Form Gt 5 Instructions - Maine Gasoline Distributors Tax Return

ADVERTISEMENT

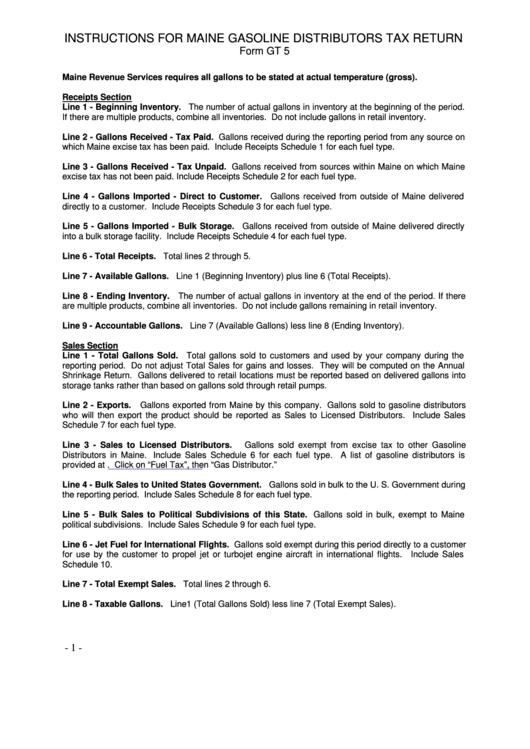

INSTRUCTIONS FOR MAINE GASOLINE DISTRIBUTORS TAX RETURN

Form GT 5

Maine Revenue Services requires all gallons to be stated at actual temperature (gross).

Receipts Section

Line 1 - Beginning Inventory. The number of actual gallons in inventory at the beginning of the period.

If there are multiple products, combine all inventories. Do not include gallons in retail inventory.

Line 2 - Gallons Received - Tax Paid. Gallons received during the reporting period from any source on

which Maine excise tax has been paid. Include Receipts Schedule 1 for each fuel type.

Line 3 - Gallons Received - Tax Unpaid. Gallons received from sources within Maine on which Maine

excise tax has not been paid. Include Receipts Schedule 2 for each fuel type.

Line 4 - Gallons Imported - Direct to Customer.

Gallons received from outside of Maine delivered

directly to a customer. Include Receipts Schedule 3 for each fuel type.

Line 5 - Gallons Imported - Bulk Storage.

Gallons received from outside of Maine delivered directly

into a bulk storage facility. Include Receipts Schedule 4 for each fuel type.

Line 6 - Total Receipts. Total lines 2 through 5.

Line 7 - Available Gallons. Line 1 (Beginning Inventory) plus line 6 (Total Receipts).

Line 8 - Ending Inventory. The number of actual gallons in inventory at the end of the period. If there

are multiple products, combine all inventories. Do not include gallons remaining in retail inventory.

Line 9 - Accountable Gallons. Line 7 (Available Gallons) less line 8 (Ending Inventory).

Sales Section

Line 1 - Total Gallons Sold.

Total gallons sold to customers and used by your company during the

reporting period. Do not adjust Total Sales for gains and losses. They will be computed on the Annual

Shrinkage Return. Gallons delivered to retail locations must be reported based on delivered gallons into

storage tanks rather than based on gallons sold through retail pumps.

Line 2 - Exports. Gallons exported from Maine by this company. Gallons sold to gasoline distributors

who will then export the product should be reported as Sales to Licensed Distributors. Include Sales

Schedule 7 for each fuel type.

Line 3 - Sales to Licensed Distributors.

Gallons sold exempt from excise tax to other Gasoline

Distributors in Maine. Include Sales Schedule 6 for each fuel type. A list of gasoline distributors is

provided at Click on “Fuel Tax”, then “Gas Distributor.”

Line 4 - Bulk Sales to United States Government. Gallons sold in bulk to the U. S. Government during

the reporting period. Include Sales Schedule 8 for each fuel type.

Line 5 - Bulk Sales to Political Subdivisions of this State. Gallons sold in bulk, exempt to Maine

political subdivisions. Include Sales Schedule 9 for each fuel type.

Line 6 - Jet Fuel for International Flights. Gallons sold exempt during this period directly to a customer

for use by the customer to propel jet or turbojet engine aircraft in international flights.

Include Sales

Schedule 10.

Line 7 - Total Exempt Sales. Total lines 2 through 6.

Line 8 - Taxable Gallons. Line 1 (Total Gallons Sold) less line 7 (Total Exempt Sales).

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2