Instructions For Form 8038-G - Information Return For Tax-Exempt Governmental Obligations - Internal Revenue Service - 2011

ADVERTISEMENT

Instructions for Form

Department of the Treasury

Internal Revenue Service

8038-G

(Rev. September 2011)

Information Return for Tax-Exempt Governmental Obligations

Rounding to Whole Dollars

indenture or other bond documents. See

Section references are to the Internal

Where To File next.

Revenue Code unless otherwise noted.

You may show amounts on this return as

whole dollars. To do so, drop amounts

General Instructions

Where To File

less than 50 cents and increase amounts

File Form 8038-G, and any attachments,

from 50 cents through 99 cents to the

Purpose of Form

with the Department of the Treasury,

next higher dollar.

Form 8038-G is used by issuers of

Internal Revenue Service Center, Ogden,

Questions on Filing Form

tax-exempt governmental obligations to

UT 84201.

8038-G

provide the IRS with the information

required by section 149(e) and to monitor

Private delivery services. You can use

For specific questions on how to file Form

the requirements of sections 141 through

certain private delivery services

8038-G send an email to the IRS at

150.

designated by the IRS to meet the “timely

TaxExemptBondQuestions@irs.gov

mailing as timely filing/paying” rule for tax

and put “Form 8038-G Question” in the

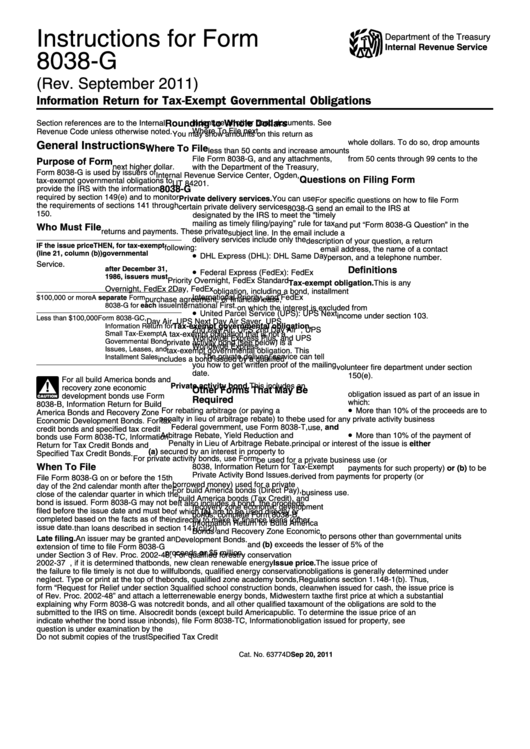

Who Must File

returns and payments. These private

subject line. In the email include a

delivery services include only the

description of your question, a return

IF the issue price

THEN, for tax-exempt

following:

email address, the name of a contact

(line 21, column (b)) governmental

•

DHL Express (DHL): DHL Same Day

person, and a telephone number.

is...

obligations issued

Service.

Definitions

after December 31,

•

Federal Express (FedEx): FedEx

1986, issuers must

Priority Overnight, FedEx Standard

Tax-exempt obligation. This is any

file...

Overnight, FedEx 2Day, FedEx

obligation, including a bond, installment

International Priority, and FedEx

$100,000 or more

A separate Form

purchase agreement, or financial lease,

International First.

8038-G for each issue

on which the interest is excluded from

•

United Parcel Service (UPS): UPS Next

income under section 103.

Less than $100,000

Form 8038-GC,

Day Air, UPS Next Day Air Saver, UPS

Tax-exempt governmental obligation.

Information Return for

2nd Day Air, UPS 2nd Day Air A.M., UPS

Small Tax-Exempt

A tax-exempt obligation that is not a

Worldwide Express Plus, and UPS

Governmental Bond

private activity bond (see below) is a

Worldwide Express.

Issues, Leases, and

tax-exempt governmental obligation. This

The private delivery service can tell

Installment Sales

includes a bond issued by a qualified

you how to get written proof of the mailing

volunteer fire department under section

date.

150(e).

For all build America bonds and

Private activity bond. This includes an

!

recovery zone economic

Other Forms That May Be

obligation issued as part of an issue in

development bonds use Form

Required

CAUTION

which:

8038-B, Information Return for Build

•

For rebating arbitrage (or paying a

More than 10% of the proceeds are to

America Bonds and Recovery Zone

penalty in lieu of arbitrage rebate) to the

be used for any private activity business

Economic Development Bonds. For tax

Federal government, use Form 8038-T,

use, and

credit bonds and specified tax credit

•

Arbitrage Rebate, Yield Reduction and

More than 10% of the payment of

bonds use Form 8038-TC, Information

Penalty in Lieu of Arbitrage Rebate.

principal or interest of the issue is either

Return for Tax Credit Bonds and

(a) secured by an interest in property to

Specified Tax Credit Bonds.

For private activity bonds, use Form

be used for a private business use (or

When To File

8038, Information Return for Tax-Exempt

payments for such property) or (b) to be

Private Activity Bond Issues.

derived from payments for property (or

File Form 8038-G on or before the 15th

borrowed money) used for a private

day of the 2nd calendar month after the

For build America bonds (Direct Pay),

business use.

close of the calendar quarter in which the

build America bonds (Tax Credit), and

bond is issued. Form 8038-G may not be

It also includes a bond, the proceeds

recovery zone economic development

filed before the issue date and must be

of which (a) are to be used directly or

bonds, complete Form 8038-B,

completed based on the facts as of the

indirectly to make or finance loans (other

Information Return for Build America

issue date.

than loans described in section 141(c)(2))

Bonds and Recovery Zone Economic

to persons other than governmental units

Late filing. An issuer may be granted an

Development Bonds.

and (b) exceeds the lesser of 5% of the

extension of time to file Form 8038-G

proceeds or $5 million.

under Section 3 of Rev. Proc. 2002-48,

For qualified forestry conservation

Issue price. The issue price of

2002-37 I.R.B. 531, if it is determined that

bonds, new clean renewable energy

the failure to file timely is not due to willful

bonds, qualified energy conservation

obligations is generally determined under

neglect. Type or print at the top of the

bonds, qualified zone academy bonds,

Regulations section 1.148-1(b). Thus,

form “Request for Relief under section 3

qualified school construction bonds, clean

when issued for cash, the issue price is

of Rev. Proc. 2002-48” and attach a letter

renewable energy bonds, Midwestern tax

the first price at which a substantial

explaining why Form 8038-G was not

credit bonds, and all other qualified tax

amount of the obligations are sold to the

submitted to the IRS on time. Also

credit bonds (except build America

public. To determine the issue price of an

indicate whether the bond issue in

bonds), file Form 8038-TC, Information

obligation issued for property, see

question is under examination by the IRS.

Return for Tax Credit Bonds and

sections 1273 and 1274 and the related

Do not submit copies of the trust

Specified Tax Credit Bonds.

regulations.

Sep 20, 2011

Cat. No. 63774D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4