Form Nuc-1-H Instructions - Household Employer Registration

ADVERTISEMENT

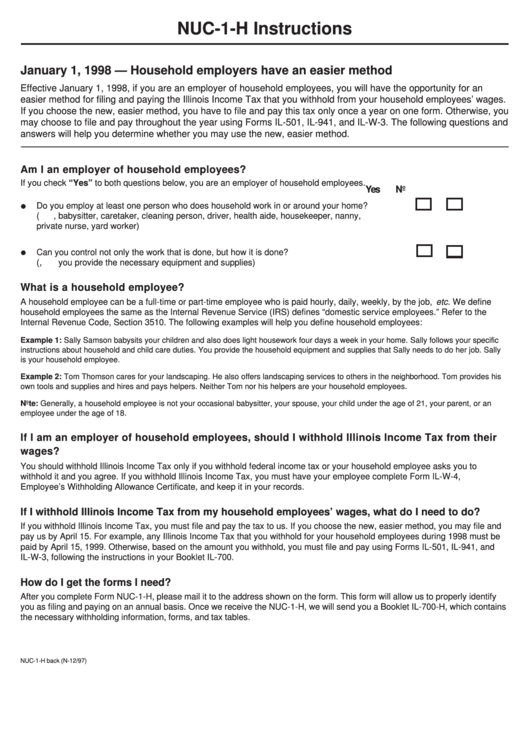

NUC-1-H Instructions

January 1, 1998 — Household employers have an easier method

Effective January 1, 1998, if you are an employer of household employees, you will have the opportunity for an

easier method for filing and paying the Illinois Income Tax that you withhold from your household employees’ wages.

If you choose the new, easier method, you have to file and pay this tax only once a year on one form. Otherwise, you

may choose to file and pay throughout the year using Forms IL-501, IL-941, and IL-W-3. The following questions and

answers will help you determine whether you may use the new, easier method.

Am I an employer of household employees?

If you check “Yes” to both questions below, you are an employer of household employees.

Yes

No

Do you employ at least one person who does household work in or around your home?

( e.g. , babysitter, caretaker, cleaning person, driver, health aide, housekeeper, nanny,

private nurse, yard worker)

Can you control not only the work that is done, but how it is done?

( e.g., you provide the necessary equipment and supplies)

What is a household employee?

A household employee can be a full-time or part-time employee who is paid hourly, daily, weekly, by the job, etc . We define

household employees the same as the Internal Revenue Service (IRS) defines “domestic service employees.” Refer to the

Internal Revenue Code, Section 3510. The following examples will help you define household employees:

Example 1: Sally Samson babysits your children and also does light housework four days a week in your home. Sally follows your specific

instructions about household and child care duties. You provide the household equipment and supplies that Sally needs to do her job. Sally

is your household employee.

Example 2: Tom Thomson cares for your landscaping. He also offers landscaping services to others in the neighborhood. Tom provides his

own tools and supplies and hires and pays helpers. Neither Tom nor his helpers are your household employees.

Note: Generally, a household employee is not your occasional babysitter, your spouse, your child under the age of 21, your parent, or an

employee under the age of 18.

If I am an employer of household employees, should I withhold Illinois Income Tax from their

wages?

You should withhold Illinois Income Tax only if you withhold federal income tax or your household employee asks you to

withhold it and you agree. If you withhold Illinois Income Tax, you must have your employee complete Form IL-W-4,

Employee’s Withholding Allowance Certificate, and keep it in your records.

If I withhold Illinois Income Tax from my household employees’ wages, what do I need to do?

If you withhold Illinois Income Tax, you must file and pay the tax to us. If you choose the new, easier method, you may file and

pay us by April 15. For example, any Illinois Income Tax that you withhold for your household employees during 1998 must be

paid by April 15, 1999. Otherwise, based on the amount you withhold, you must file and pay using Forms IL-501, IL-941, and

IL-W-3, following the instructions in your Booklet IL-700.

How do I get the forms I need?

After you complete Form NUC-1-H, please mail it to the address shown on the form. This form will allow us to properly identify

you as filing and paying on an annual basis. Once we receive the NUC-1-H, we will send you a Booklet IL-700-H, which contains

the necessary withholding information, forms, and tax tables.

NUC-1-H back (N-12/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1