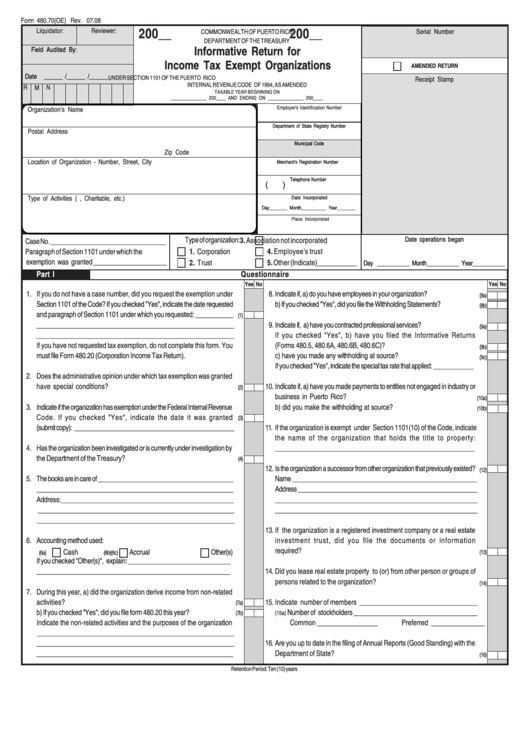

Form 480.70(Oe) - Informative Return For Income Tax Exempt Organizations July 2008

ADVERTISEMENT

Form 480.70(OE) Rev. 07.08

200__

200__

Liquidator:

Reviewer:

Serial Number

COMMONWEALTH OF PUERTO RICO

DEPARTMENT OF THE TREASURY

Informative Return for

Field Audited By:

Income Tax Exempt Organizations

AMENDED RETURN

Date

______ /______ /______

UNDER SECTION 1101 OF THE PUERTO RICO

Receipt Stamp

INTERNAL REVENUE CODE OF 1994, AS AMENDED

R

M

N

TAXABLE YEAR BEGINNING ON

_______________ 200____ AND ENDING ON _______________ 200____

Employer's Identification Number

Organization's Name

Department of State Registry Number

Postal Address

Municipal Code

Zip Code

Location of Organization - Number, Street, City

Merchant's Registration Number

Telephone Number

(

)

Type of Activities (i.e. Educational, Charitable, etc.)

Date Incorporated

Day________ Month___________ Year________

Place Incorporated

Type of organization:

Date operations began

3. Association not incorporated

Case No. __________________________________

4. Employee's trust

Paragraph of Section 1101 under which the

1. Corporation

exemption was granted _____________________

5. Other (Indicate)___________

2. Trust

Day ___________ Month___________ Year___________

Part I

Questionnaire

Yes No

Yes No

1.

If you do not have a case number, did you request the exemption under

8.

Indicate if, a) do you have employees in your organization?..............................

(8a)

Section 1101 of the Code? If you checked "Yes", indicate the date requested

b) If you checked "Yes", did you file the Withholding Statements?......................

(8b)

and paragraph of Section 1101 under which you requested: ___________

(1)

_____________________________________________________________

9.

Indicate if, a) have you contracted professional services?...................................

(9a)

_______________________________________________________________

If you checked "Yes", b) have you filed the Informative Returns

If you have not requested tax exemption, do not complete this form. You

(Forms 480.5, 480.6A, 480.6B, 480.6C)?.......................................................

(9b)

must file Form 480.20 (Corporation Income Tax Return).

c) have you made any withholding at source?...............................................

(9c)

If you checked "Yes", indicate the special tax rate that applied: ____________

2.

Does the administrative opinion under which tax exemption was granted

have special conditions? ...................................................................

10.

Indicate if, a) have you made payments to entities not engaged in industry or

(2)

business in Puerto Rico?..........................................................................

(10a)

3.

Indicate if the organization has exemption under the Federal Internal Revenue

b) did you make the withholding at source?.................................................

(10b)

Code. If you checked "Yes", indicate the date it was granted

(3)

(submit copy): ________________________________________________

11.

If the organization is exempt under Section 1101(10) of the Code, indicate

the name of the organization that holds the title to property:

4.

Has the organization been investigated or is currently under investigation by

____________________________________________________________________

the Department of the Treasury? .............................................................

(4)

12.

Is the organization a successor from other organization that previously existed?

(12)

5.

The books are in care of _________________________________________

Name ________________________________________________________

_____________________________________________________________

Address ______________________________________________________

Address:____________________________________________________

______________________________________________________________

_____________________________________________________________

______________________________________________________________

_____________________________________________________________

13.

If the organization is a registered investment company or a real estate

6.

Accounting method used:

investment trust, did you file the documents or information

required?...................................................................................................

Cash

Accrual

Other(s)

(6a)

(6b)

(6c)

(13)

If you checked "Other(s)", explain: ______________________________

____________________________________________________________

14.

Did you lease real estate property to (or) from other person or groups of

persons related to the organization?.......................................................

(14)

7.

During this year, a) did the organization derive income from non-related

activities? .........................................................................................

15.

Indicate number of members _________________________________

(7a)

b) If you checked "Yes", did you file form 480.20 this year? .........................

Number of stockholders ____________________________________

(15a)

(7b)

Indicate the non-related activities and the purposes of the organization

Common _________________

Preferred _______________

________________________________________________________________

________________________________________________________________

16.

Are you up to date in the filing of Annual Reports (Good Standing) with the

_____________________________________________________________

Department of State?...............................................................................

(16)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5