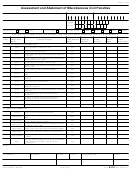

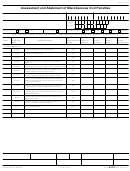

Page 5 of 8

Assessment and Abatement of Miscellaneous Civil Penalties

1. Taxpayer’s Name: Last, First, Middle Initial

5. Year

6. Statute Date

(single name only)

(mandatory)

(mandatory) (mmddyyyy)

2. Address

7.

-

-

(a) SSN:

or

(b) EIN:

-

3. MFT

:

IMF 55

BMF 13

4. “X” if no ASED:

8. Function

:

LMSB

SB/SE

W&I

TE/GE

Appeals

("x" one)

(“x” one)

CAUTION: FOR CORRECT LINE ITEM ENTRIES, FIRST IDENTIFY THE APPROPRIATE PENALTY CODE SECTION.

(a)

(b)

(c)

(d)

(e)

(f)

9. Item

Penalty Code

Penalty Description

Penalty Reference

Number of

Amount

Amount

Penalty

Section

Number

Violations

Assessed

Abated

Reason Code

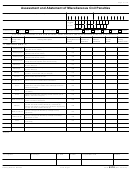

G. Excise (IRM 20.1.10)

6675

Excessive claims with respect to the use of certain fuels

661

6715

Dyed fuel sold for use or used in taxable use, etc.

656

Tampering with or failing to maintain security requirements

6715A

665

for mechanical dye injection systems

6717

655

Refusal of entry or inspection - IRC sec. 4083(d)(1)

Failure to display tax registration on vessels - IRC sec.

6718

657

4101(a)(3)

6719

670

Failure to register/reregister - IRC sec. 4101(a)

6720A

673

Penalty with respect to certain adulterated fuels

6725

Failure to report a vessel/facility - IRC sec. 4101(d)

667

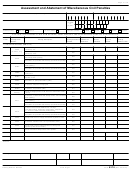

H. Other (IRM 20.1.10)

Failure to file certification with respect to certain residential

6652(j)

587

rental projects required under section 142(d)(7)

6652(k)

588

Failure to make reports required under sec. 1202

6652(l)

649

Failure to file Form 8806 - IRC sec. 6043(c)

6653

Willful failure to pay, evade or defeat stamp tax

574

6673(a)

Sanctions and costs awarded by Tax Court

643

6673(b)

Sanctions and costs awarded by other courts

644

Fraudulent statement or willful failure to furnish statement to

6674

575

employee – IRC sec. 6051 or 6053(b)

Penalty with respect to tax liability of regulated investment

6697

582

company

6702(a)

Frivolous tax return

666

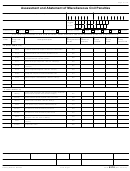

Remarks:

10a. Originator

10b. Manager

11a. Date

11b. Date

12. Organization Code

13. Phone

14. Reviewer

15. Date

16. Terminal Operator

17. Date

8278

Catalog Number 62278G

Form

(Rev. 02-2010)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8