Property Owner'S Registration Form - New York Department Of Finance

ADVERTISEMENT

FOR OFFICE USE ONLY

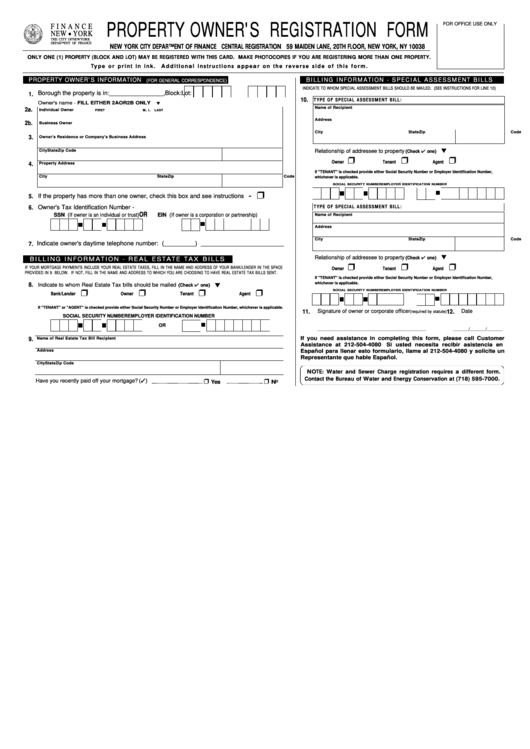

PROPERTY OWNER'S REGISTRATION FORM

F I N A N C E

NEW YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

NEW YORK CITY DEPARTMENT OF FINANCE CENTRAL REGISTRATION 59 MAIDEN LANE, 20TH FLOOR, NEW YORK, NY 10038

ONLY ONE (1) PROPERTY (BLOCK AND LOT) MAY BE REGISTERED WITH THIS CARD. MAKE PHOTOCOPIES IF YOU ARE REGISTERING MORE THAN ONE PROPERTY.

Ty p e o r p r i n t i n i n k .

A d d i t i o n a l i n s t r u c t i o n s a p p e a r o n t h e r e v e r s e s i d e o f t h i s f o r m .

PROPERTY OWNER'S INFORMATION

B I L L I N G I N F O R M AT I O N - S P E C I A L A S S E S S M E N T B I L L S

(FOR GENERAL CORRESPONDENCE)

INDICATE TO WHOM SPECIAL ASSESSMENT BILLS SHOULD BE MAILED. (SEE INSTRUCTIONS FOR LINE 10)

Borough the property is in:________________, Block:

Lot:

1.

10.

TYPE OF SPECIAL ASSESSMENT BILL:

Owner's name - FILL EITHER 2A OR 2B ONLY

Name of Recipient

2a.

Individual Owner

.

.

FIRST

M

I

LAST

Address

2b.

Business Owner

City

State

Zip Code

3.

Owner's Residence or Company's Business Address

City

State

Zip Code

Relationship of addressee to property

(Check

one)

Owner

Tenant

Agent

4.

Property Address

If "TENANT" is checked provide either Social Security Number or Employer Identification Number,

City

State

Zip Code

whichever is applicable.

SOCIAL SECURITY NUMBER

EMPLOYER IDENTIFICATION NUMBER

5.

If the property has more than one owner, check this box and see instructions -

6.

Owner's Tax Identification Number -

TYPE OF SPECIAL ASSESSMENT BILL:

OR

SSN (If owner is an individual or trust)

EIN (If owner is a corporation or partnership)

Name of Recipient

Address

City

State

Zip Code

7. Indicate owner's daytime telephone number: (_________) ________________________

Relationship of addressee to property

(Check

one)

B I L L I N G I N F O R M AT I O N - R E A L E S TAT E TA X B I L L S

IF YOUR MORTGAGE PAYMENTS INCLUDE YOUR REAL ESTATE TAXES, FILL IN THE NAME AND ADDRESS OF YOUR BANK/LENDER IN THE SPACE

Owner

Tenant

Agent

PROVIDED IN 9 BELOW. IF NOT, FILL IN THE NAME AND ADDRESS TO WHICH YOU ARE CHOOSING TO HAVE REAL ESTATE TAX BILLS SENT.

If "TENANT" is checked provide either Social Security Number or Employer Identification Number,

whichever is applicable.

8.

Indicate to whom Real Estate Tax bills should be mailed

(Check

one)

SOCIAL SECURITY NUMBER

EMPLOYER IDENTIFICATION NUMBER

Bank/Lender

Owner

Tenant

Agent

If "TENANT" or "AGENT" is checked provide either Social Security Number or Employer Identification Number, whichever is applicable.

11.

Signature of owner or corporate officer

12.

Date

(required by statute)

SOCIAL SECURITY NUMBER

EMPLOYER IDENTIFICATION NUMBER

OR

________________________________________________

_______/_______/_______

9.

If you need assistance in completing this form, please call Customer

Name of Real Estate Tax Bill Recipient

Assistance at 212-504-4080

Si usted necesita recibir asistencia en

Address

Español para llenar esto formulario, llame al 212-504-4080 y solicite un

Representante que hable Español.

City

State

Zip Code

NOTE: Water and Sewer Charge registration requires a different form.

Contact the Bureau of Water and Energy Conservation at (718) 595-7000.

Have you recently paid off your mortgage? ( )

Yes

No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1