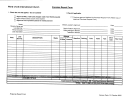

Apartment Income & Expense Report Form Page 4

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING – APARTMENT BUILDING INCOME AND EXPENSE REPORT

(Please do not return these instructions with your report)

The following instructions are provided to aid you in filling out this questionnaire. The information submitted in

this report should be in accordance with the accounting methodology used for Federal income tax purposes.

Expenses are to be reported only once; double reporting is prohibited. If you have any questions, please call

Mr. Anthony Daniels, Program Coordinator, at (202) 442-6794.

List Apartment Name – Square Suffix and Lot (List the main SSL here)

List the Premise Address

You may list additional SSLS that may comprise an economic unit and receive filing credit for the

additional SSLs.

Provide the Owner’s name and address.

C

ERTIFICATION

District of Columbia law (D.C. code §22-2514) requires certification of this information by the owner or an

officially authorized representative. Please print or type the name and title of the person certifying the

Information, the name and phone number of the person to contact with questions on the information, and the

property owner’s federal tax I.D. number.

Provide certification information. Be certain to sign the form to ensure you receive filing credit.

List Utilities paid by tenants.

Provide information regarding HUD or Low‐Income programs.

SUMMARY OF RENT SCHEDULES

A.

1. Please provide the number of residential units and average monthly rent for each listed category.

2. Provide information for retail/commercial units.

3. Submit a copy of your EOY rent roll along with the form.

HUD/SUBSIDIZED/LOW INCOME HOUSING INFORMATION

This information is requested to identify subsidized properties. Please identify in the space provided the

subsidy program in which you participate.

DEBT SERVICE INFORMATION

1. Please provide information concerning any existing mortgage or mortgages that exist on this property.

Please list the mortgage or mortgages amount, itemize if needed. This information is requested to study

the financing trends for this property type to determine typical debt coverage ratios.

2. Please list the most recent appraisal, date of valuation and appraised amount. If an appraisal has been

completed within the past 24 months please provide a copy.

ANNUAL INCOME

B.

1. List the total rental revenue received of occupied units at their contract rent and the total potential

rent of the vacant units at market rent. The potential gross income includes all the rental income

assuming 100% occupancy, including employee apartments. This potential gross income should be

reported on line 1. All miscellaneous income contributed to retail, office, corporate suites, parking, etc.

will be addressed on lines 7-11. (Potential Gross Income line 1 Annual Income Section)

2. List the rental loss (Vacancy) at current rental rates due to un-leased units during this reporting period.

(line 2 Annual Income Section)

3. List the income loss due to inability to collect rent owed (Collection Loss) (line 3 Annual Income

Section).

4. List all incentives (Concessions) given to tenants in order to increase occupancy (line 4 Annual

Income Section).

5. List the income loss at current rental rates for employee apartments. Please provide the number of

st

units made available for employees (occupied or not) for year ending December 31

(line 5 Annual

Income Section).

6. Total Actual Income line 6 is derived as follows (line 1 less lines 2-5)

7. Please provide income received from corporate suites, retail, office, commercial units. This reported

income should be referenced from the retail/commercial section under Summary of Rent Schedules

(line 7 Annual Income Section).

8. Provide the total amount of income collected from coin laundry, parking, storage, clubhouse and or

party rooms, vending etc. (line 8 Annual Income Section).

9. List any tenant/HUD/Subsidized Housing repayment to the owners for utilities where utilities are sub-

metered or where reimbursements are given by HUD for Subsidized units (line 9 Annual Income

Section).

10. For subsidized apartments only, indicate the amount of HUD interest subsidy reimbursements to

owners. Indicate the program; if it provides tax credits, subsidized financing, etc. please provide

attachments for covenant terms and time frame (line 10 Annual Income Section).

11. Please provide any other miscellaneous income under other. This could pertain to any income

received from percentage leases, fees collected for pet allowance, pool use, exercise facility or other

fees not accounted for elsewhere (line 11 Annual Income Section).

12. Total actual income is derived as follows (line 1 less lines 2-5 plus lines 7-11).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6