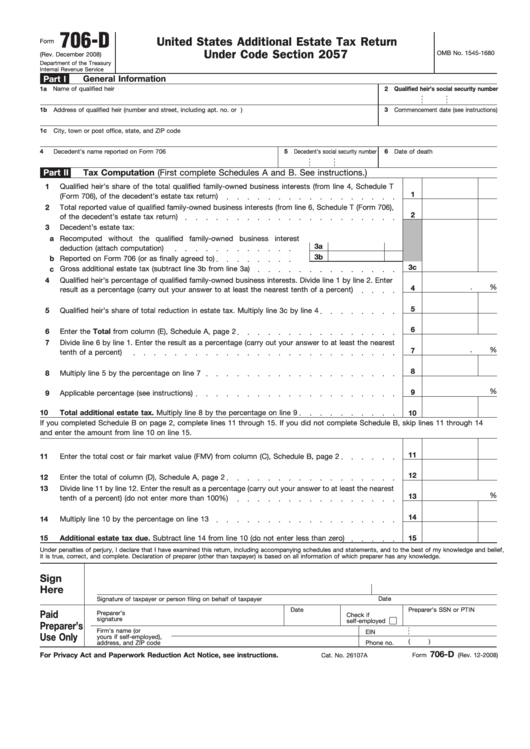

706-D

United States Additional Estate Tax Return

Form

Under Code Section 2057

OMB No. 1545-1680

(Rev. December 2008)

Department of the Treasury

Internal Revenue Service

Part I

General Information

1a Name of qualified heir

2

Qualified heir’s social security number

1b

Address of qualified heir (number and street, including apt. no. or P.O. box)

3

Commencement date (see instructions)

1c

City, town or post office, state, and ZIP code

4

Decedent’s name reported on Form 706

5

Decedent’s social security number

6

Date of death

Part II

Tax Computation (First complete Schedules A and B. See instructions.)

1

Qualified heir’s share of the total qualified family-owned business interests (from line 4, Schedule T

1

(Form 706), of the decedent’s estate tax return)

2

Total reported value of qualified family-owned business interests (from line 6, Schedule T (Form 706),

2

of the decedent’s estate tax return)

3

Decedent’s estate tax:

a

Recomputed without the qualified family-owned business interest

3a

deduction (attach computation)

3b

b

Reported on Form 706 (or as finally agreed to)

3c

c

Gross additional estate tax (subtract line 3b from line 3a)

4

Qualified heir’s percentage of qualified family-owned business interests. Divide line 1 by line 2. Enter

.

%

4

result as a percentage (carry out your answer to at least the nearest tenth of a percent)

5

5

Qualified heir’s share of total reduction in estate tax. Multiply line 3c by line 4

6

6

Enter the Total from column (E), Schedule A, page 2

7

Divide line 6 by line 1. Enter the result as a percentage (carry out your answer to at least the nearest

.

%

7

tenth of a percent)

8

8

Multiply line 5 by the percentage on line 7

%

9

9

Applicable percentage (see instructions)

10

Total additional estate tax. Multiply line 8 by the percentage on line 9

10

If you completed Schedule B on page 2, complete lines 11 through 15. If you did not complete Schedule B, skip lines 11 through 14

and enter the amount from line 10 on line 15.

11

11

Enter the total cost or fair market value (FMV) from column (C), Schedule B, page 2

12

12

Enter the total of column (D), Schedule A, page 2

13

Divide line 11 by line 12. Enter the result as a percentage (carry out your answer to at least the nearest

%

13

tenth of a percent) (do not enter more than 100%)

14

14

Multiply line 10 by the percentage on line 13

15

Additional estate tax due. Subtract line 14 from line 10 (do not enter less than zero)

15

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

Signature of taxpayer or person filing on behalf of taxpayer

Date

Date

Preparer’s SSN or PTIN

Preparer’s

Paid

Check if

signature

self-employed

Preparer’s

Firm’s name (or

EIN

Use Only

yours if self-employed),

(

)

address, and ZIP code

Phone no.

706-D

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 26107A

Form

(Rev. 12-2008)

1

1 2

2