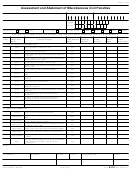

Page 7 of 8

IMPORTANT REMINDERS AND INSTRUCTIONS FOR COMPLETING FORM 8278

BACKGROUND

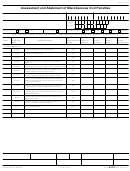

Form 8278 is an adjustment document (ADJ54) used for the manual assessment or abatement of miscellaneous civil penalties that are

not subject to deficiency procedures. The Penalty Reference Number (PRN) is keyed in with a dollar amount and a Transaction Code

(TC) 290 with a zero (.00) dollar amount in MFT 13 (BMF) or 55 (IMF). The posted TC 240 with a PRN indicates a miscellaneous civil

penalty assessment. The PRN dictates the language in the CP 15 (IMF) or 215 (BMF) Notice that provides an explanation of the

penalty being assessed, the amount due, and the taxpayer's recourse in contesting the assessment or paying the balance due.

Abating a penalty is just the opposite of assessing the penalty. Input the PRN for a negative amount and a Transaction Code (TC) 290

with a zero (.00) dollar amount in MFT 13 (BMF) or 55 (IMF). This will generate a TC 241 (as the secondary TC) with the TC 290 for .00

(as the primary TC). Note: If TC 241 is used instead of the corresponding PRN with a negative amount, the adjustment will not post.

IMPORTANT REMINDERS:

1. Always use the most current version of Form 8278 for applicable RNs, as other source documents (e.g., Doc. 6209, IRMs, etc.)

might contain outdated PRN information.

2. Select the appropriate code section of the applicable miscellaneous civil penalty on the form first, and then choose the

corresponding PRN.

3. If the PRN is not listed on Form 8278, enter all information in a blank line under the appropriate Penalty Category A, B, C, D, E,

F, G or H.

4. Use only the PRN listed for the Code section of the penalty that is to be assessed. Note: All listed miscellaneous civil penalty

PRNs apply to tax years after 12-31-89.

5. Prepare a separate form for each penalty assessment.

6. Multiple assessments of identical penalties for the same taxpayer in the same tax period must be consolidated as a single

assessment.

7. "*" -- At the conclusion of the penalty investigation, please provide the taxpayer with a copy of a detailed calculation worksheet.

8. IRC section 6751(b) requires that for Chapter 68 (Additions to the Tax, Additional Amounts, and Assessable Penalties) penalty

assessments, the immediate supervisor of the individual making the determination (or a higher level official the Secretary may

designate) must personally approve the assessment in writing. Exceptions are additions to tax under section 6651, 6654, 6655,

or any other penalty automatically calculated through “electronic means."

9. For IRC sections 6700 and 6701 penalties, the tax period is a calendar year period (12/31/XXXX) for all taxpayers, including

fiscal year filing taxpayers. The penalty is imposed for actions during the calendar year. See Line-by-Line Instructions for

Completing the Form, item # 5.

8278

Catalog Number 62278G

Form

(Rev. 02-2010)

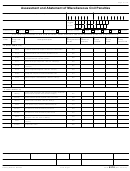

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8