Cigarette Tax Amnesty Page 2

ADVERTISEMENT

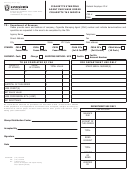

Instructions for Compliance with Cigarette Tax SDCL 10-50

Please provide the name of the online supplier from whom you purchased cigarettes.

The AMOUNT OF INVOICE for your online purchases should include all non-cigarette purchases and freight charges. Sales/Use

tax is payable on these items.

For the NUMBER OF PACKS PURCHASED column, enter the number of packs you purchased from each Internet seller.

Line 1.

The “ Amount of Invoice” column is added to determine the total amount you paid for all purchases.

Line 2.

Add the Amount of Packages Purchased column to determine the total number of pack you bought.

Line 3.

Multiply Line 2 by the Excise Tax Rate of $.53 per package.

Line 4.

Add Lines 1 plus line 3 for the Total Amount Taxable.

Line 5.

Multiply Line 4 times the State Use Tax Rate of 4%.

Line 6.

Multiply Line 4 times the City Use Tax Rate. The City Use Tax Rate is the same as the City Sales Tax Rate.

Use the rate for the city where the cigarettes were shipped. If you do not know the use tax rate of your city

you may call the help desk for the Department of Revenue at 1-800-TAX-9188.

Line 7.

Add Line 3, 5 and 6 for the total use and excise tax due.

If you have any questions or concerns please direct them to the SD Department of Revenue & Regulation at (605) 773-7804.

Mail the form and payment for taxes to: DRR, Special Taxes, 445 East Capitol Avenue, Pierre, SD 57501.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2