Instructions For Sales Tax For Direct Selling Companies

ADVERTISEMENT

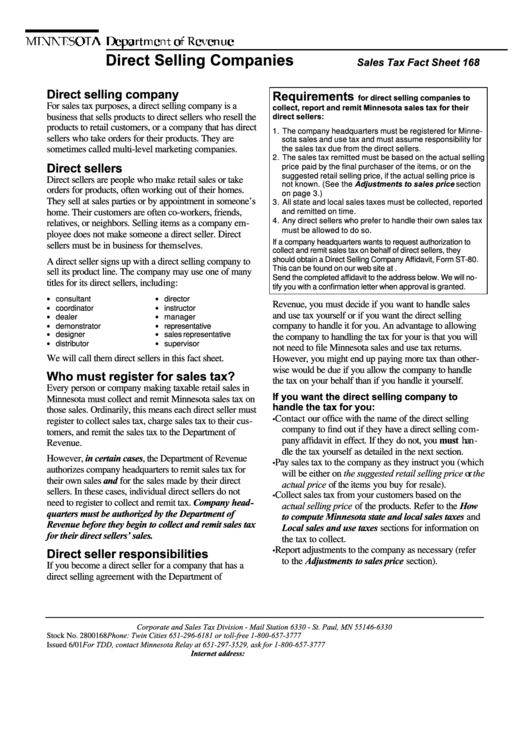

Direct Selling Companies

Sales Tax Fact Sheet 168

Direct selling company

Requirements

for direct selling companies to

For sales tax purposes, a direct selling company is a

collect, report and remit Minnesota sales tax for their

direct sellers:

business that sells products to direct sellers who resell the

products to retail customers, or a company that has direct

1. The company headquarters must be registered for Minne-

sellers who take orders for their products. They are

sota sales and use tax and must assume responsibility for

the sales tax due from the direct sellers.

sometimes called multi-level marketing companies.

2. The sales tax remitted must be based on the actual selling

Direct sellers

price paid by the final purchaser of the items, or on the

suggested retail selling price, if the actual selling price is

Direct sellers are people who make retail sales or take

not known. (See the Adjustments to sales price section

orders for products, often working out of their homes.

on page 3.)

They sell at sales parties or by appointment in someone’s

3. All state and local sales taxes must be collected, reported

home. Their customers are often co-workers, friends,

and remitted on time.

4. Any direct sellers who prefer to handle their own sales tax

relatives, or neighbors. Selling items as a company em-

must be allowed to do so.

ployee does not make someone a direct seller. Direct

If a company headquarters wants to request authorization to

sellers must be in business for themselves.

collect and remit sales tax on behalf of direct sellers, they

should obtain a Direct Selling Company Affidavit, Form ST-80.

A direct seller signs up with a direct selling company to

This can be found on our web site at

sell its product line. The company may use one of many

Send the completed affidavit to the address below. We will n o-

titles for its direct sellers, including:

tify you with a confirmation letter when a pproval is granted.

•

•

consultant

director

Revenue, you must decide if you want to handle sales

•

•

coordinator

instructor

and use tax yourself or if you want the direct selling

•

•

dealer

manager

•

•

company to handle it for you. An advantage to allowing

demonstrator

representative

•

•

designer

sales representative

the company to handling the tax for your is that you will

•

•

distributor

supervisor

not need to file Minnesota sales and use tax returns.

We will call them direct sellers in this fact sheet.

However, you might end up paying more tax than other-

wise would be due if you allow the company to handle

Who must register for sales tax?

the tax on your behalf than if you handle it yourself.

Every person or company making taxable retail sales in

If you want the direct selling company to

Minnesota must collect and remit Minnesota sales tax on

handle the tax for you:

those sales. Ordinarily, this means each direct seller must

Contact our office with the name of the direct selling

•

register to collect sales tax, charge sales tax to their cus-

company to find out if they have a direct selling com-

tomers, and remit the sales tax to the Department of

pany affidavit in effect. If they do not, you must han-

Revenue.

dle the tax yourself as detailed in the next section.

However, in certain cases, the Department of Revenue

Pay sales tax to the company as they instruct you (which

•

authorizes company headquarters to remit sales tax for

will be either on the suggested retail selling price or the

their own sales and for the sales made by their direct

actual price of the items you buy for resale).

sellers. In these cases, individual direct sellers do not

Collect sales tax from your customers based on the

•

need to register to collect and remit tax. Company head-

actual selling price of the products. Refer to the How

quarters must be authorized by the Department of

to compute Minnesota state and local sales taxes and

Revenue before they begin to collect and remit sales tax

Local sales and use taxes sections for information on

for their direct sellers’ sales.

the tax to collect.

Direct seller responsibilities

Report adjustments to the company as necessary (refer

•

to the Adjustments to sales price section).

If you become a direct seller for a company that has a

direct selling agreement with the Department of

Corporate and Sales Tax Division - Mail Station 6330 - St. Paul, MN 55146-6330

Phone: Twin Cities 651-296-6181 or toll-free 1-800-657-3777

Stock No. 2800168

For TDD, contact Minnesota Relay at 651-297-3529, ask for 1-800-657-3777

Issued 6/01

Internet address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4