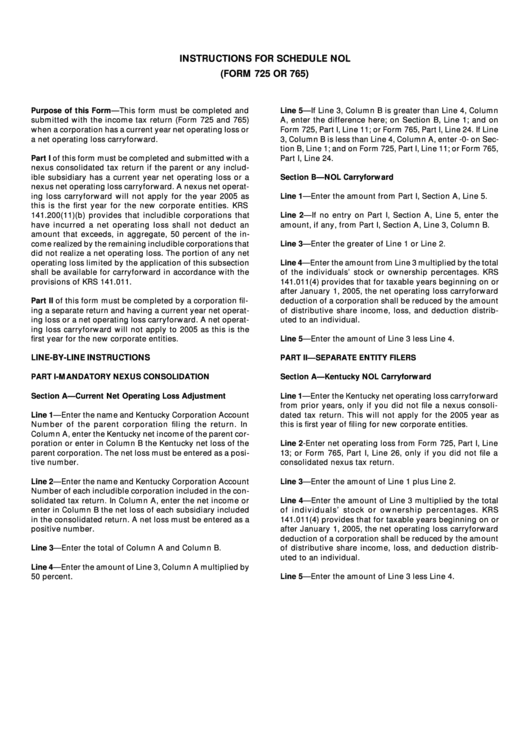

Instructions For Schedule Nol (Form 725 Or 765)

ADVERTISEMENT

INSTRUCTIONS FOR SCHEDULE NOL

(FORM 725 OR 765)

Purpose of this Form—This form must be completed and

Line 5—If Line 3, Column B is greater than Line 4, Column

submitted with the income tax return (Form 725 and 765)

A, enter the difference here; on Section B, Line 1; and on

when a corporation has a current year net operating loss or

Form 725, Part I, Line 11; or Form 765, Part I, Line 24. If Line

a net operating loss carryforward.

3, Column B is less than Line 4, Column A, enter -0- on Sec-

tion B, Line 1; and on Form 725, Part I, Line 11; or Form 765,

Part I of this form must be completed and submitted with a

Part I, Line 24.

nexus consolidated tax return if the parent or any includ-

ible subsidiary has a current year net operating loss or a

Section B—NOL Carryforward

nexus net operating loss carryforward. A nexus net operat-

ing loss carryforward will not apply for the year 2005 as

Line 1—Enter the amount from Part I, Section A, Line 5.

this is the first year for the new corporate entities. KRS

141.200(11)(b) provides that includible corporations that

Line 2—If no entry on Part I, Section A, Line 5, enter the

have incurred a net operating loss shall not deduct an

amount, if any, from Part I, Section A, Line 3, Column B.

amount that exceeds, in aggregate, 50 percent of the in-

come realized by the remaining includible corporations that

Line 3—Enter the greater of Line 1 or Line 2.

did not realize a net operating loss. The portion of any net

operating loss limited by the application of this subsection

Line 4—Enter the amount from Line 3 multiplied by the total

shall be available for carryforward in accordance with the

of the individuals’ stock or ownership percentages. KRS

provisions of KRS 141.011.

141.011(4) provides that for taxable years beginning on or

after January 1, 2005, the net operating loss carryforward

Part II of this form must be completed by a corporation fil-

deduction of a corporation shall be reduced by the amount

ing a separate return and having a current year net operat-

of distributive share income, loss, and deduction distrib-

ing loss or a net operating loss carryforward. A net operat-

uted to an individual.

ing loss carryforward will not apply to 2005 as this is the

first year for the new corporate entities.

Line 5—Enter the amount of Line 3 less Line 4.

LINE-BY-LINE INSTRUCTIONS

PART II—SEPARATE ENTITY FILERS

PART I-MANDATORY NEXUS CONSOLIDATION

Section A—Kentucky NOL Carryforward

Section A—Current Net Operating Loss Adjustment

Line 1—Enter the Kentucky net operating loss carryforward

from prior years, only if you did not file a nexus consoli-

Line 1—Enter the name and Kentucky Corporation Account

dated tax return. This will not apply for the 2005 year as

Number of the parent corporation filing the return. In

this is first year of filing for new corporate entities.

Column A, enter the Kentucky net income of the parent cor-

poration or enter in Column B the Kentucky net loss of the

Line 2-Enter net operating loss from Form 725, Part I, Line

parent corporation. The net loss must be entered as a posi-

13; or Form 765, Part I, Line 26, only if you did not file a

tive number.

consolidated nexus tax return.

Line 2—Enter the name and Kentucky Corporation Account

Line 3—Enter the amount of Line 1 plus Line 2.

Number of each includible corporation included in the con-

solidated tax return. In Column A, enter the net income or

Line 4—Enter the amount of Line 3 multiplied by the total

enter in Column B the net loss of each subsidiary included

of individuals’ stock or ownership percentages. KRS

in the consolidated return. A net loss must be entered as a

141.011(4) provides that for taxable years beginning on or

positive number.

after January 1, 2005, the net operating loss carryforward

deduction of a corporation shall be reduced by the amount

Line 3—Enter the total of Column A and Column B.

of distributive share income, loss, and deduction distrib-

uted to an individual.

Line 4—Enter the amount of Line 3, Column A multiplied by

50 percent.

Line 5—Enter the amount of Line 3 less Line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1