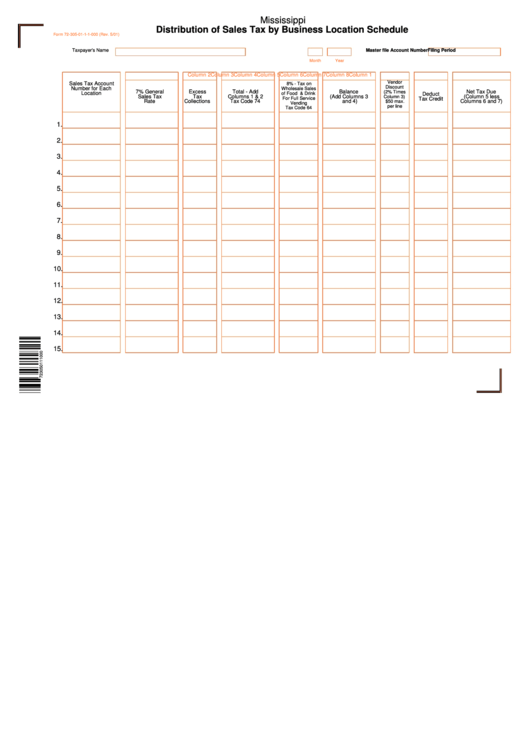

Form 72-305-01-1-1-000 - Distribution Of Sales Tax By Business Location Schedule - 2001

ADVERTISEMENT

Mississippi

Distribution of Sales Tax by Business Location Schedule

Form 72-305-01-1-1-000 (Rev. 5/01)

Taxpayer's Name

Filing Period

Master file Account Number

Month

Year

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Column 8

Vendor

Sales Tax Account

8% - Tax on

Discount

Number for Each

Wholesale Sales

7% General

Excess

Total - Add

Balance

Net Tax Due

(2% Times

Location

of Food & Drink

Deduct

Sales Tax

Tax

Columns 1 & 2

(Add Columns 3

(Column 5 less

Column 3)

For Full Service

Tax Credit

Rate

Collections

Tax Code 74

and 4)

Columns 6 and 7)

$50 max.

Vending

per line

Tax Code 64

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1

![Form 72-440-01-1-1-000 - Rider (sales, Use, Income, Franchise, Withholding, And Special Fuel [diesel Fuel] Tax Bond) Form 72-440-01-1-1-000 - Rider (sales, Use, Income, Franchise, Withholding, And Special Fuel [diesel Fuel] Tax Bond)](https://data.formsbank.com/pdf_docs_html/212/2127/212751/page_1_thumb.png)