Instructions For Timber Severance Tax Schedule T-1b - Schedule Of Timber Products On Which Others Are To Pay Severance Tax

ADVERTISEMENT

Instructions for Timber Severance Tax Schedule T-1B

Schedule of Timber Products on which others are to Pay Severance Tax

REPORTING COMPANY BLOCK

Name and address of reporting company – Self-explanatory.

Account Revenue Number – A 10 digit Taxpayer Account ID number as assigned by the Department of Revenue.

Plant or mill for which this report is filed – Name and location of the plant or mill. A separate report must be filed for

each plant or mill owned by the reporting company.

TAXABLE PERIOD

Schedule B

Purchaser/Seller Account ID number – The taxpayer Revenue Account Number as assigned by the Department of

Revenue for the payment of timber severance tax. No one can be listed on this form who does not have a valid Revenue

Account Number. Purchases/sales from/to those that do not have an Revenue account number must be reported on

Schedule T-1A, form number R – 9006L, and the Timber-Parish Summary Return, form number R-9005-L, with the appro-

priate timber volumes and severance tax accounted for and remitted to the Department.

Seller/purchaser – Write in one of the following:

Seller = S

Purchaser = P

Name and complete address of seller/purchaser – Self-explanatory.

Taxable period – period (month and year) for which the tax is due.

Parish code – parish number assigned by the Louisiana Department of Revenue that identifies the parish from which the

timber product was severed. A list of the parish codes can be obtained by contacting the Taxpayer Services Division,

Severance Tax Section of the Louisiana Department of Revenue.

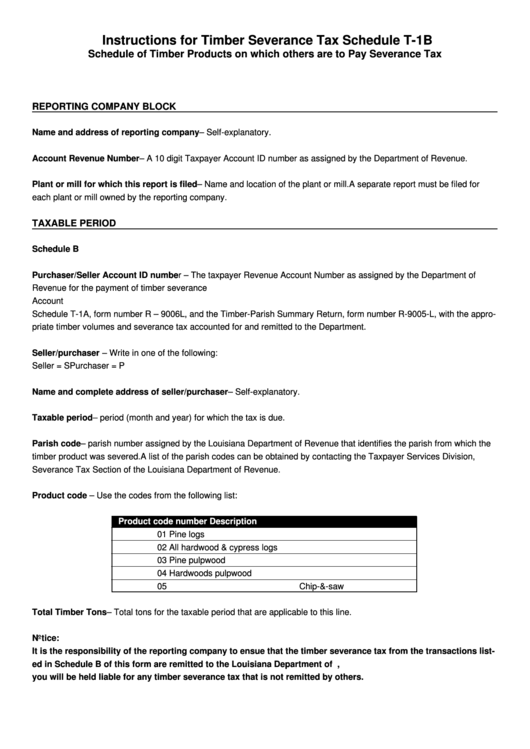

Product code – Use the codes from the following list:

Product code number

Description

01

Pine logs

02

All hardwood & cypress logs

03

Pine pulpwood

04

Hardwoods pulpwood

05

Chip-&-saw

Total Timber Tons – Total tons for the taxable period that are applicable to this line.

Notice:

It is the responsibility of the reporting company to ensue that the timber severance tax from the transactions list-

ed in Schedule B of this form are remitted to the Louisiana Department of Revenue. As the reporting company,

you will be held liable for any timber severance tax that is not remitted by others.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1