Form 50-149 - Confidential Industrial Real Property Rendition Of Taxable Property - Fixed Machinery And Equipment Page 2

ADVERTISEMENT

50-149 (Rev. 8-03/4) (Back)

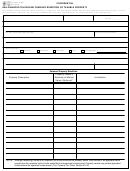

FIXED MACHINERY AND EQUIPMENT

List all fixed machinery and equipment (considered real property) showing your costs, regardless of whether new or used, and

the year you purchased. Items received as gifts are to be listed in the same manner. If needed, attach additional sheets.

Indicate

Whether

Description of Property

Purchased

(by individual item or

New (N) or

Owner’s

Year

Life

by asset group)

Used (U)

Cost

Acquired

Expectancy

$

TOTALS

$

Total property owner’s value for fixed machinery and equipment (optional):

NOTE:

Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value

greater than the rendered value is to be submitted to the appraisal review board. Property owners may protest appraised

values before the appraisal review board. (Section 25.19, Tax Code)

Are you the property owner, an employee of the property owner, or an employee of a property owner on behalf of an affiliated entity of the property

owner?

Yes

No

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your

knowledge and belief. If you checked “Yes” above, sign and date on the signature line below. No notarization is required.

Signature

__________________________________________________________________ Date _________________

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and correct to the best of my knowledge and belief.

Signature

__________________________________________________________________ Date _________________

Subscribed and sworn before me this ____________day of ____________________________, 20______.

__________________________________________________________

Notary Public, State of Texas

Section 22.26 of the Tax Code states:

(a)

Each rendition statement or property report required or authorized by this chapter must be signed by an individual who is

required to file the statement or report.

(b)

When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has

been designated in writing by the board of directors or by an authorized officer to sign in behalf of the corporation must sign

the statement or report.

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10,

Penal Code.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2