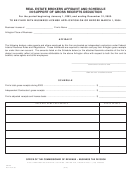

Form Crl-29 - Real Estate Brokers Affidavit And Schedule In Support Of Gross Receipts Deduction Page 2

ADVERTISEMENT

Page Two

SALES AGENTS NAME AND ADDRESS

GROSS SHARE $

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

NAME

STREET ADDRESS

CITY

STATE

ZIP

PHONE:

CELL PHONE:

E-MAIL

(If additional space is required, attach additional sheet of paper)

AFFIDAVIT

Pursuant to the Internal Revenue Code and Regulations, and the Arlington County Code, Brokers and Sales Agents are

treated as independent contractors. Sales Agents are required to obtain a business license under Section 11-57.1 of the

Arlington County Code for part of the gross receipts attributable to the activity as an independent contractor which are not

retained by the Broker as the Brokers share of the gross receipts produced by the Sales Agent. The Sales Agents license

tax shall be assessed at the same rate as for Brokers. The amounts listed on the schedule accurately reflect all gross

income for the above Arlington Office.

____________________________________________________

SIGNATURE OF OFFICER OF FIRM

____________________________________________________

NAME AND TITLE OF SIGNING OFFICER

OFFICE OF THE COMMISSIONER OF REVENUE – BUSINESS TAX DIVISION

2100 CLARENDON BOULEVARD / SUITE 208 / ARLINGTON, VIRGINIA 22201 / 703-228-3060

CRL-29

Rev. 12/31/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2