Instructions For Form 706-D - United States Additional Estate Tax Return Under Code Section 2057 - 2008

ADVERTISEMENT

Department of the Treasury

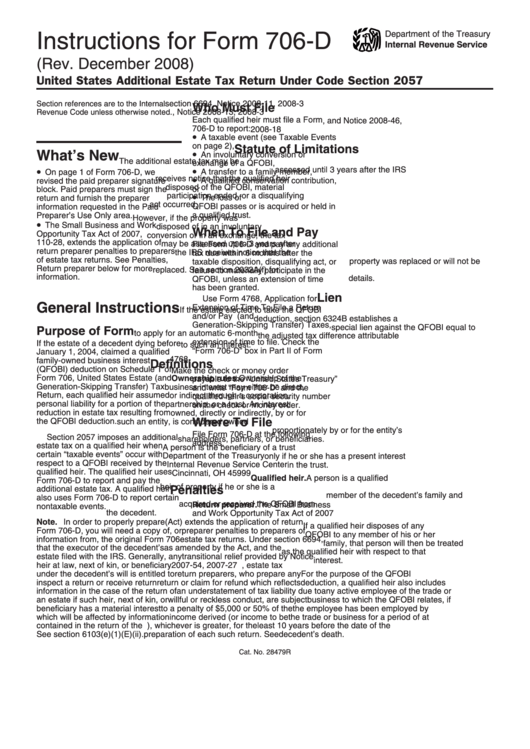

Instructions for Form 706-D

Internal Revenue Service

(Rev. December 2008)

United States Additional Estate Tax Return Under Code Section 2057

Section references are to the Internal

section 6694, Notice 2008-11, 2008-3

Who Must File

I.R.B. 279, Notice 2008-13, 2008-3

Revenue Code unless otherwise noted.

Each qualified heir must file a Form

I.R.B. 282, and Notice 2008-46,

706-D to report:

2008-18 I.R.B. 868 for more details.

•

A taxable event (see Taxable Events

on page 2),

Statute of Limitations

•

What’s New

An involuntary conversion or

The additional estate tax may be

exchange of a QFOBI,

•

•

assessed until 3 years after the IRS

A transfer to a family member,

On page 1 of Form 706-D, we

•

receives notice that the qualified heir

A qualified conservation contribution,

revised the paid preparer signature

disposed of the QFOBI, material

block. Paid preparers must sign the

or

•

participation ended, or a disqualifying

The loss of U.S. citizenship if the

return and furnish the preparer

act occurred.

QFOBI passes or is acquired or held in

information requested in the Paid

a qualified trust.

Preparer’s Use Only area.

However, if the property was

•

The Small Business and Work

disposed of in an involuntary

When To File and Pay

Opportunity Tax Act of 2007, P.L.

conversion or in an exchange, the tax

110-28, extends the application of

may be assessed up to 3 years after

File Form 706-D and pay any additional

return preparer penalties to preparers

the IRS receives notice that the

tax due within 6 months after the

of estate tax returns. See Penalties,

property was replaced or will not be

taxable disposition, disqualifying act, or

Return preparer below for more

replaced. See section 2032A(f) for

failure to materially participate in the

information.

details.

QFOBI, unless an extension of time

has been granted.

Lien

Use Form 4768, Application for

General Instructions

Extension of Time To File a Return

If the estate elected to take the QFOBI

and/or Pay U.S. Estate (and

deduction, section 6324B establishes a

Generation-Skipping Transfer) Taxes,

special lien against the QFOBI equal to

Purpose of Form

to apply for an automatic 6-month

the adjusted tax difference attributable

extension of time to file. Check the

If the estate of a decedent dying before

to such an interest.

“Form 706-D” box in Part II of Form

January 1, 2004, claimed a qualified

4768.

family-owned business interest

Definitions

(QFOBI) deduction on Schedule T of

Make the check or money order

Form 706, United States Estate (and

Ownership rules. Ownership of the

payable to the “United States Treasury”

Generation-Skipping Transfer) Tax

business interest may either be direct,

and write “Form 706-D” and the

Return, each qualified heir assumed

or indirect through a corporation,

qualified heir’s social security number

personal liability for a portion of the

partnership, or a trust. An interest

on the check or money order.

reduction in estate tax resulting from

owned, directly or indirectly, by or for

the QFOBI deduction.

Where To File

such an entity, is considered owned

proportionately by or for the entity’s

File Form 706-D at the following

Section 2057 imposes an additional

shareholders, partners, or beneficiaries.

address.

estate tax on a qualified heir when

A person is the beneficiary of a trust

certain “taxable events” occur with

Department of the Treasury

only if he or she has a present interest

respect to a QFOBI received by the

Internal Revenue Service Center

in the trust.

qualified heir. The qualified heir uses

Cincinnati, OH 45999

Qualified heir. A person is a qualified

Form 706-D to report and pay the

heir of property if he or she is a

additional estate tax. A qualified heir

Penalties

member of the decedent’s family and

also uses Form 706-D to report certain

acquired or received the QFOBI from

Return preparer. The Small Business

nontaxable events.

the decedent.

and Work Opportunity Tax Act of 2007

Note. In order to properly prepare

(Act) extends the application of return

If a qualified heir disposes of any

Form 706-D, you will need a copy of, or

preparer penalties to preparers of

QFOBI to any member of his or her

information from, the original Form 706

estate tax returns. Under section 6694,

family, that person will then be treated

that the executor of the decedent’s

as amended by the Act, and the

as the qualified heir with respect to that

estate filed with the IRS. Generally, any

transitional relief provided by Notice

interest.

heir at law, next of kin, or beneficiary

2007-54, 2007-27 I.R.B. 12, estate tax

under the decedent’s will is entitled to

return preparers, who prepare any

For the purpose of the QFOBI

inspect a return or receive return

return or claim for refund which reflects

deduction, a qualified heir also includes

information in the case of the return of

an understatement of tax liability due to

any active employee of the trade or

an estate if such heir, next of kin, or

willful or reckless conduct, are subject

business to which the QFOBI relates, if

beneficiary has a material interest

to a penalty of $5,000 or 50% of the

the employee has been employed by

which will be affected by information

income derived (or income to be

the trade or business for a period of at

contained in the return of the estate.

derived), whichever is greater, for the

least 10 years before the date of the

See section 6103(e)(1)(E)(ii).

preparation of each such return. See

decedent’s death.

Cat. No. 28479R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5