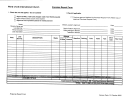

Apartment Income & Expense Report Form Page 5

ADVERTISEMENT

EXPENSES

C.

These are annual expenses necessary to maintain the production of income from operation of the property. Do

not include under any expense category items such as ground rent, mortgage interest or amortization,

personal property tax, depreciation, income taxes, or capital expenditures. These are not operating expenses.

Capital expenditures include investments in remodeling, or replacements, which materially add to the value of

the property or appreciably prolong its life. Capital expenditures are requested under Capital

Improvements Section (lines 34 & 35).

13. Amount paid to a management company or self for operating the building. This should be management

expense only, if any management expenses are categorized under administrative or under payroll they

should be reported here and not under payroll or administrative.

14. Administrative expenses should include: advertising, office supplies, accounting, legal fees and liability

insurance. List any furniture rental costs (for models, offices, tenants, etc.), please detail each and

submit separate sheet.

15. Payroll expenses. Itemized list required if applicable. If reporting security payroll with payroll under this

section please do not double report. Do not report management expenses under payroll section, please

refer them to management section line 13.

16. Expenses for providing corporate suites.

UTILITIES

D.

This utility section applies to the utility expenses associated with operating and maintaining the property. This

may include the heating and cooling of common area such as hallways, foyers, office space for management

etc. Utilities services as they pertain to HVAC are excluded if associated with tenants who are responsible for

paying own utilities

st

17. Water & sewer services for the reporting period ending December 31

. This should be electric service

to maintain the common areas (hallways, foyer, entry levels), office etc.

st

18. Electricity service for the reporting period ending December 31

. This should be electric service to

maintain the common areas (hallways, elevators, foyer, entry levels), office etc.

19. Specify the primary heating fuel (oil, gas, etc.) used for heating the common areas or office area. If

more than one type of fuel is used, indicate the type and cost. Do not include an amount for electric if it

is listed above. (line 19 Expense Section)

REPAIRS MAINTENANCE AND CONTRACT SERVICES

E.

20. Payroll expenses for maintenance staff and expenses for maintenance supplies.)

21. Maintenance and repair expenses associated with all mechanical systems of the property. These

include heating, ventilation, air-conditioning, plumbing, electrical. Do not include capital

Improvements/Expenditure items.

22. Roof repairs; include repairs and routine maintenance expenses to roof. Do not enter the cost to

replace entire roof. Roof replacement is a capital expense, as it will be shown within capital

improvements/expenditure section lines 34&35.

23. Elevator expenses. Include any cost of maintenance (parts, labor) to maintain or repair. Also include

any contracts services if they exist.

24. Pool expenses. Include any cost of maintenance (parts, labor) to maintain or repair. Also include any

contracts services if they exist.

25. Redecorating Costs (Carpet, paint, drywall repair etc). This could also include repairs to exterior of the

property not covered elsewhere. These costs should be cosmetic items only. Do not include capital

expenditures, or any short lived items being replaced through replacement reserves. A detailed list is

required to be submitted or uploaded, please reference you’re reporting to line 25 redecorating cost.

26. Janitorial/Cleaning. Include supplies & payroll pertaining to janitorial and cleaning services. Also

include any contract service expenses if they exist

27. Landscaping and Ground Services. Include any landscaping cost, snow removal, lawn care, parking lot

maintenance etc. Also include any contract service costs if they exist.

28. Trash Expenses. Include any expenses with onsite dumpsters, trash chutes, or trash removal. Include

any contract service expenses if they exist.

29. Security Expenses. Include expenses associated with security guard payroll, electrical or computer

systems associated with security. Maintenance of security electrical and computer systems. Do not

include security payroll under this section if reporting above under payroll.

30. Other maintenance contract services etc. not covered above. A detailed list must be attached or

submitted for consideration as expense item.

FIXED EXPENSES

F.

Fixed expenses incurred by the property should contain fire/casualty insurance, miscellaneous taxes

(excluding Real Estate Taxes).

31. Identify fire/casualty insurance expenses relevant to the reporting period only (year ending December

st

31

). Some insurance policies are multi-year contracts. Please include only one year’s cost.

32. Specify any miscellaneous taxes (ex. payroll taxes, BID Taxes, Vault, Taxes, etc.) do not include Real

Estate Tax. Though Real Estate Taxes are considered fixed expense, OTR uses a loaded tax rate to

compensate for Real Estate Taxes.

Total fixed expenses should equal the sum of lines 31&32 under fixed expenses section.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6