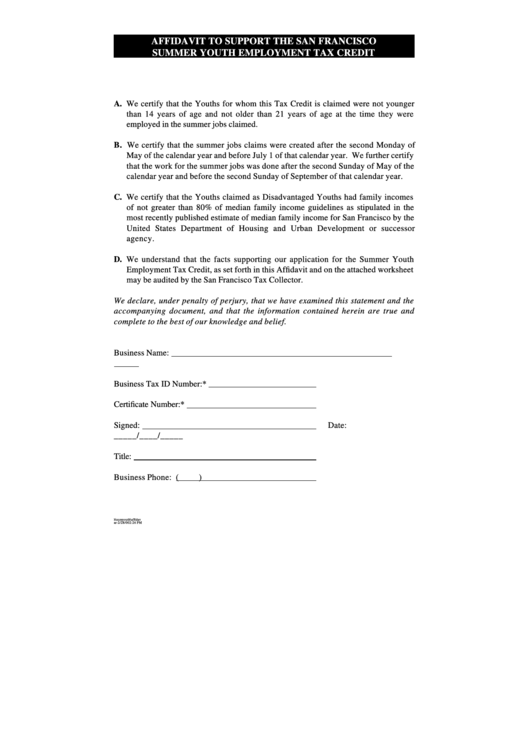

Affidavit To Support The San Francisco Summer Youth Employment Tax Credit

ADVERTISEMENT

AFFIDAVIT TO SUPPORT THE SAN FRANCISCO

SUMMER YOUTH EMPLOYMENT TAX CREDIT

A. We certify that the Youths for whom this Tax Credit is claimed were not younger

than 14 years of age and not older than 21 years of age at the time they were

employed in the summer jobs claimed.

B. We certify that the summer jobs claims were created after the second Monday of

May of the calendar year and before July 1 of that calendar year. We further certify

that the work for the summer jobs was done after the second Sunday of May of the

calendar year and before the second Sunday of September of that calendar year.

C. We certify that the Youths claimed as Disadvantaged Youths had family incomes

of not greater than 80% of median family income guidelines as stipulated in the

most recently published estimate of median family income for San Francisco by the

United States Department of Housing and Urban Development or successor

agency.

D. We understand that the facts supporting our application for the Summer Youth

Employment Tax Credit, as set forth in this Affidavit and on the attached worksheet

may be audited by the San Francisco Tax Collector.

We declare, under penalty of perjury, that we have examined this statement and the

accompanying document, and that the information contained herein are true and

complete to the best of our knowledge and belief.

Business Name:

Business Tax ID Number:*

Certificate Number:*

Signed:

Date:

_____/____/_____

Title:

Business Phone: (

)

h\sumyouth\affidav

ar-2/28/002:26 PM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2