Form 0405-533i - Instructions For Form 530 Alaska Motor Fuel Tax Return For Diesel - State Of Alaska

ADVERTISEMENT

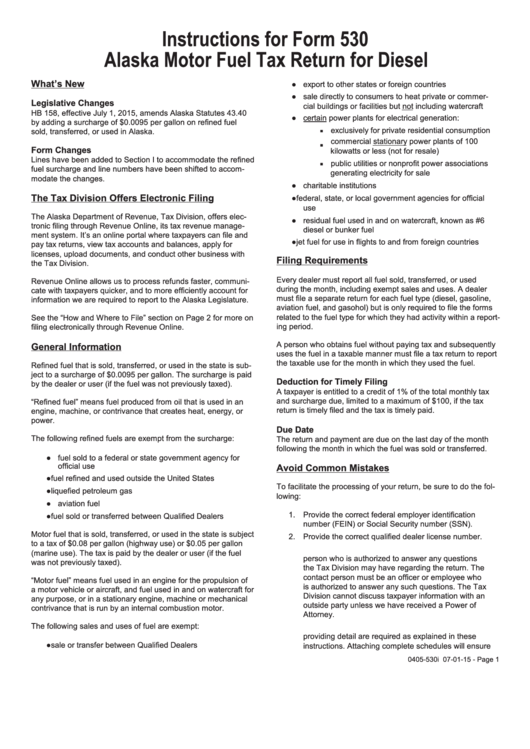

Instructions for Form 530

Alaska Motor Fuel Tax Return for Diesel

What’s New

● export to other states or foreign countries

● sale directly to consumers to heat private or commer-

Legislative Changes

cial buildings or facilities but not including watercraft

HB 158, effective July 1, 2015, amends Alaska Statutes 43.40

● certain power plants for electrical generation:

by adding a surcharge of $0.0095 per gallon on refined fuel

▪

exclusively for private residential consumption

sold, transferred, or used in Alaska.

commercial stationary power plants of 100

▪

Form Changes

kilowatts or less (not for resale)

Lines have been added to Section I to accommodate the refined

▪

public utilities or nonprofit power associations

fuel surcharge and line numbers have been shifted to accom-

generating electricity for sale

modate the changes.

● charitable institutions

The Tax Division Offers Electronic Filing

● federal, state, or local government agencies for official

use

The Alaska Department of Revenue, Tax Division, offers elec-

● residual fuel used in and on watercraft, known as #6

tronic filing through Revenue Online, its tax revenue manage-

diesel or bunker fuel

ment system. It’s an online portal where taxpayers can file and

● jet fuel for use in flights to and from foreign countries

pay tax returns, view tax accounts and balances, apply for

licenses, upload documents, and conduct other business with

Filing Requirements

the Tax Division.

Every dealer must report all fuel sold, transferred, or used

Revenue Online allows us to process refunds faster, communi-

during the month, including exempt sales and uses. A dealer

cate with taxpayers quicker, and to more efficiently account for

must file a separate return for each fuel type (diesel, gasoline,

information we are required to report to the Alaska Legislature.

aviation fuel, and gasohol) but is only required to file the forms

related to the fuel type for which they had activity within a report-

See the “How and Where to File” section on Page 2 for more on

ing period.

filing electronically through Revenue Online.

A person who obtains fuel without paying tax and subsequently

General Information

uses the fuel in a taxable manner must file a tax return to report

the taxable use for the month in which they used the fuel.

Refined fuel that is sold, transferred, or used in the state is sub-

ject to a surcharge of $0.0095 per gallon. The surcharge is paid

Deduction for Timely Filing

by the dealer or user (if the fuel was not previously taxed).

A taxpayer is entitled to a credit of 1% of the total monthly tax

and surcharge due, limited to a maximum of $100, if the tax

“Refined fuel” means fuel produced from oil that is used in an

return is timely filed and the tax is timely paid.

engine, machine, or contrivance that creates heat, energy, or

power.

Due Date

The following refined fuels are exempt from the surcharge:

The return and payment are due on the last day of the month

following the month in which the fuel was sold or transferred.

● fuel sold to a federal or state government agency for

official use

Avoid Common Mistakes

● fuel refined and used outside the United States

To facilitate the processing of your return, be sure to do the fol-

● liquefied petroleum gas

lowing:

● aviation fuel

1. Provide the correct federal employer identification

● fuel sold or transferred between Qualified Dealers

number (FEIN) or Social Security number (SSN).

Motor fuel that is sold, transferred, or used in the state is subject

2. Provide the correct qualified dealer license number.

to a tax of $0.08 per gallon (highway use) or $0.05 per gallon

3. Provide the name and phone number of a contact

(marine use). The tax is paid by the dealer or user (if the fuel

person who is authorized to answer any questions

was not previously taxed).

the Tax Division may have regarding the return. The

contact person must be an officer or employee who

“Motor fuel” means fuel used in an engine for the propulsion of

is authorized to answer any such questions. The Tax

a motor vehicle or aircraft, and fuel used in and on watercraft for

Division cannot discuss taxpayer information with an

any purpose, or in a stationary engine, machine or mechanical

outside party unless we have received a Power of

contrivance that is run by an internal combustion motor.

Attorney.

The following sales and uses of fuel are exempt:

4. Attach schedules as required by the forms. Schedules

providing detail are required as explained in these

● sale or transfer between Qualified Dealers

instructions. Attaching complete schedules will ensure

0405-530i 07-01-15 - Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16