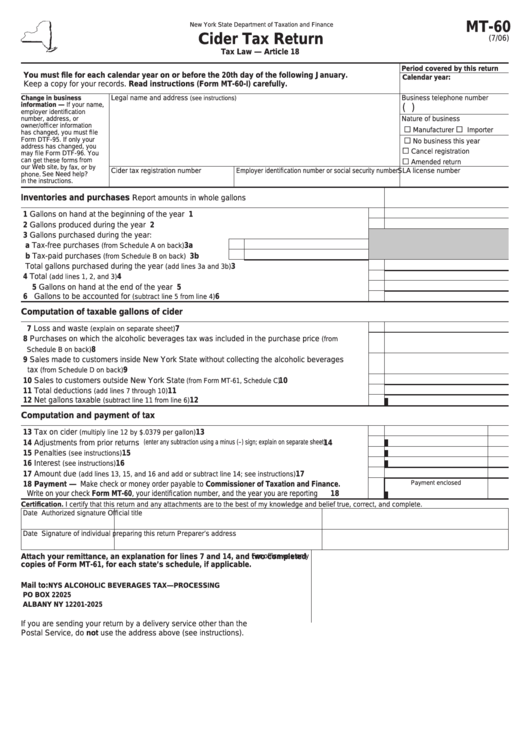

Form Mt-60 - Cider Tax Return

ADVERTISEMENT

MT-60

New York State Department of Taxation and Finance

Cider Tax Return

(7/06)

Tax Law — Article 18

Period covered by this return

You must file for each calendar year on or before the 20th day of the following January.

Calendar year:

Keep a copy for your records. Read instructions (Form MT-60-I) carefully.

Change in business

Legal name and address

Business telephone number

(see instructions)

information — If your name,

(

)

employer identification

Nature of business

number, address, or

owner/officer information

G

G

Manufacturer

Importer

has changed, you must file

G

Form DTF‑95. If only your

No business this year

address has changed, you

G

Cancel registration

may file Form DTF‑96. You

G

can get these forms from

Amended return

our Web site, by fax, or by

Cider tax registration number

Employer identification number or social security number SLA license number

phone. See Need help?

in the instructions.

Inventories and purchases

Report amounts in whole gallons

1 Gallons on hand at the beginning of the year ..............................................................................

1

2 Gallons produced during the year ................................................................................................

2

3 Gallons purchased during the year:

a Tax‑free purchases

.........

3a

(from Schedule A on back)

b Tax‑paid purchases

3b

(from Schedule B on back) ..........

Total gallons purchased during the year

.......................................................

3

(add lines 3a and 3b)

4 Total

.............................................................................................................

4

(add lines 1, 2, and 3)

5 Gallons on hand at the end of the year ........................................................................................

5

6 Gallons to be accounted for

..................................................................

6

(subtract line 5 from line 4)

Computation of taxable gallons of cider

7 Loss and waste

......................................................................................

7

(explain on separate sheet)

8 Purchases on which the alcoholic beverages tax was included in the purchase price

(from

......................................................................................................................

8

Schedule B on back)

9 Sales made to customers inside New York State without collecting the alcoholic beverages

tax

........................................................................................................

9

(from Schedule D on back)

10 Sales to customers outside New York State

....................................... 10

(from Form MT-61, Schedule C)

11 Total deductions

.......................................................................................... 11

(add lines 7 through 10)

12 Net gallons taxable

................................................................................ 12

(subtract line 11 from line 6)

Computation and payment of tax

13 Tax on cider

............................................................................. 13

(multiply line 12 by $.0379 per gallon)

14 Adjustments from prior returns

................... 14

(enter any subtraction using a minus (–) sign; explain on separate sheet)

15 Penalties

............................................................................................................... 15

(see instructions)

16 Interest

.................................................................................................................. 16

(see instructions)

17 Amount due

................................ 17

(add lines 13, 15, and 16 and add or subtract line 14; see instructions)

Payment enclosed

18 Payment — Make check or money order payable to Commissioner of Taxation and Finance.

Write on your check Form MT-60, your identification number, and the year you are reporting ................ 18

Certification. I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Date

Authorized signature

Official title

Date

Signature of individual preparing this return

Preparer’s address

Attach your remittance, an explanation for lines 7 and 14, and two completed

For office use only

copies of Form MT-61, for each state’s schedule, if applicable.

Mail to:

NYS ALCOHOLIC BEVERAGES TAX—PROCESSING

PO BOX 22025

ALBANY NY 12201-2025

If you are sending your return by a delivery service other than the U.S.

Postal Service, do not use the address above (see instructions).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2