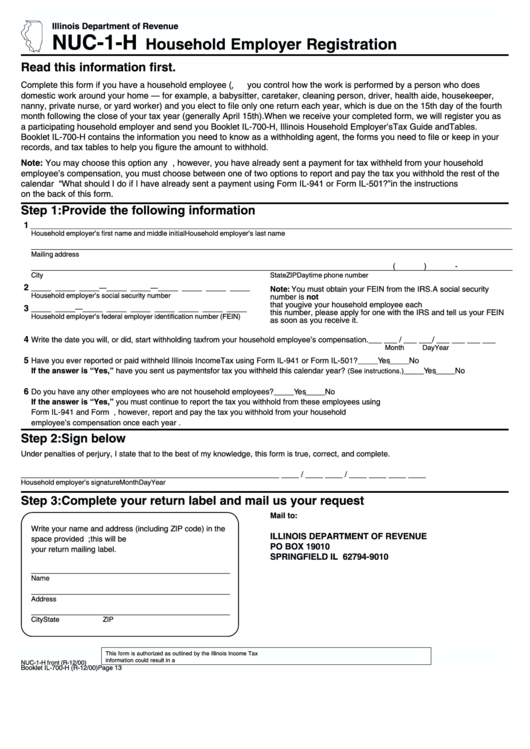

Form Nuc-1-H - Household Employer Registration

ADVERTISEMENT

Illinois Department of Revenue

NUC-1-H

Household Employer Registration

Read this information first.

Complete this form if you have a household employee ( i.e., you control how the work is performed by a person who does

domestic work around your home — for example, a babysitter, caretaker, cleaning person, driver, health aide, housekeeper,

nanny, private nurse, or yard worker) and you elect to file only one return each year, which is due on the 15th day of the fourth

month following the close of your tax year (generally April 15th). When we receive your completed form, we will register you as

a participating household employer and send you Booklet IL-700-H, Illinois Household Employer’s Tax Guide and Tables.

Booklet IL-700-H contains the information you need to know as a withholding agent, the forms you need to file or keep in your

records, and tax tables to help you figure the amount to withhold.

Note: You may choose this option any time. If, however, you have already sent a payment for tax withheld from your household

employee’s compensation, you must choose between one of two options to report and pay the tax you withhold the rest of the

calendar year. See “ What should I do if I have already sent a payment using Form IL-941 or Form IL-501?” in the instructions

on the back of this form.

Step 1: Provide the following information

1

______________________________________________________________________________________________________________

Household employer’s first name and middle initial

Household employer’s last name

______________________________________________________________________________________________________________

Mailing address

(

)

-

______________________________________________________________________________________________________________

City

State

ZIP

Daytime phone number

2

_____ _____ _____ — _____ _____ — _____ _____ _____ _____

Note: You must obtain your FEIN from the IRS. A social security

Household employer’s social security number

number is not acceptable. You must write your FEIN on the W-2 form

that you give your household employee each year. If you do not have

3

_____ _____ — _____ _____ _____ _____ _____ _____ _____

this number, please apply for one with the IRS and tell us your FEIN

Household employer’s federal employer identification number (FEIN)

as soon as you receive it.

4

Write the date you will, or did, start withholding tax from your household employee’s compensation.

___ ___ / ___ ___/ ___ ___ ___ ___

Month

Day

Year

5

Have you ever reported or paid withheld Illinois Income Tax using Form IL-941 or Form IL-501?

Yes

No

_____

_____

If the answer is “Yes,” have you sent us payments for tax you withheld this calendar year?

_____

Yes

_____

No

(See instructions.)

6

Do you have any other employees who are not household employees?

Yes

No

_____

_____

If the answer is “Yes,” you must continue to report the tax you withhold from these employees using

Form IL-941 and Form IL-W-3. You may, however, report and pay the tax you withhold from your household

employee’s compensation once each year .

Step 2: Sign below

Under penalties of perjury, I state that to the best of my knowledge, this form is true, correct, and complete.

_______________________________________________________

____ ____ / ____ ____ / ____ ____ ____ ____

Household employer’s signature

Month

Day

Year

Step 3: Complete your return label and mail us your request

Mail to:

Write your name and address (including ZIP code) in the

ILLINOIS DEPARTMENT OF REVENUE

space provided below. Please print clearly; this will be

PO BOX 19010

your return mailing label.

SPRINGFIELD IL 62794-9010

_______________________________________________

Name

_______________________________________________

Address

_______________________________________________

City

State

ZIP

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3827

NUC-1-H front (R-12/00)

Booklet IL-700-H (R-12/00)

Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1