Instructions For Schedule Nol (Form 720)

ADVERTISEMENT

41A720NOL (10-09)

Page 2

INSTRUCTIONS FOR SCHEDULE NOL (FORM 720)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

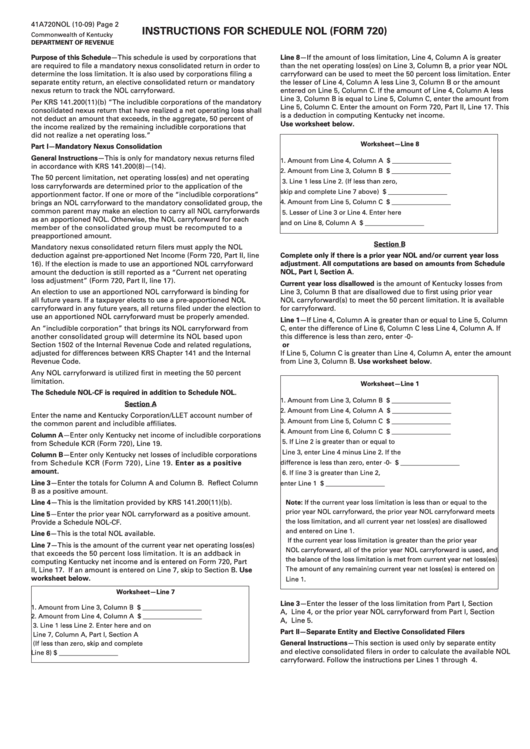

Purpose of this Schedule—This schedule is used by corporations that

Line 8—If the amount of loss limitation, Line 4, Column A is greater

are required to file a mandatory nexus consolidated return in order to

than the net operating loss(es) on Line 3, Column B, a prior year NOL

determine the loss limitation. It is also used by corporations filing a

carryforward can be used to meet the 50 percent loss limitation. Enter

separate entity return, an elective consolidated return or mandatory

the lesser of Line 4, Column A less Line 3, Column B or the amount

nexus return to track the NOL carryforward.

entered on Line 5, Column C. If the amount of Line 4, Column A less

Line 3, Column B is equal to Line 5, Column C, enter the amount from

Per KRS 141.200(11)(b) “The includible corporations of the mandatory

Line 5, Column C. Enter the amount on Form 720, Part II, Line 17. This

consolidated nexus return that have realized a net operating loss shall

is a deduction in computing Kentucky net income.

not deduct an amount that exceeds, in the aggregate, 50 percent of

Use worksheet below.

the income realized by the remaining includible corporations that

did not realize a net operating loss. ”

Worksheet—Line 8

Part I—Mandatory Nexus Consolidation

General Instructions—This is only for mandatory nexus returns filed

1.

Amount from Line 4, Column A ................... $ __________________

in accordance with KRS 141.200(8)—(14).

2.

Amount from Line 3, Column B ................... $ __________________

The 50 percent limitation, net operating loss(es) and net operating

3.

Line 1 less Line 2. (If less than zero,

loss carryforwards are determined prior to the application of the

skip and complete Line 7 above) ................. $ __________________

apportionment factor. If one or more of the “includible corporations”

4.

Amount from Line 5, Column C ................... $ __________________

brings an NOL carryforward to the mandatory consolidated group, the

common parent may make an election to carry all NOL carryforwards

5.

Lesser of Line 3 or Line 4. Enter here

as an apportioned NOL. Otherwise, the NOL carryforward for each

and on Line 8, Column A .............................. $ __________________

member of the consolidated group must be recomputed to a

preapportioned amount.

Section B

Mandatory nexus consolidated return filers must apply the NOL

deduction against pre-apportioned Net Income (Form 720, Part II, line

Complete only if there is a prior year NOL and/or current year loss

16). If the election is made to use an apportioned NOL carryforward

adjustment. All computations are based on amounts from Schedule

amount the deduction is still reported as a “Current net operating

NOL, Part I, Section A.

loss adjustment” (Form 720, Part II, line 17).

Current year loss disallowed is the amount of Kentucky losses from

An election to use an apportioned NOL carryforward is binding for

Line 3, Column B that are disallowed due to first using prior year

all future years. If a taxpayer elects to use a pre-apportioned NOL

NOL carryforward(s) to meet the 50 percent limitation. It is available

carryforward in any future years, all returns filed under the election to

for carryforward.

use an apportioned NOL carryforward must be properly amended.

Line 1—If Line 4, Column A is greater than or equal to Line 5, Column

An “includible corporation” that brings its NOL carryforward from

C, enter the difference of Line 6, Column C less Line 4, Column A. If

another consolidated group will determine its NOL based upon

this difference is less than zero, enter -0-

Section 1502 of the Internal Revenue Code and related regulations,

or

adjusted for differences between KRS Chapter 141 and the Internal

If Line 5, Column C is greater than Line 4, Column A, enter the amount

Revenue Code.

from Line 3, Column B. Use worksheet below.

Any NOL carryforward is utilized first in meeting the 50 percent

limitation.

Worksheet—Line 1

The Schedule NOL-CF is required in addition to Schedule NOL.

1.

Amount from Line 3, Column B ................... $ __________________

Section A

2.

Amount from Line 4, Column A ................... $ __________________

Enter the name and Kentucky Corporation/LLET account number of

3.

Amount from Line 5, Column C ................... $ __________________

the common parent and includible affiliates.

4.

Amount from Line 6, Column C ................... $ __________________

Column A—Enter only Kentucky net income of includible corporations

5.

If Line 2 is greater than or equal to

from Schedule KCR (Form 720), Line 19.

Line 3, enter Line 4 minus Line 2. If the

Column B—Enter only Kentucky net losses of includible corporations

from Schedule KCR (Form 720), Line 19. Enter as a positive

difference is less than zero, enter -0- ........... $ __________________

amount.

6.

If line 3 is greater than Line 2,

Line 3—Enter the totals for Column A and Column B. Reflect Column

enter Line 1 .................................................... $ __________________

B as a positive amount.

Line 4—This is the limitation provided by KRS 141.200(11)(b).

Note: If the current year loss limitation is less than or equal to the

prior year NOL carryforward, the prior year NOL carryforward meets

Line 5—Enter the prior year NOL carryforward as a positive amount.

the loss limitation, and all current year net loss(es) are disallowed

Provide a Schedule NOL-CF .

and entered on Line 1.

Line 6—This is the total NOL available.

If the current year loss limitation is greater than the prior year

Line 7—This is the amount of the current year net operating loss(es)

NOL carryforward, all of the prior year NOL carryforward is used, and

that exceeds the 50 percent loss limitation. It is an addback in

the balance of the loss limitation is met from current year net loss(es).

computing Kentucky net income and is entered on Form 720, Part

The amount of any remaining current year net loss(es) is entered on

II, Line 17. If an amount is entered on Line 7, skip to Section B. Use

worksheet below.

Line 1.

Worksheet—Line 7

Line 3—Enter the lesser of the loss limitation from Part I, Section

1.

Amount from Line 3, Column B ................... $ __________________

A, Line 4, or the prior year NOL carryforward from Part I, Section

2.

Amount from Line 4, Column A ................... $ __________________

A, Line 5.

3.

Line 1 less Line 2. Enter here and on

Part II—Separate Entity and Elective Consolidated Filers

Line 7, Column A, Part I, Section A

General Instructions—This section is used only by separate entity

(If less than zero, skip and complete

and elective consolidated filers in order to calculate the available NOL

Line 8)............................................................. $ __________________

carryforward. Follow the instructions per Lines 1 through 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1