Controlling Interest Transfer Tax - Return/declaration Of Value Form

ADVERTISEMENT

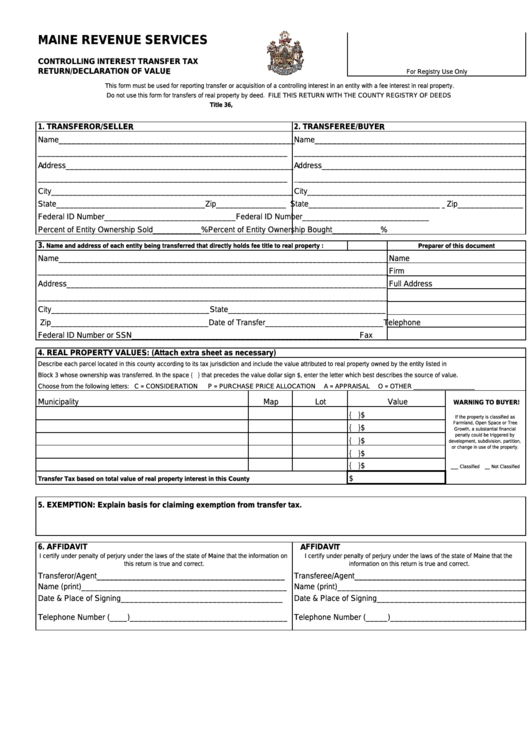

MAINE REVENUE SERVICES

CONTROLLING INTEREST TRANSFER TAX

RETURN/DECLARATION OF VALUE

For Registry Use Only

This form must be used for reporting transfer or acquisition of a controlling interest in an entity with a fee interest in real property.

Do not use this form for transfers of real property by deed. FILE THIS RETURN WITH THE COUNTY REGISTRY OF DEEDS

Title 36, M.R.S.A. Sections 4641 through 4641-N

1. TRANSFEROR/SELLER

2. TRANSFEREE/BUYER

Name_______________________________________________________

Name_________________________________________________

_________________________________________________________

______________________________________________________

Address_____________________________________________________

Address_______________________________________________

_________________________________________________________

______________________________________________________

City________________________________________________________City___________________________________________________

State__________________________________ Zip________________ State_______________________________Zip_______________

Federal ID Number______________________________

Federal ID Number_____________________________

Percent of Entity Ownership Sold___________%

Percent of Entity Ownership Bought___________%

3.

Name and address of each entity being transferred that directly holds fee title to real property :

Preparer of this document

Name___________________________________________________________________________

Name

________________________________________________________________________________

Firm

Address_________________________________________________________________________

Full Address

________________________________________________________________________________

City_____________________________________State____________________________________

Zip____________________________________ Date of Transfer___________________________ Telephone

Federal ID Number or SSN____________________________________________________

Fax

4. REAL PROPERTY VALUES: (Attach extra sheet as necessary)

Describe each parcel located in this county according to its tax jurisdiction and include the value attributed to real property owned by the entity listed in

Block 3 whose ownership was transferred. In the space { } that precedes the value dollar sign $, enter the letter which best describes the source of value.

Choose from the following letters: C = CONSIDERATION

P = PURCHASE PRICE ALLOCATION

A = APPRAISAL

O = OTHER __________________

Municipality

Map

Lot

Value

WARNING TO BUYER!

{ }$

If the property is classified as

Farmland, Open Space or Tree

{ }$

Growth, a substantial financial

penatly could be triggered by

{ }$

development, subdivision, partition,

or change in use of the property.

{ }$

{ }$

___ Classified

__ Not Classified

$

Transfer Tax based on total value of real property interest in this County

5. EXEMPTION: Explain basis for claiming exemption from transfer tax.

6. AFFIDAVIT

AFFIDAVIT

I certify under penalty of perjury under the laws of the state of Maine that the information on

I certify under penalty of perjury under the laws of the state of Maine that the

this return is true and correct.

information on this return is true and correct.

Transferor/Agent___________________________________________

Transferee/Agent________________________________________

Name (print)_______________________________________________

Name (print)____________________________________________

Date & Place of Signing_____________________________________

Date & Place of Signing__________________________________

Telephone Number (____)____________________________________

Telephone Number (_____)________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1