Form Sn 2007(10) - 2007 Legislation Affecting The Application Of The Controlling Interest Transfer Tax To Maritime Heritage Land

ADVERTISEMENT

STATE OF CONNECTICUT

SN 2007(10)

DEPARTMENT OF REVENUE SERVICES

25 Sigourney Street

Hartford CT 06106-5032

SPECIAL NOTICE

2007 Legislation Affecting the Application of the Controlling

Interest Transfer Tax to Maritime Heritage Land

Purpose: This Special Notice discusses 2007

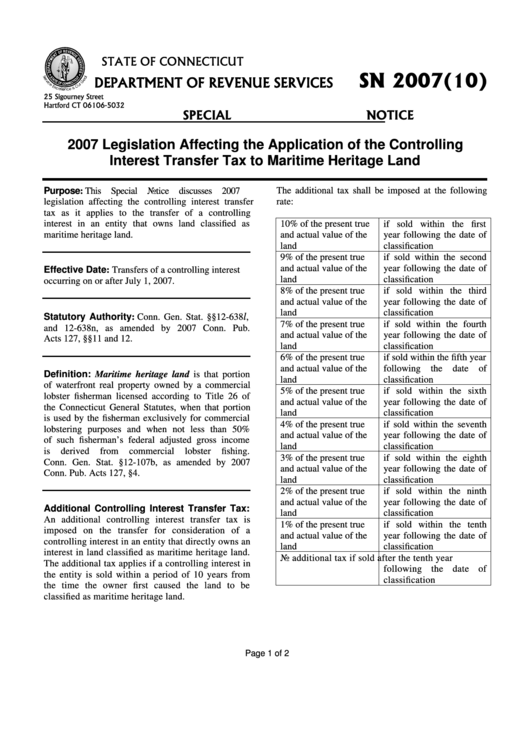

The additional tax shall be imposed at the following

rate:

legislation affecting the controlling interest transfer

tax as it applies to the transfer of a controlling

interest in an entity that owns land classified as

10% of the present true

if sold within the first

maritime heritage land.

and actual value of the

year following the date of

land

classification

9% of the present true

if sold within the second

and actual value of the

year following the date of

Effective Date: Transfers of a controlling interest

land

classification

occurring on or after July 1, 2007.

8% of the present true

if sold within the third

and actual value of the

year following the date of

land

classification

l

Statutory Authority: Conn. Gen. Stat. §§12-638

,

7% of the present true

if sold within the fourth

and 12-638n, as amended by 2007 Conn. Pub.

and actual value of the

year following the date of

Acts 127, §§11 and 12.

land

classification

6% of the present true

if sold within the fifth year

and actual value of the

following

the

date

of

Definition: Maritime heritage land is that portion

land

classification

of waterfront real property owned by a commercial

5% of the present true

if sold within the sixth

lobster fisherman licensed according to Title 26 of

and actual value of the

year following the date of

the Connecticut General Statutes, when that portion

land

classification

is used by the fisherman exclusively for commercial

4% of the present true

if sold within the seventh

lobstering purposes and when not less than 50%

and actual value of the

year following the date of

of such fisherman’s federal adjusted gross income

land

classification

is

derived

from

commercial

lobster

fishing.

3% of the present true

if sold within the eighth

Conn. Gen. Stat. §12-107b, as amended by 2007

and actual value of the

year following the date of

Conn. Pub. Acts 127, §4.

land

classification

2% of the present true

if sold within the ninth

and actual value of the

year following the date of

Additional Controlling Interest Transfer Tax:

land

classification

An additional controlling interest transfer tax is

1% of the present true

if sold within the tenth

imposed on the transfer for consideration of a

and actual value of the

year following the date of

controlling interest in an entity that directly owns an

land

classification

interest in land classified as maritime heritage land.

No additional tax

if sold after the tenth year

The additional tax applies if a controlling interest in

following the date of

the entity is sold within a period of 10 years from

classification

the time the owner first caused the land to be

classified as maritime heritage land.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2