Annual Reconciliation Of Earnings Tax Instructions - City Of Philadelphia - 1999

ADVERTISEMENT

1999 Annual Reconciliation of Earnings Tax Instructions

Where to File – Sign return and mail to:

City of Philadelphia

Department of Revenue

P.O. Box 1648

Philadelphia, PA 19105-1648

* Who Must File: 1) Residents of Philadelphia who have received compensation from

which wage tax was not deducted on total wages. 2) Non-residents who have received

compensation for services performed in Philadelphia on which wage tax was not deducted

on total wages.

* Gross Compensation: Wages, commissions, tips, bonuses, severance pay, sick and/or

vacation pay, non-cash compensation and military reserve pay not including active duty.

Pension plan contributions (such as 401K contributions) are subject to wage tax and

are not deductible from gross taxable compensation.

Tax Rates:

Residents of Philadelphia:

1/1/99 to 6/30/99: 4.6869%; 7/1/99 to 12/31/99: 4.6135%

Non-Residents:

1/1/99 to 6/30/99: 4.075%; 7/1/99 to 12/31/99: 4.0112%

* Allocated Compensation: A non-resident who receives compensation for services

performed both in and out of Philadelphia may allocate that compensation by filing the

Allocation of Earnings Report for non-resident employees (Form #83 T-320). This form

must be filed if compensation is allocated and it must be signed by the employer.

•

The 1999 Earnings Tax Reconciliation form is due on or before April 17, 2000.

•

Failure to file this return by the due date could result in the imposition of fines

and legal costs.

•

To ensure efficient processing, print your numbers legibly.

•

Photocopies of this form are not acceptable. Do not use correction fluids for changes.

•

If you wish to pay in person, come to the Municipal Services Building, Concourse

Level, 1401 John F. Kennedy Boulevard, Philadelphia, PA.

•

If the tax due on Line 10 is more than $1, make check payable to “City of

Philadelphia”. Do not pay tax if less than $1.

•

Direct telephone inquiries to 215-686-6600. Send e-mail to revenue@phila.gov

•

Visit our web site –

•

Each individual must file separately since there is no provision for filing a joint return.

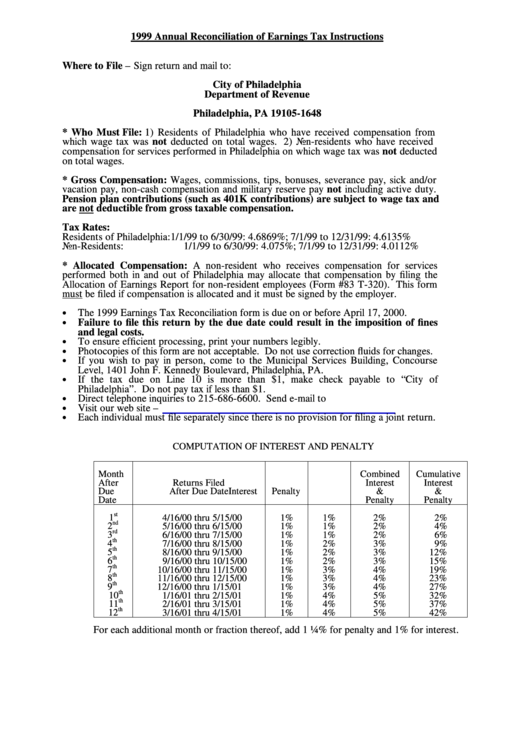

COMPUTATION OF INTEREST AND PENALTY

Month

Combined

Cumulative

After

Returns Filed

Interest

Interest

Due

After Due Date

Interest

Penalty

&

&

Date

Penalty

Penalty

st

1

4/16/00 thru 5/15/00

1%

1%

2%

2%

nd

2

5/16/00 thru 6/15/00

1%

1%

2%

4%

rd

3

6/16/00 thru 7/15/00

1%

1%

2%

6%

th

4

7/16/00 thru 8/15/00

1%

2%

3%

9%

th

5

8/16/00 thru 9/15/00

1%

2%

3%

12%

th

6

9/16/00 thru 10/15/00

1%

2%

3%

15%

th

7

10/16/00 thru 11/15/00

1%

3%

4%

19%

th

8

11/16/00 thru 12/15/00

1%

3%

4%

23%

th

9

12/16/00 thru 1/15/01

1%

3%

4%

27%

th

10

1/16/01 thru 2/15/01

1%

4%

5%

32%

th

11

2/16/01 thru 3/15/01

1%

4%

5%

37%

th

12

3/16/01 thru 4/15/01

1%

4%

5%

42%

For each additional month or fraction thereof, add 1 ¼% for penalty and 1% for interest.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1