Parking Tax Worksheet - City Of Philadelphia

ADVERTISEMENT

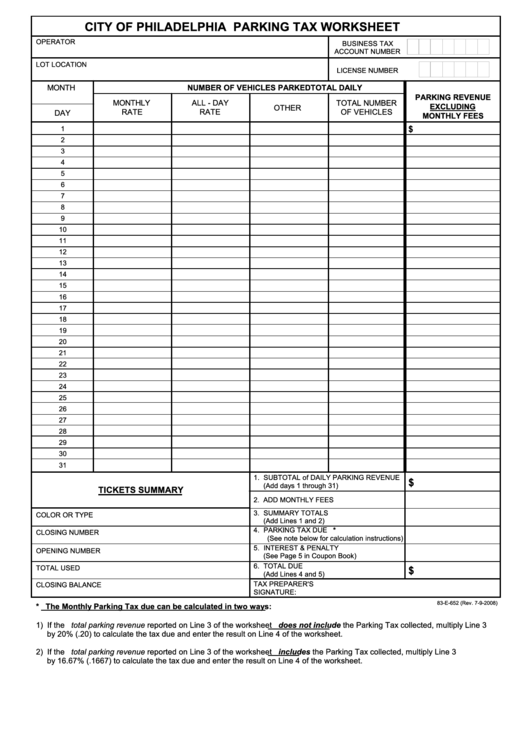

CITY OF PHILADELPHIA

PARKING TAX WORKSHEET

OPERATOR

BUSINESS TAX

ACCOUNT NUMBER

LOT LOCATION

LICENSE NUMBER

MONTH

NUMBER OF VEHICLES PARKED

TOTAL DAILY

PARKING REVENUE

MONTHLY

ALL - DAY

TOTAL NUMBER

EXCLUDING

OTHER

RATE

RATE

OF VEHICLES

DAY

MONTHLY FEES

1

$

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

1. SUBTOTAL of DAILY PARKING REVENUE

$

(Add days 1 through 31)

TICKETS SUMMARY

2. ADD MONTHLY FEES

3. SUMMARY TOTALS

COLOR OR TYPE

(Add Lines 1 and 2)

4. PARKING TAX DUE *

CLOSING NUMBER

(See note below for calculation instructions)

5. INTEREST & PENALTY

OPENING NUMBER

(See Page 5 in Coupon Book)

6. TOTAL DUE

TOTAL USED

$

(Add Lines 4 and 5)

TAX PREPARER'S

CLOSING BALANCE

SIGNATURE:

83-E-652 (Rev. 7-9-2008)

* The Monthly Parking Tax due can be calculated in two ways:

1) If the total parking revenue reported on Line 3 of the worksheet does not include the Parking Tax collected, multiply Line 3

by 20% (.20) to calculate the tax due and enter the result on Line 4 of the worksheet.

2) If the total parking revenue reported on Line 3 of the worksheet includes the Parking Tax collected, multiply Line 3

by 16.67% (.1667) to calculate the tax due and enter the result on Line 4 of the worksheet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1