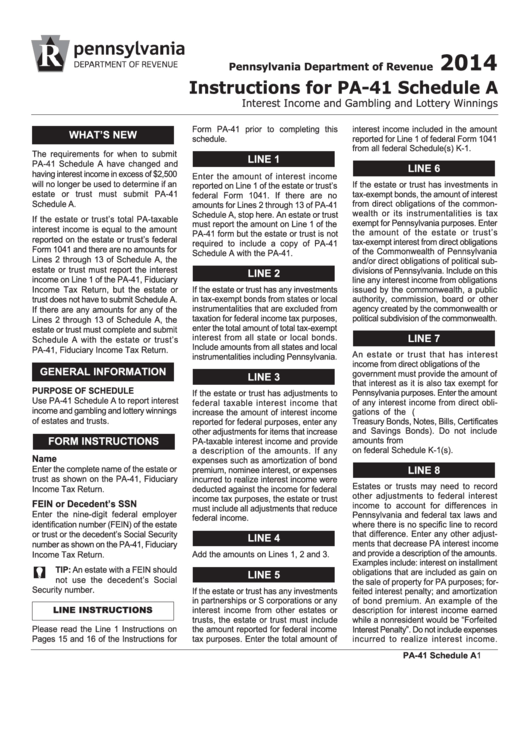

Instructions For Pa-41 Schedule A - Interest Income And Gambling And Lottery Winnings - Pennsylvania Department Of Revenue - 2014

ADVERTISEMENT

2014

Pennsylvania Department of Revenue

Instructions for PA-41 Schedule A

Interest Income and Gambling and Lottery Winnings

Form PA-41 prior to completing this

interest income included in the amount

WHAT’S NEW

schedule.

reported for Line 1 of federal Form 1041

from all federal Schedule(s) K-1.

The requirements for when to submit

LINE 1

PA-41 Schedule A have changed and

LINE 6

having interest income in excess of $2,500

Enter the amount of interest income

will no longer be used to determine if an

If the estate or trust has investments in

reported on Line 1 of the estate or trust’s

estate or trust must submit PA-41

tax-exempt bonds, the amount of interest

federal Form 1041. If there are no

from direct obligations of the common-

Schedule A.

amounts for Lines 2 through 13 of PA-41

wealth or its instrumentalities is tax

Schedule A, stop here. An estate or trust

If the estate or trust’s total PA-taxable

exempt for Pennsylvania purposes. Enter

must report the amount on Line 1 of the

interest income is equal to the amount

the amount of the estate or trust’s

PA-41 form but the estate or trust is not

reported on the estate or trust’s federal

tax-exempt interest from direct obligations

required to include a copy of PA-41

Form 1041 and there are no amounts for

of the Commonwealth of Pennsylvania

Schedule A with the PA-41.

Lines 2 through 13 of Schedule A, the

and/or direct obligations of political sub-

estate or trust must report the interest

divisions of Pennsylvania. Include on this

LINE 2

income on Line 1 of the PA-41, Fiduciary

line any interest income from obligations

If the estate or trust has any investments

Income Tax Return, but the estate or

issued by the commonwealth, a public

in tax-exempt bonds from states or local

authority, commission, board or other

trust does not have to submit Schedule A.

instrumentalities that are excluded from

agency created by the commonwealth or

If there are any amounts for any of the

political subdivision of the commonwealth.

taxation for federal income tax purposes,

Lines 2 through 13 of Schedule A, the

enter the total amount of total tax-exempt

estate or trust must complete and submit

interest from all state or local bonds.

LINE 7

Schedule A with the estate or trust’s

Include amounts from all states and local

PA-41, Fiduciary Income Tax Return.

An estate or trust that has interest

instrumentalities including Pennsylvania.

income from direct obligations of the U.S.

GENERAL INFORMATION

government must provide the amount of

LINE 3

that interest as it is also tax exempt for

PURPOSE OF SCHEDULE

Pennsylvania purposes. Enter the amount

If the estate or trust has adjustments to

Use PA-41 Schedule A to report interest

federal taxable interest income that

of any interest income from direct obli-

income and gambling and lottery winnings

gations of the U.S. government (U.S.

increase the amount of interest income

of estates and trusts.

Treasury Bonds, Notes, Bills, Certificates

reported for federal purposes, enter any

and Savings Bonds). Do not include

other adjustments for items that increase

amounts from U.S. obligations reported

FORM INSTRUCTIONS

PA-taxable interest income and provide

on federal Schedule K-1(s).

a description of the amounts. If any

Name

expenses such as amortization of bond

Enter the complete name of the estate or

LINE 8

premium, nominee interest, or expenses

trust as shown on the PA-41, Fiduciary

incurred to realize interest income were

Estates or trusts may need to record

Income Tax Return.

deducted against the income for federal

other adjustments to federal interest

income tax purposes, the estate or trust

FEIN or Decedent’s SSN

income to account for differences in

must include all adjustments that reduce

Enter the nine-digit federal employer

Pennsylvania and federal tax laws and

federal income.

identification number (FEIN) of the estate

where there is no specific line to record

or trust or the decedent’s Social Security

that difference. Enter any other adjust-

LINE 4

ments that decrease PA interest income

number as shown on the PA-41, Fiduciary

and provide a description of the amounts.

Income Tax Return.

Add the amounts on Lines 1, 2 and 3.

Examples include: interest on installment

TIP: An estate with a FEIN should

obligations that are included as gain on

LINE 5

not use the decedent’s Social

the sale of property for PA purposes; for-

Security number.

If the estate or trust has any investments

feited interest penalty; and amortization

in partnerships or S corporations or any

of bond premium. An example of the

LINE INSTRUCTIONS

interest income from other estates or

description for interest income earned

trusts, the estate or trust must include

while a nonresident would be “Forfeited

Please read the Line 1 Instructions on

the amount reported for federal income

Interest Penalty”. Do not include expenses

Pages 15 and 16 of the Instructions for

tax purposes. Enter the total amount of

incurred to realize interest income.

PA-41 Schedule A

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2