Form Mts - Municipal/reservation Tax Schedule Page 4

ADVERTISEMENT

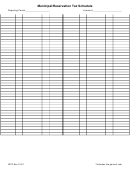

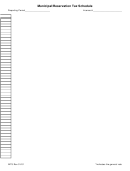

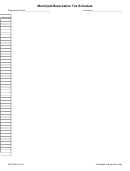

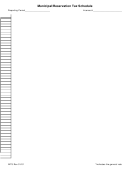

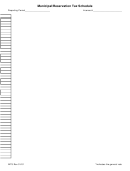

Municipal/Reservation Tax Schedule

Reporting Period____________________

License # _______________________

City

Code

Net Taxable Sales % Rate

Tax Due

City

Code

Net Taxable Sales % Rate

Tax Due

Veblen*

360-1

1.0

Tourism Tax

Vermillion

362-1

1.0

Tourism

700-1

1.0

Vermillion*

362-2

2.0

Sioux Falls

800-1

1.0

Vermillion

362-3

3.0

Viborg

363-1

1.0

Motor Vehicle Leasing Receipts

Viborg*

363-2

2.0

MVLR

600-1

4.5

Volga*

367-1

1.0

Wagner

369-1

1.0

Wagner*

369-2

2.0

Wakonda*

370-1

1.0

Wall

372-1

1.0

Wall*

372-2

2.0

Total Other Taxes

Wall

372-3

3.0

Warner

376-1

1.0

Indian Reservation Sales

Warner*

376-2

2.0

Cheyenne*

408-4

4.0

Wasta*

377-1

1.0

Cheyenne

408-3

3.0

Watertown

379-1

1.0

Cheyenne

Watertown*

379-2

2.0

Excise

408-2

2.0

Watertown

379-3

3.0

Pine Ridge*

411-4

4.0

Waubay

380-3

1.0

Pine Ridge

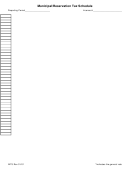

411-3

3.0

Waubay*

380-2

2.0

Pine Ridge

Webster

382-1

1.0

Excise

411-2

2.0

Webster*

382-2

2.0

Rosebud*

412-4

4.0

Wentworth*

383-1

1.0

Rosebud

412-3

3.0

Wessington*

384-1

1.0

Rosebud

Wess. Springs 385-1

1.0

Excise

412-2

2.0

Wess. Springs* 385-2

2.0

Stand. Rock*

413-4

4.0

White Lake*

389-1

1.0

Stand. Rock

413-3

3.0

White River

391-1

1.0

Stand. Rock

White River*

391-2

2.0

Excise

413-2

2.0

Whitewood

393-1

1.0

Total Reservation Taxes

Whitewood*

393-2

2.0

Grand Total Tax Due

Willow Lake

394-1

1.0

Willow Lake*

394-2

2.0

Wilmot*

395-1

1.0

Winner

397-1

1.0

Winner*

397-2

2.0

Witten*

398-1

1.0

Woonsocket

401-3

1.0

Woonsocket* 401-2

2.0

Worthing

402-3

1.0

Worthing*

402-2

2.0

Yankton

405-1

1.0

Yankton*

405-2

2.0

Yankton

405-3

3.0

Total Municipal Tax Due

MTS Rev 01/01

*Indicates the general rate

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10