Form 75a002(I)- Instructions For Telecommunications Provider Tax Return

ADVERTISEMENT

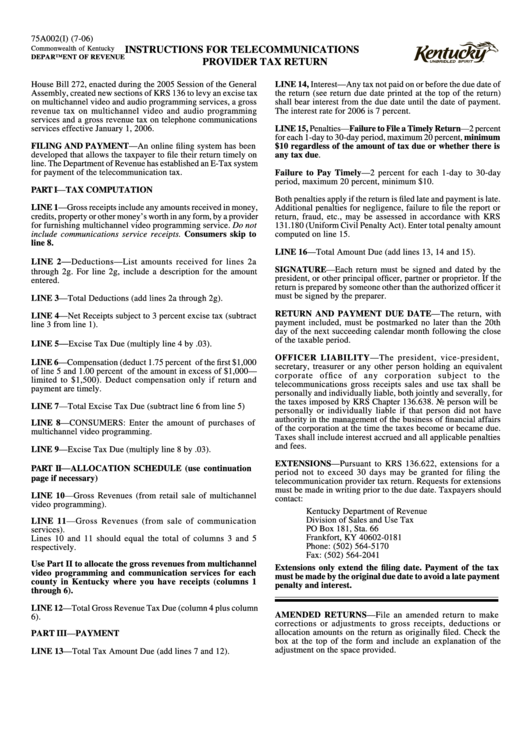

75A002(I) (7-06)

Commonwealth of Kentucky

INSTRUCTIONS FOR TELECOMMUNICATIONS

DEPARTMENT OF REVENUE

PROVIDER TAX RETURN

House Bill 272, enacted during the 2005 Session of the General

LINE 14, Interest—Any tax not paid on or before the due date of

Assembly, created new sections of KRS 136 to levy an excise tax

the return (see return due date printed at the top of the return)

on multichannel video and audio programming services, a gross

shall bear interest from the due date until the date of payment.

revenue tax on multichannel video and audio programming

The interest rate for 2006 is 7 percent.

services and a gross revenue tax on telephone communications

services effective January 1, 2006.

LINE 15, Penalties—Failure to File a Timely Return—2 percent

for each 1-day to 30-day period, maximum 20 percent, minimum

FILING AND PAYMENT—An online filing system has been

$10 regardless of the amount of tax due or whether there is

developed that allows the taxpayer to file their return timely on

any tax due.

line. The Department of Revenue has established an E-Tax system

for payment of the telecommunication tax.

Failure to Pay Timely—2 percent for each 1-day to 30-day

period, maximum 20 percent, minimum $10.

PART I—TAX COMPUTATION

Both penalties apply if the return is filed late and payment is late.

LINE 1—Gross receipts include any amounts received in money,

Additional penalties for negligence, failure to file the report or

credits, property or other money’s worth in any form, by a provider

return, fraud, etc., may be assessed in accordance with KRS

for furnishing multichannel video programming service. Do not

131.180 (Uniform Civil Penalty Act). Enter total penalty amount

include communications service receipts. Consumers skip to

computed on line 15.

line 8.

LINE 16—Total Amount Due (add lines 13, 14 and 15).

—

LINE 2

Deductions—List amounts received for lines 2a

SIGNATURE—Each return must be signed and dated by the

through 2g. For line 2g, include a description for the amount

president, or other principal officer, partner or proprietor. If the

entered.

return is prepared by someone other than the authorized officer it

must be signed by the preparer.

LINE 3—Total Deductions (add lines 2a through 2g).

RETURN AND PAYMENT DUE DATE—The return, with

LINE 4—Net Receipts subject to 3 percent excise tax (subtract

payment included, must be postmarked no later than the 20th

line 3 from line 1).

day of the next succeeding calendar month following the close

of the taxable period.

—

LINE 5

Excise Tax Due (multiply line 4 by .03).

OFFICER LIABILITY—The president, vice-president,

LINE 6—Compensation (deduct 1.75 percent of the first $1,000

secretary, treasurer or any other person holding an equivalent

of line 5 and 1.00 percent of the amount in excess of $1,000—

corporate office of any corporation subject to the

limited to $1,500). Deduct compensation only if return and

telecommunications gross receipts sales and use tax shall be

payment are timely.

personally and individually liable, both jointly and severally, for

the taxes imposed by KRS Chapter 136.638. No person will be

LINE 7—Total Excise Tax Due (subtract line 6 from line 5)

personally or individually liable if that person did not have

authority in the management of the business of financial affairs

LINE 8—CONSUMERS: Enter the amount of purchases of

of the corporation at the time the taxes become or became due.

multichannel video programming.

Taxes shall include interest accrued and all applicable penalties

and fees.

LINE 9—Excise Tax Due (multiply line 8 by .03).

EXTENSIONS—Pursuant to KRS 136.622, extensions for a

—

PART II

ALLOCATION SCHEDULE (use continuation

period not to exceed 30 days may be granted for filing the

page if necessary)

telecommunication provider tax return. Requests for extensions

must be made in writing prior to the due date. Taxpayers should

LINE 10—Gross Revenues (from retail sale of multichannel

contact:

video programming).

Kentucky Department of Revenue

Division of Sales and Use Tax

LINE 11—Gross Revenues (from sale of communication

PO Box 181, Sta. 66

services).

Frankfort, KY 40602-0181

Lines 10 and 11 should equal the total of columns 3 and 5

Phone: (502) 564-5170

respectively.

Fax: (502) 564-2041

Use Part II to allocate the gross revenues from multichannel

Extensions only extend the filing date. Payment of the tax

video programming and communication services for each

must be made by the original due date to avoid a late payment

county in Kentucky where you have receipts (columns 1

penalty and interest.

through 6).

LINE 12—Total Gross Revenue Tax Due (column 4 plus column

AMENDED RETURNS—File an amended return to make

6).

corrections or adjustments to gross receipts, deductions or

allocation amounts on the return as originally filed. Check the

PART III—PAYMENT

box at the top of the form and include an explanation of the

adjustment on the space provided.

LINE 13—Total Tax Amount Due (add lines 7 and 12).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1